News

84 Arrested in Islandwide Bribery Raids Conducted in 2025: CIABOC

The Commission to Investigate Allegations of Bribery or Corruption (CIABOC) has revealed that 84 individuals were arrested in 2025 for offences related to bribery and corruption.

According to the Commission, these arrests resulted from 130 raids conducted across the country between January 1 and December 31, 2025. The Sri Lanka Police recorded the highest number of arrests, with 30 police officers taken into custody. Those arrested from the police service included 13 Police Sergeants, nine Police Constables, four Sub-Inspectors, and two Chief Inspectors.

CIABOC further stated that arrests were also made among 11 individuals attached to institutions under the Ministry of Justice, five officers from the Department of Agricultural and Public Services, three Grama Niladharis, and three officials serving in Pradeshiya Sabhas.

In addition to raid-related arrests, the Commission noted that a further 56 individuals were taken into custody following investigations conducted throughout the year.

Those arrested include a range of public figures such as former ministers, ministry secretaries, heads of government departments, medical professionals, former chairpersons of Pradeshiya Sabhas, and several other public officials.

During 2025, CIABOC filed 115 cases against 153 individuals and successfully concluded 69 cases. The Commission also reported receiving 8,409 complaints during the year, with investigations initiated into 569 of them.

Meanwhile, CIABOC Director General Ranga Dissanayake emphasized that eliminating bribery and corruption within the public service is a shared responsibility. He made these remarks while addressing a recent awareness programme conducted for public officials.

Apple reportedly plans to reveal its Gemini-powered Siri in February

A new and improved Siri may finally make an appearance, but this time, it could be with a Google Gemini glow up.

According to Bloomberg’s Mark Gurman, Apple wants to announce a new Siri in “the second half of February” that will show off the results of its recently announced partnership with Google and offer demonstrations of the Gemini-powered capabilities.

After this reveal, Gurman reported that the new Siri will make its way to iOS 26.4, which is also slated to enter beta testing in February before its public release in March or early April.

Apple has been meaning to launch its next-gen Siri ever since its announcement at WWDC 2024, but now we know that this Gemini-powered Siri will behave more like an AI chatbot, similar to OpenAI’s ChatGPT, thanks to another Bloomberg report from last week.

Following the reported demo that’s scheduled for late February, Gurman said Apple will have a grand reveal of the new Siri, which is currently codenamed Campos, at its annual developer conference in the summer.

After that, the latest Siri and the accompanying Gemini-powered Apple Intelligence features are expected to arrive with iOS 27, iPadOS 27 and macOS 27, which are expected to be available as beta releases in the summer.

(Source: Engadget)

30 people dead from effects of winter storm as more freezing cold pummels US

Many in the U.S. faced another night of below-freezing temperatures and no electricity after a colossal winter storm heaped more snow Monday on the Northeast and kept parts of the South coated in ice. At least 30 deaths were reported in states afflicted with severe cold.

Deep snow — over a foot (30 centimeters) extending in a 1,300-mile (2,100-kilometer) swath from Arkansas to New England — halted traffic, canceled flights and triggered wide school closures Monday. The National Weather Service said areas north of Pittsburgh got up to 20 inches (50 centimeters) of snow and faced wind chills as low as minus 25 degrees Fahrenheit (minus 31 degrees Celsius) late Monday into Tuesday.

The bitter cold afflicting two-thirds of the U.S. wasn’t going away. The weather service said Monday that a fresh influx of artic air is expected to sustain freezing temperatures in places already covered in snow and ice. And forecasters said it’s possible another winter storm could hit parts of the East Coast this weekend.

A rising death toll included two people run over by snowplows in Massachusetts and Ohio, fatal sledding accidents that killed teenagers in Arkansas and Texas, and a woman whose body was found covered in snow by police with bloodhounds after she was last seen leaving a Kansas bar. In New York City, officials said eight people were found dead outdoors over the frigid weekend.

Hundreds of thousands without power

There were still more than 560,000 power outages in the nation Monday evening, according to poweroutage.com. Most of them were in the South, where weekend blasts of freezing rain caused tree limbs and power lines to snap, inflicting crippling outages on northern Mississippi and parts of Tennessee. Officials warned that it could take days for power to be restored.

In Mississippi, officials scrambled to get cots, blankets, bottled water and generators to warming stations in hard-hit areas in the aftermath of the state’s worst ice storm since 1994. At least 14 homes, one business and 20 public roads had major damage, Gov. Tate Reeves said Monday evening.

The University of Mississippi, where most students hunkered down without power Monday, canceled classes for the entire week as its Oxford campus remained coated in treacherous ice. Oxford Mayor Robyn Tannehill said on social media that so many trees, limbs and power lines had fallen that “it looks like a tornado went down every street.”

A pair of burly, falling tree branches damaged real estate agent Tim Phillips’ new garage, broke a window and cut off power to his home in Oxford.

“It’s just one of those things that you try to prepare for,” Phillips said, “but this one was just unreal.”

The U.S. had more than 12,000 flight delays or cancellations nationwide Monday, according to flight tracker flightaware.com. On Sunday, 45% of U.S. flights got cancelled, making it the highest day for cancellations since the COVID-19 pandemic, according to aviation analytics firm Cirium.

The impact extended far beyond the storm’s reach because such major hubs as the Dallas–Fort Worth International Airport were clobbered by the storm, stranding planes and flight crews.

More light to moderate snow was forecast in New England through Monday evening.

New York City saw its snowiest day in years, with neighborhoods recording 8 to 15 inches (20 to 38 cm) of snow. Though public schools shut down, roughly 500,000 students were told to log in for online lessons Monday. The nation’s largest public school system saw snow days stripped away after remote learning gained traction during the coronavirus pandemic.

Bitter cold grips much of the nation

Meanwhile, bitter cold followed in the storm’s wake. Communities across the Midwest, South, and Northeast awakened Monday to subzero weather. The entire Lower 48 states were forecast to have their coldest average low temperature of minus 9.8 F (minus 12.3 C) since January 2014.

In the Nashville, Tennessee, area, electricity returned for thousands of homes and businesses Monday, while about 146,000 others still didn’t have power Monday evening after subfreezing temperatures overnight. Many hotels were sold out overnight to residents escaping dark and frigid homes.

Alex Murray booked a Nashville hotel room for his family to ensure they had a working freezer to preserve pumped breast milk to feed their 6-month-old daughter. Anticipating a long wait until power gets restored at his home, Murray planned to extend their hotel stay through Wednesday.

“I know there’s many people that may not be able to find a place or pay for a place or anything like that, or even travel,” Murray said Monday. “So, we were really fortunate.”

Storm leads to deaths in a number of states

In Emporia, Kansas, police found a 28-year-old teacher dead in the snow after she was seen leaving a bar without her coat and phone.

Police said snowplows backed into two people who died in Norwood, Massachusetts, and Dayton, Ohio. Arkansas and Texas reported two deaths apiece.

The cause of deaths for the eight people found outside in New York City as temperatures plunged between Saturday and Monday morning remained under investigation.

Officials reported four deaths in Tennessee, three deaths apiece in Louisiana and Pennsylvania; two deaths in Mississippi; and one each in New Jersey, South Carolina and Kentucky.

Kramon reported from Atlanta. Bynum reported from Savannah, Georgia. Associated Press writers around the country contributed.

Source:adaderana.lk

Obama, Clinton say killings by immigration agents should be wake-up call for US

Former presidents Barack Obama and Bill Clinton issued pointed calls on Sunday (Jan 25) for Americans to stand up and defend their values after the second killing of a citizen in Minneapolis by immigration agents that Donald Trump blamed on Democratic “chaos”.

The Trump administration has faced intensifying pressure over its mass immigration crackdown, particularly after federal agents shot and killed Alex Pretti, a 37-year-old ICU nurse, on Saturday while scuffling with him on an icy roadway.

That incident came less than three weeks after an immigration officer fired on Renee Good, also 37, killing her in her car in the same Midwestern city.

Trump administration officials quickly claimed Pretti had intended to harm the federal agents - as they did after Good’s death - pointing to a pistol they said was discovered on him.

However, video shared widely on social media and verified by US media showed Pretti never drawing a weapon, with agents firing at him seconds after he was sprayed in the face with chemical irritant and thrown to the ground.

Trump provocatively attributed the deaths to Minnesota’s Democratic elected officials, including Governor Tim Walz and Minneapolis Mayor Jacob Frey, writing on his Truth Social platform: “Democrat run Sanctuary Cities and States are REFUSING to cooperate with ICE.”

“Tragically, two American Citizens have lost their lives as a result of this Democrat ensued chaos,” he added.

After top officials described Pretti as an “assassin” who had assaulted the agents, Pretti’s parents issued a statement Saturday condemning the administration’s “sickening lies” about their son.

With tensions high, protesters gathered Sunday in Minneapolis, denouncing Immigration and Customs Enforcement (ICE). One person held a cardboard sign that read: “Be Pretti, be Good.”

The double tragedies have stirred outrage, including from two of Trump’s Democratic presidential predecessors. Barack and Michelle Obama on Sunday said in a statement that Pretti’s shooting should be a “wake-up call” that core US values “are increasingly under assault”.

Hours later, Bill Clinton delivered a fierce indictment of the current administration, saying peaceful protesters “have been arrested, beaten, teargassed, and most searingly, in the cases of Renee Good and Alex Pretti, shot and killed”.

“All of this is unacceptable,” Clinton said in a statement as he urged Americans to “stand up, speak out”.

“If we give our freedoms away after 250 years, we might never get them back.”

“WE’RE REVIEWING EVERYTHING”

US Deputy Attorney General Todd Blanche, speaking to NBC’s Meet the Press, said an investigation was necessary.

While administration officials have defended the officer who shot Pretti, Trump, in a brief Sunday interview with the Wall Street Journa,l declined twice to say whether the officer had acted appropriately.

“We’re looking, we’re reviewing everything and will come out with a determination,” the president told the paper.

Multiple senators from Trump’s Republican Party have called for a thorough probe into the killing, and for cooperation with local authorities.

Trump’s administration controversially excluded local investigators from a probe into Good’s death.

Walz posed a question directly to the president during a press briefing Sunday, asking: “What do we need to do to get these federal agents out of our state?”

On Sunday, business leaders from 60 corporations headquartered in Minnesota - including retailer Target, food giant General Mills and several professional sports franchises - signed an open letter “calling for an immediate de-escalation of tensions” and for authorities to work together.

VOTERS UPSET

Thousands of federal immigration agents have been deployed to heavily Democratic Minneapolis for weeks, after conservative media reported on alleged fraud by Somali immigrants, which Trump has repeatedly amplified.

The city, known for its bitterly cold winters, has one of the country’s highest concentrations of Somali immigrants.

Minnesota Attorney General Keith Ellison pushed back against Trump’s claim, telling reporters “it’s not about fraud, because if he sent people who understand forensic accounting, we’d be having a different conversation. But he’s sending armed masked men”.

Since Operation Metro Surge began, many residents have carried whistles to notify others of the presence of immigration agents, while sometimes violent skirmishes have broken out between the officers and protesters.

Recent polling has shown voters increasingly upset with Trump’s domestic immigration operations, as videos of masked agents seizing people off sidewalks - including children - proliferate.

Source:adaderana.lk

Shiranthi Rajapaksa Called Before FCID Over ‘Siriliya’ Account Probe

Former President Mahinda Rajapaksa’s wife, Shiranthi Rajapaksa, has been instructed to appear before the Financial Crimes Investigation Division (FCID) today (27) to provide a statement as part of an ongoing investigation.

According to reports, she was formally notified on January 23 to present herself at the FCID at 9.00 a.m. The summons is linked to investigations into alleged financial irregularities involving a bank account operated under the name ‘Siriliya’ during Mahinda Rajapaksa’s time in office.

The FCID noted that inquiries into this matter were initially launched during the period of the ‘Yahapalanaya’ administration and are now being pursued further.

Meanwhile, Sri Lanka Podujana Peramuna (SLPP) National Organizer and Parliamentarian Namal Rajapaksa has also been issued a notice to appear before the Criminal Investigation Department (CID). The notice required him to be present yesterday .SLPP General Secretary Sagara Kariyawasam stated that the summons was issued yesterday morning while Namal Rajapaksa was on an official visit to India.

Silent Struggle: Elderly Mental Health Emerges as a Growing Crisis in Sri Lanka

one in three Sri Lankan adults is affected by mental health issues, with a large proportion being those aged 60 and above, Consultant Psychiatrist Dr. Madhushani Dias revealed at a Colombo programme on the 26th. As Sri Lanka’s elderly population grows rapidly, mental health concerns such as depression, memory loss, and emotional withdrawal are often misunderstood and dismissed as “normal ageing,” leading to dangerous neglect. Dr. Dias warned that this lack of awareness has seriously reduced older adults’ quality of life and increased related physical health problems.

Highlighting progress, she noted that the National Institute of Mental Health has operated a dedicated elderly mental health unit since 1999, with separate male and female wards, and has recently launched “Dheergayu,” a day-care treatment centre offering psychiatric and behavioural therapy for senior citizens. However, she stressed that treatment alone is not enough.

Dr. Dias identified loneliness and social isolation now recognized by the World Health Organization as a global public health concern as major drivers of elderly mental health issues in Sri Lanka, worsened by the migration of younger generations abroad. She urged families to maintain regular contact with elderly parents and encouraged seniors to stay socially active through friendships and volunteer work. Concluding, she emphasized that despite the growing scale of the problem, Sri Lanka still lacks a strong protective and support framework, calling on the government to take greater responsibility in safeguarding the mental well-being of the nation’s ageing population.

Scattered Showers and Gusty Winds Forecast Across Several Regions Today

The Department of Meteorology has forecast a mix of isolated showers, gusty winds, and misty conditions across parts of the country today (27).

According to the Met Department, brief showers may develop in the North-Central and Eastern provinces during the day. In addition, a few locations in the Sabaragamuwa Province, along with the Galle and Matara districts, could experience showers or thundershowers after 2.00 p.m.

Fairly strong winds, reaching speeds of around 30–40 kmph, are expected at times, particularly over the eastern slopes of the central hills. Similar windy conditions may also affect the Northern, North-Central, North-Western, Eastern and Uva provinces, as well as the Hambantota district.

Meanwhile, misty weather is likely during the early morning hours in parts of the Western, Sabaragamuwa and Central provinces, including the Galle and Matara districts.

The general public is advised to remain alert and take necessary precautions to reduce potential damage from sudden strong winds and lightning associated with thundershowers.

Gold Prices Climb in Sri Lanka as Global Rates Surge

Gold prices in the local market have recorded a significant increase, in line with a sharp rise in global gold rates, according to market traders.

They noted that the price of a gold sovereign (pavun) has gone up by approximately Rs. 12,000 over the past few days. At present, a 24-carat gold sovereign is trading at around Rs. 397,000, while the 22-carat equivalent is priced at about Rs. 362,200.

Meanwhile, international gold prices have crossed the USD 5,000 per ounce threshold. Economic analysts suggest the upward trend could continue, with global gold prices potentially climbing beyond USD 5,500 per ounce before the end of the year.

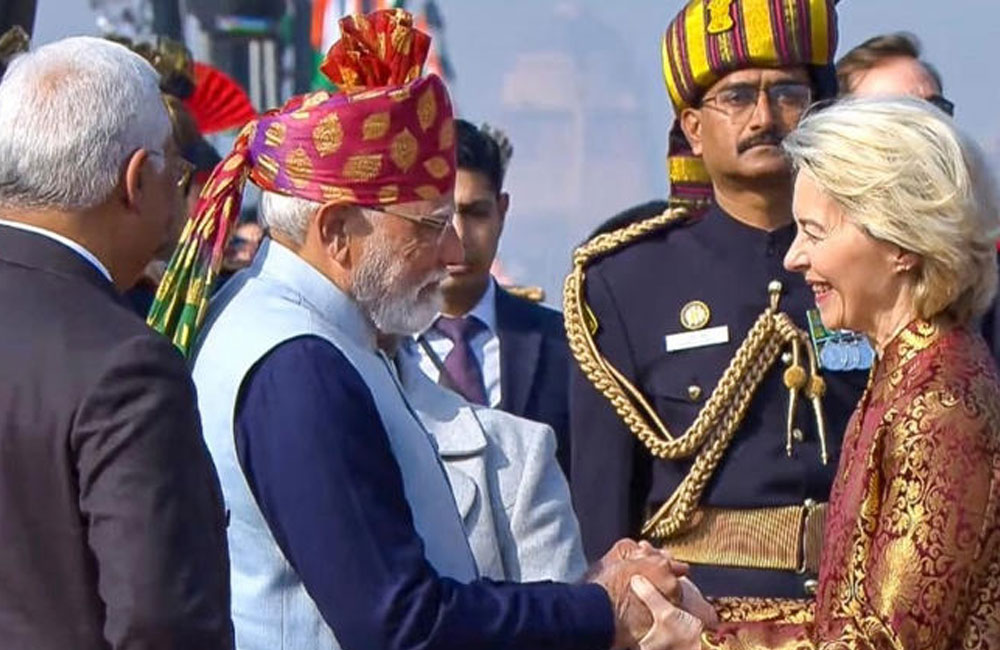

“Successful India makes world stable”: European Commission Chief

European Commission President Ursula von der Leyen on Monday said that a “successful India” makes the world more “stable, prosperous and secure”, a statement that came ahead of the “historic” trade agreement between New Delhi and the 27-nation bloc.

von der Leyen, who is on three-day visit to India, attended India’s Republic Day celebrations as a chief guest and said it was an “honour of a lifetime”. von der Leyen and European Council President Antonio Costa were the chief guests as India marked its 77th Republic Day.

“A successful India makes the world more stable, prosperous and secure. And we all benefit,” von der Leyen posted on X.

Von der Leyen is in India for summit talks with Prime Minister Narendra Modi, which are scheduled for Tuesday.

India-EU Trade Deal

At the India-EU summit, the two sides are set to announce the conclusion of negotiations for the much-awaited free trade deal.

Days before her trip to New Delhi, von der Leyen said that India and the European Union were on the cusp of a “historic trade agreement” that would create a market comprising two billion people accounting for almost a quarter of the global GDP.

“I will travel to India. There is still work to do. But we are on the cusp of a historic trade agreement. Some call it the mother of all deals. One that would create a market of 2 billion people, accounting for almost a quarter of global GDP,” she said in an address at the World Economic Forum in Davos last Tuesday.

“And, crucially, that would provide a first-mover advantage for Europe with one of the world’s fastest-growing and most dynamic continents. Europe wants to do business with the growth centres of today and the economic powerhouses of this century,” she said.

The European Union is India’s biggest trade partner, with bilateral trade in goods recording USD 135 billion in the financial year 2023-24.

The EU and India had first launched negotiations for the free trade agreement in 2007, but the talks were suspended in 2013. The negotiations were relaunched in 2022.

India reportedly plans to slash tariffs on cars imported from the European Union to 40% from as high as 110%.

The Indian government has agreed to immediately reduce the tax on a limited number of cars from the 27-nation bloc with an import price of more than 15,000 euros ($17,739), Reuters reported.

This will be further lowered to 10% over time, easing access to the Indian market for European automakers like Volkswagen, Mercedes-Benz, and BMW.

Source: adaderana.lk

Plantation companies demand more tea leaves to pay budget-approved Rs. 200 daily wage hike

A trade union leader who is also a public representative has alleged that the National People’s Power (NPP) government, which vowed to increase the daily wage of the country’s plantation sector workers who have worked tirelessly to strengthen the country’s economy for two centuries, has taken them for granted.

“This is because you have taken the plantation sector community for granted. I have said again and again in this House, don’t trust plantation companies as they will promise to increase wages but will create bigger issues through the back door," he said.

United National Party (UNP) Member of Parliament and Ceylon Workers’ Congress General Secretary Jeevan Thondaman recently revealed in Parliament that, instead of paying the Rs. 200 proposed by the government through the latest budget, plantation companies have increased the amount of tea leaves required per day.

“The Horana Plantation Company and the Talawakelle Plantation Company have increased the amount of tea leaves that should be plucked. It has been increased from 20 kg to 22, 23 kg. At the same time, in certain other parts of the plantation sector, plantation companies that required 20 kg are now demanding up to 26 kg. Is this the confidence you are giving us? Is this what we are getting in return for the Rs. 200 allowance that you are giving us?”

Presenting the budget proposals for the year 2026, President Anura Kumara Dissanayake informed Parliament last year that the daily wage of Rs. 1,350 paid to a plantation sector worker at the time would be increased to Rs. 1,750 with effect from January 2026.

That includes a Rs. 200 daily incentive paid by the government and a Rs. 200 allowance paid by plantation companies for each day worked.

MP Thondaman explained to Parliament how those promises have not been fulfilled thus far.

“You said that you would ensure a basic wage of Rs. 1,750. However, what is being paid today is only a basic salary of Rs. 1,550. The remaining Rs. 200 is a six-month allowance. Even that is acceptable to me; it is fine. You did not fulfill the promise you made to the plantation sector people. But you have given a basic salary of Rs. 1,550."

MP Thondaman also explained to Parliament the hardships in the professional lives of plantation sector workers, who have been working tirelessly to strengthen the country’s economy for two centuries without a wage commensurate with their labor.

“Today, some people may be holding flags in support of the government saying, ‘no, no, our President will do it, the President will do it.’ Let me tell you one thing. You may be a flag holder, someone who does not work in the plantation sector, someone sitting in this House, or even me… it is only those who climb mountains three times a day – morning, noon and evening – and pluck tea leaves know how difficult it is when they have to pluck even a single kilogram more.”

As pointed out by plantation sector trade unions, the daily wage of Rs. 1,750, which has remained an unfulfilled demand for several years, is not adequate at all in today’s economic conditions.

Hope for Thousands as IVF Comes to Sri Lanka’s Public Health System

Lanka is preparing to make a major leap in public healthcare by introducing In Vitro Fertilization (IVF) services at the Castle Street Hospital for Women in Colombo, marking the first time test-tube baby treatment will be available at a government hospital.

Hospital Director Dr. Ajith Kumara Danthanarayana said the new IVF unit is expected to become operational within the next three months, significantly widening access to advanced fertility care. The initiative aims to support couples who are unable to afford costly private treatments and to bring reproductive health services within reach of ordinary citizens.

Currently, IVF treatment in Sri Lanka is limited to a handful of private hospitals, with costs ranging from Rs. 2–3 million per cycle, placing it beyond the means of many families. By introducing the service in the public sector, health authorities hope to ease both the financial and emotional burden faced by couples struggling with infertility.

IVF, a procedure where fertilization takes place outside the body before the embryo is transferred to the uterus, is commonly used to address infertility linked to medical and unexplained causes. The move is widely seen as a milestone in public healthcare, offering new hope to thousands of couples seeking the chance to start a family.

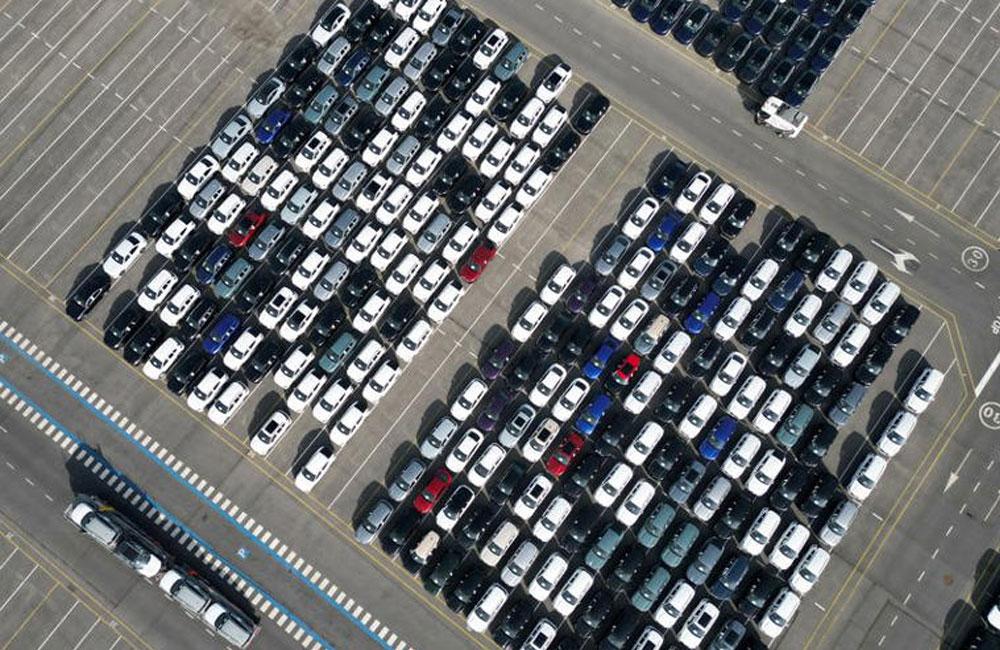

India to slash tariffs on cars to 40% in trade deal with EU

India plans to slash tariffs on cars imported from the European Union to 40% from as high as 110%, sources said, in the biggest opening yet of the country’s vast market as the two sides close in on a free trade pact that could come as early as Tuesday.

Prime Minister Narendra Modi’s government has agreed to immediately reduce the tax on a limited number of cars from the 27-nation bloc with an import price of more than 15,000 euros ($17,739), two sources briefed on the talks told Reuters.

This will be further lowered to 10% over time, they added, easing access to the Indian market for European automakers such as Volkswagen, Mercedes-Benz and BMW.

The sources declined to be identified as the talks are confidential and could be subject to last-minute changes. India’s commerce ministry and the European Commission declined to comment.

PACT ALREADY DUBBED ‘MOTHER OF ALL DEALS’

India and the EU are expected to announce on Tuesday the conclusion of protracted negotiations for the free trade pact, after which the two sides will finalise the details and ratify what is being called “the mother of all deals.

The pact could expand bilateral trade and lift Indian exports of goods such as textiles and jewellery, which have been hit by 50% U.S. tariffs since late August.

India is the world’s third-largest car market by sales after the U.S. and China, but its domestic auto industry has been one of the most protected. New Delhi currently levies tariffs of 70% and 110% on imported cars, a level often criticised by executives, including Tesla chief Elon Musk.

New Delhi has proposed slashing import duties to 40% immediately for about 200,000 combustion-engine cars a year, one of the sources said, its most aggressive move yet to open up the sector. This quota could be subject to last-minute changes, the source added.

Battery electric vehicles will be excluded from import duty reductions for the first five years to protect investments by domestic players like Mahindra & Mahindra and Tata Motors in the nascent sector, the two sources said. After five years EVs will follow similar duty cuts.

MARKET CURRENTLY DOMINATED BY SUZUKI AND LOCAL MAKERS

Lower import taxes will be a boost for European automakers such as Volkswagen, Renault and Stellantis, as well as luxury players Mercedes-Benz and BMW which locally manufacture cars in India but have struggled to grow beyond a point in part due to high tariffs.

Lower taxes will allow carmakers to sell imported vehicles for a cheaper price and test the market with a broader portfolio before committing to manufacturing more cars locally, said one of the two sources.

European carmakers currently hold a less than 4% share of India’s 4.4-million units a year car market, which is dominated by Japan’s Suzuki Motor as well as homegrown brands Mahindra and Tata that together hold two-thirds.

With the Indian market expected to grow to 6 million units a year by 2030, some companies are already lining up new investment.

Renault is making a comeback in India with a new strategy as it seeks growth outside Europe, where Chinese carmakers are making strong inroads, and Volkswagen Group is finalising its next leg of investment in India through its Skoda brand.

Source:adaderana.lk

Page 5 of 661