Business

Public – Private Partnerships strengthen rebuilding efforts post Cyclone ‘Ditwah’

Pyramid Wilmar, one of Sri Lanka’s most progressive and influential corporate entities in the food manufacturing and marketing sector has donated a sum of Lankan Rupees Fifty Million to the Presidential Secretariat to aid the government’s relief effort towards the victims of the recent ‘Ditwah’ cyclone.

Group Managing Director of Pyramid Wilmar (Pvt) Ltd., M. Sajjad Mawzoon said, “The devastation that took place throughout the country due to the recent cyclone has left everyone in a vulnerable situation. For some who lost their loved ones, life will not be the same. In light of all affected individuals and families, we stand with the people of Sri Lanka as the country begins to recover and rebuild from this existential challenge. Our commitment is to change life for the better.”

Pyramid Wilmar remains committed to its mandate for social responsibility, ensuring support for communities during times of crisis.

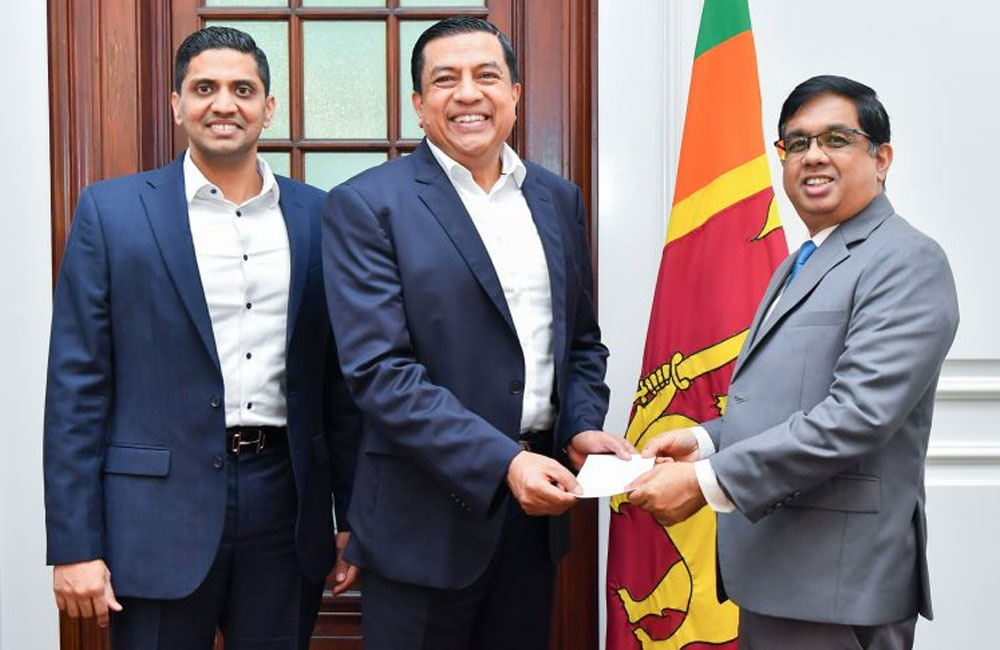

Secretary to the President, Dr. Nandika Sanath Kumanayake receiving a cheque of LKR 50 million for flood relief and humanitarian efforts from Group Managing Director of Pyramid Wilmar, M. Sajjad Mawzoon (Centre) and Director / Chief Operating Officer of Pyramid Wilmar Thanveer Siddique (Left)

Secretary to the President, Dr. Nandika Sanath Kumanayake receiving a cheque of LKR 50 million for flood relief and humanitarian efforts from Group Managing Director of Pyramid Wilmar, M. Sajjad Mawzoon (Centre) and Director / Chief Operating Officer of Pyramid Wilmar Thanveer Siddique (Left)

(Adaderana.lk - Business)

AMG Exits Sri Lanka Graphite Sector with $65 Million Sale to Asbury

AMG Critical Materials N.V. (AMG) has announced the sale of its subsidiary, Graphit Kropfmühl GmbH (GK), to Asbury Carbons Inc., a portfolio company of Mill Rock Capital, marking AMG’s complete exit from the natural graphite business. The deal, valued at $65 million, positions Asbury Carbons to expand its global graphite operations, including in Sri Lanka.

GK’s Global Operations and Sri Lankan Link

GK operates a graphite mine in Kropfmühl, Germany, and holds a majority stake in Bogala Graphite Lanka PLC, which manages one of Sri Lanka’s oldest graphite mines. The acquisition includes all GK operations and approximately 350 employees worldwide. For the 12 months ending August 2025, GK recorded $65 million in revenue, reflecting stable performance despite challenges in the natural graphite market.

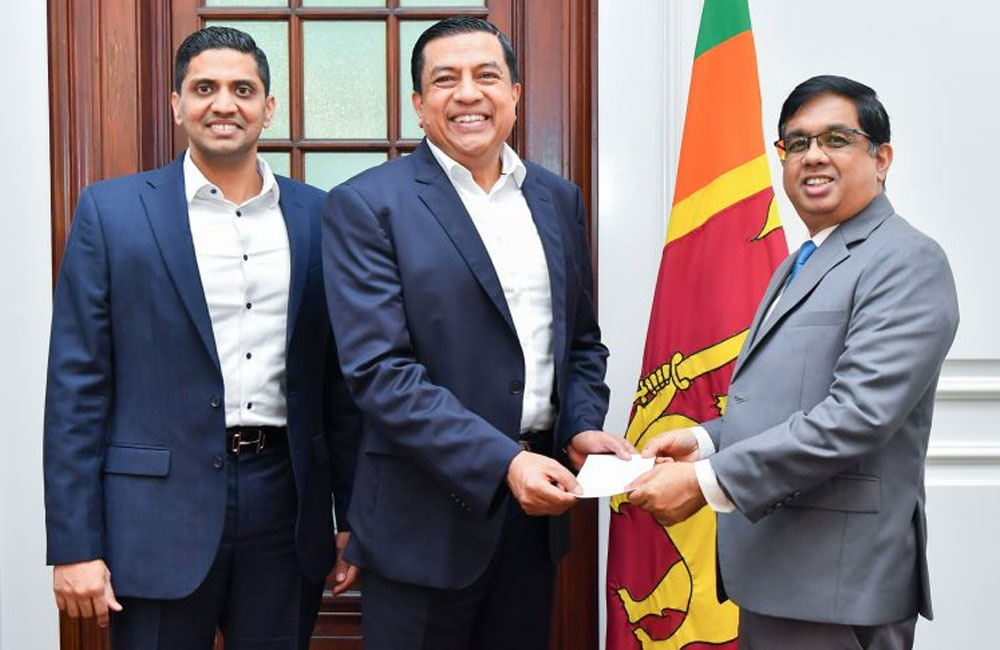

Following the announcement, Bogala Graphite Lanka PLC shares surged 25%, closing at Rs. 137, driven by investor optimism about Asbury’s potential to boost Sri Lanka’s graphite production and market reach.

Commenting on the divestment, AMG CEO and Management Board Chairman Dr. Heinz Schimmelbusch said the sale underlines AMG’s focus on strategic portfolio management. “While natural graphite remains an attractive industry, GK did not achieve the scale required to compete as a major supplier to the battery anode market. Under Asbury Carbons, GK will have better prospects for growth,” he stated.

Schimmelbusch added that the proceeds would be used to strengthen AMG’s balance sheet and invest in its core growth areas, particularly critical materials essential for clean energy technologies.

Full Ownership Before Sale

This sale follows AMG’s March 2025 repurchase of the remaining 40% of GK shares from Alterna Capital Partners, finalizing full ownership before the divestment. Under the agreement, AMG can settle the purchase in cash within three years or opt for AMG shares at its discretion.

Asbury’s Expansion Strategy

Asbury Carbons, headquartered in Asbury, New Jersey, is a global leader in carbon-based materials with over 300 employees across 10 facilities in North America and Europe. The company supplies graphite and carbon solutions to industrial clients in steel, automotive, energy, and technology sectors.

Gregg Jones, CEO and Chairman of Asbury Carbons, described the acquisition as a strategic milestone: “Bringing together Asbury and GK combines over 250 years of collective expertise. This move enhances our global supply chain resilience and allows us to deliver advanced carbon technologies to our clients.”

The transaction, pending customary regulatory approvals, is expected to close by the end of 2025. Analysts note that the sale underscores shifting dynamics in the graphite industry, as demand for battery-grade materials intensifies amid global energy transitions.With Asbury’s entry into the Sri Lankan graphite sector through GK’s majority stake in Bogala Graphite, industry observers anticipate renewed foreign investment interest and potential expansion in Sri Lanka’s high-purity graphite exports a critical component in electric vehicle and battery manufacturing.

NTB’s HSBC Takeover Reshapes Sri Lanka’s Retail Banking Landscape

Sri Lanka’s banking sector is headed for one of its most significant structural shifts in years, following the Central Bank’s approval for Nations Trust Bank (NTB) to acquire the retail banking operations of HSBC Sri Lanka in a deal valued at Rs. 18 billion plus applicable taxes.

The transaction, expected to be completed in the first half of 2026, will transfer nearly 200,000 customer accounts including premium banking portfolios, credit cards and retail loans into NTB’s network, marking a major consolidation in the country’s financial services market.

For NTB, the acquisition represents a decisive strategic leap. By absorbing one of the country’s most established foreign retail banking franchises, the bank strengthens its position in the high-value, premium segment an area HSBC has traditionally dominated.

NTB’s leadership says the approval from the Central Bank allows the bank to “move forward with confidence,” indicating that integration planning, regulatory alignment and systems preparation are already underway.

For depositors, the deal carries both opportunities and questions. NTB gains access to a customer base known for strong balances, cross-border transaction needs and high credit quality, potentially enabling better product bundling, digital upgrades and expanded service offerings.

However, longstanding HSBC clients many accustomed to international banking standards and global service integration will closely monitor how seamlessly NTB can replicate, or enhance, their experience. The Central Bank’s oversight aims to ensure smooth continuity of services, uninterrupted access to funds, and safeguards on customer rights during the transition.

From a broader economic perspective, the consolidation signals two key trends: the gradual shrinking presence of global banks in small markets and the corresponding rise of domestic financial institutions positioned to fill the void.

Analysts say HSBC’s exit from Sri Lankan retail banking reflects a global strategy prioritising large-scale markets, while the transfer of assets to NTB ensures local stability and avoids the destabilising effects of a foreign-bank withdrawal.

The deal may also support economic recovery by strengthening capital flows and lending capacity. With a larger deposit base and expanded customer portfolio, NTB will gain improved liquidity buffers important at a time when the banking system is navigating post-crisis restructuring, tighter regulation and the need to restore credit growth.

The premium customer segment, in particular, plays a significant role in long-term deposit stability, wealth management and consumption-driven economic activity.

HSBC says its priority is ensuring a smooth transition, pledging to maintain high service levels throughout the process. NTB, in turn, has committed to preserving service quality and offering continuity for staff shifting as part of the transfer.

If executed effectively, the takeover could become a textbook example of managed financial sector transformation one that strengthens domestic banking resilience while ensuring depositors benefit from improved reach, technology and service integration.

The real test, however, will be whether NTB can not only absorb HSBC’s customer base but retain their confidence in a changing financial landscape.

Sri Lanka’s Techno Park Initiative Stalls amid Multi-Hundred Million Rupee Losses

The government’s ambitious programme to establish five technology parks across Sri Lanka has hit a major barrier, as projects in Galle and Kurunegala — launched in 2021 and touted as key to the nation’s digital-economy push are now abandoned and racking up huge financial losses.

According to government audit data, construction at both parks was suspended as of 5 February 2024, the date of a physical inspection of the sites.

The parks were to be delivered under the umbrella of the Techno Park Development Company (Pvt) Ltd. (TPDC), a state-owned entity created by the cabinet to set up "commercial enterprise" techno parks in five districts, namely Galle, Kurunegala, Anuradhapura, Kandy and Batticaloa.

Clause 14.6 of the contracts for the Galle and Kurunegala parks stipulates hefty liquidated damages for delays. The Galle project carries a penalty of Rs. 236.36 million; Kurunegala’s is Rs. 416.8 million totalling a potential government loss of Rs. 653.16 million.

In addition, outstanding payments are piling up: as at 31 March 2022, Rs. 950.6 million was still owed to the Galle park contractor. Engineering consultants for Galle and Kurunegala are owed Rs. 18.17 million (since April 2022) and Rs. 36.19 million (by end 2023) respectively.

The initiative envisaged techno parks over 30-acre sites that would host R&D labs, software development firms, incubators, and advanced manufacturing. For example:

Galle’s 31-acre site in Walahanduwa, Akmeemana, planned a built-up floor area of 45,684 m² with office units, restaurants and clubhouse.

Kurunegala’s site in Rathgalla offered 14 acres (11 + 3) and a proposed floor area of 31,147 m².

According to the 2021 budget, the first two parks (Galle & Kurunegala) were already under way, with three more expected by 2023 in Nuwara Eliya (Mahagasthota), Kandy (Digana) and Habarana.

The objective: to build a “techno-entrepreneurship driven economy,” tapping Sri Lanka’s human resources and strategic locations.

Despite the optimism, progress has stalled. According to news reports, by mid-2024 the parks had been abandoned and the projects flagged for revival under the direction of Dinesh Gunawardena (Prime Minister) who initiated steps to rescue the Galle and Kurunegala sites.

Key issues include unclear timelines, weak project management, delayed contractor performance and mounting liabilities.

The lapse comes at a time when Sri Lanka is seeking to strengthen its digital economy and technology export base. Failure to realize these infrastructure projects undermines investor confidence, leaves committed capital stranded and jeopardises the strategic goal of technology-driven growth. Meanwhile, mounting penalty and unpaid-billing figures add strain on public finances already under pressure.

Reviving such large-scale infrastructure requires robust governance, accountability mechanisms and clear timelines. The TPDC’s mandate to list on the Colombo Stock Exchange and allow private investors (as outlined in the 2021 cabinet decision) may need stronger enforcement.

More importantly, contracts must include enforceable milestones, and project oversight must be professionally sustained if the techno park strategy is to deliver value.As Sri Lanka re-positions itself for the Fourth Industrial Revolution, the techno park programme’s stalled start serves as a caution: bold vision must be matched by disciplined execution. The nations’ technology aspirations risk being held back by idle buildings and overdue invoices unless urgent corrective action is taken.

Sri Lanka’s Tea Sector Faces Pressure despite Regional Leadership Bid

Sri Lanka’s tea industrylong considered the backbone of rural livelihoods and a critical source of export revenue—is navigating a period of deep structural challenges even as the country prepares to assume the Chairmanship of the Asia Tea Alliance (ATA) for 2026–2027.

The appointment of Tea Small Holdings Development Authority (TSHDA) Chairman Nimal Udugampola marks the first time a smallholder-institution leader will head the regional alliance, signalling a shift toward greater smallholder influence in Asia’s tea value chains.

(TSHDA) Chairman Nimal Udugampola

(TSHDA) Chairman Nimal Udugampola

The announcement comes at a time when the industry is under pressure from falling yields, rising production costs, labour shortages and declining global competitiveness.

According to 2025 export performance data, Sri Lanka’s tea export earnings fell to USD 1.16 billion in the first ten months, compared to USD 1.28 billion during the same period in 2024, while total tea production for January–October 2025 stagnated at 210 million kg, well below the historical average of 300–320 million kg.

Output from smallholderswho account for more than 75% of national production also dipped by nearly 8% due to extreme weather and fertiliser affordability issues.

Against this backdrop, Colombo will host the 6th ATA Annual Meeting and the Asia International Tea Summit 2025 on November 27 at Lotus Tower, under the theme “Tea Reimagined: Regenerative, Resilient and Carbon Free.”

The summit, led by Solidaridad Asia Managing Director Dr. Shatadru Chattopadhayay, is expected to stress sustainability, climate adaptation and fair value distribution across the supply chain. Minister of Plantations and Community Infrastructure Samantha Vidyarathna will attend as chief guest.

ATA’s agenda under Sri Lanka’s leadership will prioritise regenerative agriculture, climate resilience, equitable pricing, and stronger market linkageskey areas where the domestic industry is lagging. Dr. Chattopadhayay noted that collaboration, verified sustainability and market access are essential to rebuilding competitiveness, adding that Sri Lanka’s leadership comes “at the right moment” for the global shift toward decarbonised tea production.

However, local industry experts caution that broader reforms are urgently needed at home. Production costs continue to escalate as fertiliser and energy prices rise, while traditional marketsincluding the Middle East, Russia and Turkey have reduced purchasing volumes. Meanwhile, competitors like Kenya and India continue to gain market share with lower prices and higher output.

The government’s long-term target of 400 million kilograms of annual tea production by 2030 is seen as ambitious but achievableif accompanied by investment in new technology, replanting, climate-adaptation practices and consistent policy support. Of the 400 million kg target, 300 million kg is expected from smallholders, many of whom lack access to capital, extension services and modern cultivation techniques.

Addressing wage concerns, the TSHDA clarified that President Anura Kumara Dissanayake’s proposal to raise estate workers’ daily wage from Rs. 1,350 to Rs. 1,550 plus a Rs. 200 attendance incentive from January 2026 does not affect the Authority, as smallholder-sector workers typically earn higher incomes than those employed on corporate plantations.

As Sri Lanka prepares to lead the Asia Tea Alliance, the symbolic regional recognition offers momentum. Yet the country’s tea sectostill constrained by climate shocks, weakened productivity and global competition requires urgent and coordinated reforms to restore its economic strength.

Sri Lanka–Thailand Business Council Holds 24th Annual General Meeting

The Sri Lanka–Thailand Business Council held its 24th AGM recently with the presence of key stakeholders and members present.

The Council continues to play a pivotal role in strengthening trade, investment, and tourism ties between the two friendly nations. Rooted in centuries of shared cultural and religious heritage, the bond between Sri Lanka and Thailand has evolved into a partnership that blends tradition with modern economic collaboration. The Council, which will celebrate its 25th anniversary next year, has been a cornerstone of this progress, fostering dialogue and cooperation between the private sectors of both countries.

Rizan Nazeer, one of the founding members of the Council, was appointed as its President.

Rizan Nazeer

Rizan Nazeer

With his long-standing commitment to enhancing Sri Lanka–Thailand relations, Nazeer brings both experience and vision to the role. He stated that the Council has many plans underway to support the government’s efforts to strengthen trade, economic, and tourism relations between the two nations. He also highlighted the significance of the Sri Lanka–Thailand Free Trade Agreement (FTA), signed in February 2024, which aims to eliminate tariffs on nearly 85 percent of traded goods within six years. The agreement, once implemented, is expected to raise bilateral trade, currently valued at around US$350 million, to over a billion dollars in the near future.

He emphasised that the Council’s focus will be on fostering greater private-sector engagement, encouraging joint ventures, and expanding cooperation in key areas such as agriculture, food processing, health and wellness, tourism, renewable energy, and technology. The Council also plans to empower small and medium enterprises by helping them gain access to new markets and meet international quality standards, thereby enabling them to benefit from the opportunities that will arise through enhanced bilateral cooperation.

Over the years, the Sri Lanka–Thailand Business Council has organised numerous business forums, trade missions, and networking events in collaboration with the Board of Trade of Thailand, Thai Sri Lanka Chamber of Commerce and other partners. These initiatives have opened new avenues for business and investment, while also strengthening cultural understanding and people-to-people connections between the two countries.

As the Council approaches its 25th year of dedicated service, it stands as a symbol of enduring friendship and forward-looking cooperation between Sri Lanka and Thailand. Under the leadership of the President and the Executive committee the Council is poised to guide this partnership into a new era of shared prosperity, reinforcing its commitment to economic growth, tourism promotion, and mutual progress for both nations.

The Executive Committee of the Sri Lanka Thailand Business Council for the year 2025/2026:

- President Rizan Nazeer (Transtrade International)

- Immediate Past President Dushyantha Basnayake (Medimarket Ltd),

- Vice Presidents Kamil Weerasekara (Peter Weerasekara Foundation), A.M. Musajee (M.M. Noorbhoy & Co. Ltd.)

- Secretary Priyantha Kolonnage (Pyramid Wilmar Ltd.),

- Assistant Secretary Rohan Elgiriyawithana (Mazuma Lanka and Chanlanka)

- Treasurer Yashoda Peiris (Waruna Publishers)

- Asst. Treasurer Abdul Saliheen (Paramount Impex Ltd.).

Committee Members: Rienzie Fernando (Roots Global Ltd.), Asim Mukthar (Lanka Exhibition & Conference Service Ltd.), Asitha Panabokke (Mahaweli Reach Hotel), Deepal Abeysekara (Infinity Gift Cards), Chandana Nanayakkara (Siam City Cement Lanka Ltd.), Asela Inddawala (SKYNET Consulting Ltd.), Harendra Abeysundara (Oceanway Ltd.), Past President Lalith Kumarage (Alucare Ltd.), and Founder and Past President Lional Fernando (Benjarong Ltd.).

(Source - ft.lk)

National Audit Exposes Deep Rot in Sri Lanka Customs Management

Sri Lanka Customs, the country’s frontline agency for import and export regulation and a key source of government revenue, has been hit by a damning National Audit Office report exposing serious administrative lapses, opaque financial practices, and policies that undermine state coffers. The findings raise urgent questions about governance failures inside one of Sri Lanka’s most powerful institutionsan agency responsible for collecting nearly 37% of national tax revenue.

At the centre of the audit is a complex network of funds run by Customs, including the Reward Fund, Management and Compensation Fund, and the Overtime and Cargo Examination Fund, along with four additional sub-funds. While these funds are meant to incentivize performance and support operational needs, auditors found that they operate with minimal oversight, weak policy guidance, and structures that create perverse incentives for officers.

Distorted Penalty Sharing System

The most alarming revelation relates to how penalties from customs offences are shared. When an import-related offence is detected, only 30% of the net penalty after internal deductions—is ultimately credited to the Consolidated Fund. In some cases, this 30% is even lower than the legitimate customs duty that should have been charged. From 2012 to August 2023, just Rs. 14.53 billion reached the Treasury under this formula, while Rs. 24.22 billion was paid out as rewards to officers and informants.

Irregular Reward Schemes

The audit also uncovered that rewards have been distributed for 35 years based on internal departmental ordersnot on a scheme approved by the Minister of Finance as legally required. Even routine operational detections, which do not qualify as offences, were treated as revenue-generating “offence detections,” granting officers eligibility for significant reward payments. This effectively allows staff to receive salaries, incentives, overtime, and extra benefits simply for reporting to work.

Penalty Mitigation and Revenue Losses

A separate concern is the drastic mitigation of penalties. Between 2017 and 2023, 17 major penalties originally totaling Rs. 7.61 billion were reduced to just Rs. 481.69 million. As a result, the government received only Rs. 144.5 million, leading to a revenue loss of Rs. 181.5 million compared to the tax that was attempted to be evaded. Auditors linked these reductions to discretionary relaxations by investigating officers and powers exercised by senior Customs officials.

The report also points to a striking disregard for basic administrative discipline. Despite a 2017 circular mandating fingerprint-based attendance for all public servants, Customs continues to rely on handwritten registers, leaving room for manipulation.

Meanwhile, the overtime system is riddled with abuse90% of the overtime fund is paid directly to officers regardless of whether they worked beyond normal hours, with only 10% going to the state. In 2021 and 2022 alone, officers received Rs. 948 million and Rs. 938 million, while the government received just Rs. 85.7 million and Rs. 83.6 million.

The audit paints a stark picture of an institution weakened by outdated policies, unchecked internal controls, and a reward-driven culture that prioritizes personal gain over national interest. With billions in potential revenue slipping away amid lax management and discretionary decision-making, the report underscores the urgent need for sweeping reform in Sri Lanka Customs before further damage is done to the country's already strained public finances...

Hayleys PLC to enter Sri Lanka's supermarket sector

Hayleys PLC, Sri Lanka’s most diversified conglomerate, is set to make a strategic entry into the large-scale supermarket sector, marking a new chapter in its 148-year legacy of diversification and value creation.

The move reflects the Group’s commitment to bringing quality, reliability, and exceptional service closer to everyday Sri Lankan consumers, while redefining the modern retail experience.

Leveraging its extensive value chains, strong brand presence, experienced leadership, and focus on sustainable business, Hayleys aims to build a value-driven retail ecosystem across the island.

In Phase 1, the Group plans to launch 100 outlets strategically located in key urban and suburban areas. This expansion is expected to diversify its earnings profile, enhance long-term financial stability, and generate broad-based value for stakeholders.

With improving macroeconomic conditions, rising urbanisation, and increasingly sophisticated consumer lifestyles, Hayleys sees significant growth potential in the country’s retail sector.

The venture will utilise the Group’s expertise in logistics, manufacturing, and service excellence to offer customers better accessibility, higher quality, and a wider choice, reaffirming Hayleys’ enduring commitment to inclusive growth and national development.

Ghost SOEs Exposed as Sri Lanka’s Reforms Stall Again

Sri Lanka’s highly publicised state-sector reform drive once championed as a cornerstone of economic recovery is now under sharp scrutiny after a new audit revealed widespread delays, missing documentation and a growing burden of unmonitored liabilities across dozens of state-owned enterprises (SOEs).

The Auditor General’s Department has warned that the reform process is failing to deliver on its promise, leaving the public sector weighed down by “ghost entities” that continue to drain state resources.

Government records show 30 public companies and two public corporations officially classified as “non-operative.” However, the audit found that even the most basic information on many of these entities such as formal resolutions, financial statements, and in some cases their full identity remains unavailable.

This opacity has effectively turned them into untracked fiscal liabilities, making it impossible to determine the true financial exposure to the state.

For example, the Sri Lanka Rubber Manufacturing & Export Corporation (SLRMEC) has ceased operations and leased its Elpitiya foam-rubber factory, while the Co-operative Wholesale Establishment (CWE) retired all its staff by September 2023.

Yet despite being non-functional, several SOEs have not begun the legally required liquidation process. As of 31 July 2024, only four of the twelve entities slated for closure had formally entered liquidation, while six remained in complete limbo.

Compounding the problem, the audit highlights major data gaps. Even identifying all twelve dormant entities proved challenging. Well-known loss-making SOEs such as the Janatha Estates Development Board (JEDB) and the Sri Lanka State

Plantations Corporation (SLSPC) appear on various dormant lists, while lesser-known companies, including Lanka Cement Corporation Ltd, Selendiva Investments Ltd, and Magampura Ports Management Company (Pvt) Ltd, are still awaiting closure decisions.

The fiscal consequences are significant. A separate government study cited in the audit found that 20 SOEs incurred Rs. 850 billion in combined losses, and auditors warn that even a fraction of this attributable to non-operating entities represents a substantial drain on public finances.

The report stresses that dormant SOEs are “not inert they continue to carry costs, liabilities and opportunity losses,” despite contributing nothing to the economy.

The Ministry of Finance, identified as the key authority responsible for implementing closures, faces criticism for prolonged delays that “speak volumes about implementation failure.” As the country works to rebuild fiscal credibility under an IMF-supported programme, the continued presence of these ghost entities undermines reform momentum and risks eroding investor confidence.

The Auditor General recommends swift corrective action, including:

- Publishing a complete, updated list of dormant SOEs with recent financial data;

- Assigning each entity a clear exit path—revival, merger or liquidation—with strict timelines;

- Initiating and completing all pending liquidation processes without further delay.

Until these steps are taken, Sri Lanka’s dormant SOEs will remain a silent but costly burden, symbolising the widening gap between reform rhetoric and real execution.

Dhammika Perera Secures Major Ownership in Harischandra Mills PLC

In a major stock market move worth Rs. 2.57 billion, Sri Lankan business magnate Dhammika Perera has acquired a 40% stake in Harischandra Mills PLC, a long-established listed company on the Colombo Stock Exchange.

The transaction took place this morning (17), with Perera purchasing 778,946 shares from Senthilverl Holdings (Pvt) Ltd, the investment arm of Dr. T. Senthilverl, at Rs. 3,300 per share, according to market sources.

This marks Perera’s fourth major acquisition this year, underscoring his aggressive expansion strategy across key sectors. In September, his investment arm, Vallibel One, together with its subsidiary LB Finance PLC, announced the acquisition of a controlling stake in Associated Motor Finance Company PLC.

Meanwhile, 2025 has been a defining year for the tycoon, as he initiated two other major takeovers — including a high-profile merger involving LOLC Holdings and Vallibel Three Ltd. Earlier, on July 8, Perera also took over a controlling stake in East West Properties PLC, investing approximately Rs. 3.23 billion in that deal.

Dhammika Perera’s latest acquisition further cements his position as one of Sri Lanka’s most influential and expansion-driven business leaders, with a keen eye for strategic growth across diverse industries.

Court Intervention Frees Hundreds of BYD EVs amid Duty Probe

In a significant breakthrough for Sri Lanka’s electric vehicle import sector, John Keells CG Auto (JKCG) the official agent for BYD announced that the Court of Appeal has directed the release of hundreds of detained electric vehicles following weeks of legal wrangling with Sri Lanka Customs over disputed motor power classifications.

In its latest statement, JKCG confirmed that it had filed two additional Writ Applications on 26 September and 2 October 2025, challenging the continued detention of 631 electric vehicles, including the popular BYD ATTO 1 and ATTO 2 models. The company said that on 11 November 2025, Customs agreed in court to release the vehicles under corporate and bank guarantees, marking a major relief for customers and importers caught in the standoff.

The dispute, which has dominated the electric vehicle market for months, centres on whether the detained vehicles exceed the 100 kW motor capacity threshold declared by importers. Customs officials allege that certain BYD models may actually contain 150 kW motors, which would make them subject to a higher excise duty approximately LKR 5.4 million per unit, compared with LKR 2.4 million for the 100 kW variant.

JKCG, while contesting Customs’ interpretation, said it had acted in good faith by offering Corporate Guarantees for one category of vehicles and Bank Guarantees for the rest, to cover any potential tax differentials pending the outcome of testing and verification. Though initially rejected, this arrangement was later accepted in court, allowing Customs to begin releasing the shipments.

In its statement, JKCG reiterated that “the globally accepted norm for vehicle clearance is for Customs to rely on the Manufacturer’s Certificate,” and that any technical verification, if required, “should be conducted in an internationally accredited motor laboratory to ensure accuracy, credibility, and consistency.”

The company also drew attention to Customs’ delays in conducting power-verification tests. JKCG said it had filed an affidavit offering to provide the necessary technical equipment and scanning machines to assist Customs in verifying motor capacity. In line with that, the company made available a Vehicle Diagnostics Service (VDS) a specialised tool that connects to the vehicle’s onboard diagnostics (OBD) system for motor and software verification on 6 November 2025. However, Customs did not proceed with testing that day and has since informed the Court it will determine next steps.

JKCG acknowledged that the prolonged detention had caused serious inconvenience to customers who had pre-ordered vehicles amid growing demand for EVs following the post-pandemic import liberalisation. The company thanked buyers for their patience, saying the release order “will now enable us to fulfil our obligations and deliver the vehicles without further delay.”

Industry analysts note that the case could set a precedent for how electric vehicles are classified, taxed, and verified in Sri Lanka, especially as BYD continues to dominate the market since the lifting of the import ban in 2023. The ruling also highlights the need for clearer technical standards and greater transparency in customs assessments, as the country seeks to promote electric mobility while safeguarding state revenue.

With the court-directed release now underway, attention will turn to whether Customs introduces new testing protocols or international verification partnerships to prevent similar disputes in the future a step that could help restore investor confidence and support Sri Lanka’s clean-transport transition.

Giga Foods - at Colombo City Centre

Giga Foods (Pvt) Ltd, one of Sri Lanka’s fastest-growing multi-brand food companies, has opened a new outlet at Colombo City Centre (CCC). The outlet brings together three of its popular brands—Full’r Burgers, Indian Affair, and Solo Bowl—under one roof.

Giga Foods is known for its promise: “Every meal, every time; exceptional taste, consistent quality, and dependable service.” The new CCC outlet reflects the company’s goal of creating a place where different cuisines come together in one location.

Customers can enjoy a variety of meals, from burgers and biryanis to healthy wraps and bowls, suitable for families, quick lunches, or light dinners.

With this opening, Giga Foods strengthens its role in Sri Lanka’s food and beverage industry, offering quality, affordability, and a great dining experience.

Page 1 of 29