Business

Merging of finance and leasing companies begins in the New Year

Sri Lanka’s ambitious initiative of merging finance and leasing companies with their larger profit making counterparts or commercial banks proposed in budget 2021 begins to bear fruits with two such companies announcing its amalgamation on Friday (24).

The merger proposal between Arpico Finance Company PLC (AFC) and Associated Motor Finance Company PLC (AMF) has been approved by the Central Bank of Sri Lanka (CBSL) on Tuesday (22), the two companies said in separate stock exchange filings.

The surviving company would be AMF and in terms of the said approval, AMF is required to complete the merger by 31 March 2021.

The merger of aforesaid, will commence, subject to the in principle approval being given by the Colombo Stock Exchange (CSE) to AMF, for the listing of shares of AMF arising from the amalgamation of AFC with AMF, CSE filings revealed.

State Minister of Finance Ajith Nivard Cabraal that the government would be providing with the tax incentives as well for such mergers and is a wonderful way forward because that would mean that the finance system stability would be ensured.

Cabraal expressed the belief that the Central Bank also will take the steps to move that forward.

The mergers of Sri Lankan finance and leasing company (FLC) subsidiaries with their counterparts or parent banks will not have an immediate impact on the banks' ratings, Fitch Ratings said.

However, the extent of the impact of absorbed FLCs on banks' business models and their consolidated risk and financial metrics, particularly asset quality and profitability, will be important for the banks' ratings, the international rating agency said.

The merger finance and leasing companies with their counterparts will result in customers with a higher risk profile being denied credit.

“FLCs typically cater to sub-prime customers, which banks have very little appetite for,” the rating agency said.

Errant finance companies face legal action for frauds

Rogue finance companies operating in the country are now being brought under intensified surveillance of the Central Bank and it’s taking necessary legal action as these firms have become a severe threat to the current financial system affected by the second wave of COVID-19. The Central Bank will be taking measures to broaden public awareness on the consequences of engaging in unauthorised financial activities by errant finance companies.

It has intensified surveillance in detecting unauthorised finance businesses and deposit taking while seeking public support to take appropriate action against such errant financial institutions.

All operations of Eyon Lanka Investment and Film Production International Company (Pvt) Limited have been stopped by the monetary regulator as this unauthorised finance company has carried out an illicit finance business.

The Central Bank has already issued freezing orders prohibiting the company soliciting and mobilising deposits or any funds in any other forms, disposing / alienating assets, entering into any transaction in relation to any account, property or investment.

The Colombo High Court has extended the freezing orders until 15.01.2021. Further, a report was sent to the Attorney General’s Department on 02.11.2020 requesting to institute criminal proceedings against the rogue finance company.

The Central Bank reiterates the requirement for enactment of a legal framework to regulate unregulated money lending activities so that a better and more effective regulatory environment is created for money lending institutions in the future.

Registration under the Finance Leasing Act, No 56 of 2000 (as amended) (the FLA) is mandatory to carry out finance leasing business and any person carrying out finance leasing business without such registration commits an offence under the FLA.

The said institution has not been registered by CBSL to carry out finance leasing business and therefore, any finance leasing business carried out by such institution constitutes an offence.

Over 9000 depositors including retired members of security forces have become destitute due to the sudden collapse of the company and the freezing of its operations by the monetary authority, several disgruntled depositors said.

A meeting between the representatives of depositors, management of the company and CBSL officials was held on Tuesday (8) and the implementation of a payment plan was taken up for discussion. But the Monetary Board at its meeting held recently has already decided that the submitted repayment plan was not acceptable, a CBSL public notice revealed.

Tea plantation companies offer new hybrid wage model

Sri Lanka’s Regional Plantation Companies (RPCs) have presented to state authorities with aim radically expanding worker earnings during a recently concluded meeting with the Minister of Labour and Trade Unions leaders. Workers may receive a total of LKR1,025 for a day’s work under this new proposal. The newly introduced proposal provides for a hybrid between the daily wage model and the productivity-linked earning systems implemented with great success in the smallholder sector.

Adding a productivity based component will ensure that worker earnings are expanded, and workers have more flexibility and control over their monthly earnings.

Under the new proposals, RPCs will continue to offer a fixed daily wage with the re-introduction of attendance and productivity incentives in a notable departure from previous years. The RPCs have proposed a mix of 3 days of daily wage and 3 days of productivity-based earnings, where workers will have the capacity to expand their earnings based on their output.

The first alternative under the productivity-linked proposal is a system where workers are paid LKR 50 for every kilogram of green tea leaf plucked (inclusive of EPF/ETF) where a high plucking average of between 30 - 40 kilograms a day is attained. RPCs pointed out that workers have the potential of expanding their earnings exponentially. In the case of the Rs. 50 rate, a worker who plucks 20 kg will receive Rs. 1,000 per day, and monthly pay of LKR 25,000.

Current annual plucking averages among RPC companies are between 20 - 22 kilograms a day. However, a majority of the best harvesters have plucking averages between 30 - 40 kilograms, which means that earnings can now be expanded to over LKR 37,500 - 62,000 per month.

The next alternative is that workers are remunerated based on a share of the National Sales Average (NSA) ratio of 35%.

Workers may receive a total of LKR1,025 for a day’s work under this new proposal.

BOC faces management issues despite sterling financial performance

The downgrade of BOC’s Long-Term IDR and Viability Rating stems from the 27 November 2020 downgrade of the sovereign IDR to ‘CCC’, from ‘B-‘ and Fitch’s assessment of the operating environment.

BOC’s Long-Term IDR is driven by the bank’s intrinsic strength, as expressed by its Viability Rating. The ratings are constrained by the sovereign IDR.The downgrade and negative outlook on risk appetite and most of the financial profile factors reflect the downside risks to borrowers’ creditworthiness and the stability of the bank’s financial metrics stemming from the operating environment.

The two Non-Executive Directors, Lalith Withana and Hasitha Premaratne, have resigned from the board of directors of Bank of Ceylon (BOC), with effect from December 8, 2020.

Both Withana and Premaratne were appointed to the BOC board on January 14, 2020.

The downgrading of BOC and resignation of two directors took place amidst the better performance of the state bank amidst COVID-19 pandemic, a senior official said, expressing his dismay on the resignations of the two eminent directors of the bank.

Bank’s asset base increased by 15% to LKR 2.8 trillion as at the end of August 2020 from LKR 2.4 trillion as at the end of 2019.

Deposits of the bank were LKR 2.2 trillion by the end of August 2020, being the first Sri Lankan Bank to surpass the LKR 2 trillion landmarks, treasury data showed.

BOC recorded a profit before tax of LKR 12.9 billion in the first eight months of 2020, compared to the profit before tax of LKR 18.1 billion in the same period of 2019.

This was mainly due to accounting for the day one loss on COVID -19 moratorium and the increase in interest expenses in line with the growth of the deposit base

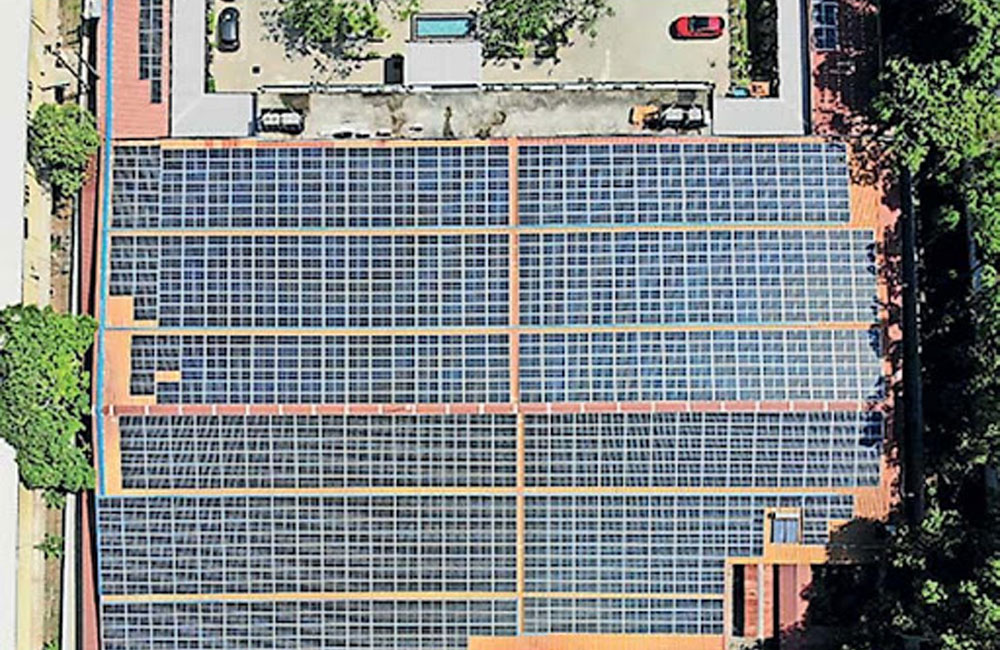

Vidullanka PLC commissions its first roof-top solar power project

This project is with a capacity of 515kWp and has utilized the roof area of Diamond Cutters Ltd’s factory premises located in the Panadura Industrial Zone.

The commissioned project will contribute 0.7GWh of energy to the local grid. PV modules used were manufactured by JA Solar Holdings, while the inverters were sourced from Huawei Technology.

This solar power project is aimed at annually saving 495 metric tonnes of carbon through clean energy power generation, Vidullanka said in a media release.

Vidullanka PLC, a pioneering entity in the renewable energy sector in Sri Lanka for over two decades has been growing from strength to strength each year.

The company has a total portfolio of more than 36MW, with a cumulative annual energy exceeding 125GWh annually to the national grids of Sri Lanka and Uganda.

It is noteworthy that Vidullanka’s energy portfolio now comprises Hydro, Dendro and Solar power plants. Vidullanka PLC was also able to reduce 66,700 tonnes of carbon emissions through its strong renewable energy project portfolio.

Despite the operational challenges posted by the COVID-19, Vidullanka PLC was successful in ensuring the safety and wellbeing of its employees while ensuring smooth operations at the power plants.

The group reported a Profit After Tax of Rs. 196 million for the first six months of the financial year compared to Rs. 52 million for the corresponding period and Rs. 362 million for the financial year 2019/20

South Africa keen to create a market for Sri Lankan jewellery

South Africa has sought Sri Lanka's assistance to improve their jewellery industry, the outgoing South African High Commissioner in Colombo Robina P. Marks said. She revealed this when she called on Foreign Minister Dinesh Gunawardena at the Foreign Ministry on December 04.

The High Commissioner apprised the Minister that the Government of South Africa was keen to obtain assistance from Sri Lankan craftsmen to develop the Jewellery Industry in South Africa.

South Africa is currently Sri Lanka’s major source of coal imports, accounting for most of the country’s imports from the region. Investment, tourism, and migration flows have also grown in recent decades, though they remain small in terms of total flows to Sri Lanka.

Foreign Minister Gunawardena sought South African expertise in the canning industry for the food and vegetable industry in Sri Lanka, as around 40% of the harvest is wasted in the country due to technology gaps in this field.

The Minister also highlighted the importance of enhancing cooperation in trade, investment and tourism sectors between the two countries. It was also discussed on further expanding tea exports to the African continent through the South African distribution network.

The outgoing High Commissioner also informed that the South African supermarket chain, SPAR has made arrangements to expand up to 20 units in Sri Lanka and also emphasised on the availability of the containers that import goods from South Africa to be used to export Sri Lankan products to the South African Market upon their return. The Foreign Minister paid a tribute to the High Commissioner for her immense contribution in further consolidating relations between Sri Lanka and South Africa in all spheres.

State banks face the threat of being blacklisted by foreign banks

Sri Lankan businessmen are now experiencing difficulties in importing essential items and other items needed for their value added products on credit terms as foreign banks begin reusing their Letters of Credit(LCs) opened in local banks, several business leaders said.

Three LCs opened in Bank of Ceylon (BOC) have been rejected by banks in the UK, Switzerland and New Zealand last week showing signs of the island nation’s bankruptcy and the country’s weakened credit profile, one of the top business leaders disclosed.

Apart from the prohibition of opening new LCs, banks have been directed to suspend the payment for already opened LCs before the enforcement of the import ban, they said, pointing out that it breaches Uniform Customs and Practice (UCP 600) regulations that govern international trade of banking.

Under this set up, the local bank which has opened the LC would be black listed in international trade for defaulting.

Sovereign’s weakened credit profile will affect Sri Lankan Banks sluggish economic activity, external and domestic vulnerabilities.

According to Fitch Ratings, the operating environment continues to have a high influence on bank ratings in Sri Lanka, as it affects the level of risk of doing business and banks’ financial and non-financials rating factors.

Muted private credit growth and the sovereign’s weakened credit profile are significant downside risks to the operating environment for Sri Lankan banks, Fitch Ratings added.

Fitch lowered its assessment of the operating environment score for Sri Lankan banks to ‘ccc’ with negative outlook from ‘b-‘ with a negative outlook, after the Sri Lanka sovereign rating was downgraded to ‘CCC’ from ‘B-‘ in November 2020.

The weaker sovereign credit profile could affect the banks’ operating environment, which is already weak due to the COVID-19 pandemic.

Corporate earnings surpass expectations - Report

Earnings of listed companies in the third quarter of 2020 have increased to Rs. 73.7 billion, the highest for a three month period since late 2018, and reflect significant recovery after the resumption of the economy following the COVID-19 first wave-induced shutdown.

Softlogic Stockbrokers Research which released its analysis of results of 277 companies (out of 285 listed) described the corporate earnings in 3Q 2020 as having “surpassed expectations” amidst the pandemic.

The Rs. 73.7 billion combined earnings reflected a robust 53% gain year-on-year and a massive 287% jump in comparison to the 2Q figure of Rs. 19 billion, and more than double the 1Q of 2020.

The previous highest for a quarter was Rs. 74.8 billion achieved in the 4Q of 2018.

From 2018 to date the 3Q of 2020 is also among the three best performing quarters.

“Capital goods (Rs. 8.47 billion, up 106%), Materials (Rs. 7.1 billion, up 155%), and Food, Beverage and Tobacco (Rs. 17.1 billion, have gone up 95%), largely contributed to earnings improvement.

Banks (Rs. 13.1 billion, down 17%), Real Estate (Rs. 1 billion, down 52%) and Consumer Services (loss of Rs. 5.5 billion as against loss of Rs. 22 billion), dragged down earnings growth in 3Q’20,” Softlogic Stockbrokers Research said.

It said the banking sector earnings fell amidst higher impairment provisioning and margin contraction; however the sector’s cumulative 4Q earnings were Rs. 58.5 billion, up 6% Y-o-Y.

Capital Goods sector earnings were up 106% on the back of import protectionism and pent-up demand following the April-May lock down, Softlogic Stockbrokers Research said.

Consumer Durables and Apparels earnings improved 32% Y-o-Y to Rs. 1.1 billion, reflecting resilient performance in 3Q’20 amidst the pandemic.

The 95% increase in Food, Beverage and Tobacco earnings was due to the inelastic nature of the products despite lower consumer spending ability.

Softlogic Stockbrokers Research also said Materials sector earnings improved significantly due to the surge in demand for construction materials and exported materials.

It said the Retailing sector witnessed a turnaround in 3Q’20, with the sector turning profitable to Rs. 1.8 billion compared to a loss of Rs. 24 million in the corresponding quarter of the previous year.

Telecommunication sector earnings surged 134% Y-o-Y in 3Q’20 to Rs. 6.96 billion on the back of improved data consumption, rupee appreciation and reduced operational expenditure.

Transportation sector earnings spiked 578% Y-o-Y to Rs. 4.8 billion on the back of the extraordinary earnings boost witnessed by Expolanka Holdings PLC, which reported earnings of Rs. 4.5 billion as against a loss of Rs. 830 million.

Utilities earnings grew 70% Y-o-Y in 3Q’20 to Rs. 817 million amidst favourable weather conditions resulting in better than expected power generation, Softlogic Stockbrokers Research said.

SEC announces constituent changes to S&P Sri Lanka 20 Index

The Colombo Stock Exchange (CSE) announced several changes in the S&P Sri Lanka 20 index constituents made by S&P Dow Jones Indices at the 2020 year-end index rebalance.

The exclusions and inclusions announced by S&P Dow Jones Indices are effective from 21st December 2020.

The new inclusions included Dipped Products PLC, Distilleries Company of Sri Lanka PLC, Expolanka Holdings PLC, Hayleys PLC, Hemas Holdings PLC, Royal Ceramics Lanka PLC, andTokyo Cement Co. (Lanka) PLC.

The S&P SL 20 index includes the 20 largest companies, by total market capitalization, listed on the CSE that meet minimum size, liquidity and financial viability thresholds. The constituents are weighted by float-adjusted market capitalization, subject to a single stock cap of 15%, which is employed to reduce single stock concentration.

The S&P SL 20 index has been designed in accordance with international practices and standards. All stocks are classified according to the Global Industry Classification Standard (GICS®), which was co-developed by S&P Dow Jones Indices and MCSI and is widely used by market participants throughout the world.

To be eligible for inclusion, a stock must have a minimum float-adjusted market capitalization of 500 million Sri Lankan rupees (Rs), a six-month median daily value traded of Rs 0.25 million, and have positive net income over the 12 months prior to the rebalancing reference date. For information, including the complete methodology.

SLT initiates 3-year strategic business plan to meet changing needs

Sri Lanka Telecom PLC (SLT) has initiated a 3-year strategic business plan continuing its commitment towards customer value propositions, SLT sources revealed.

During the COVID-19 pandemic emerging technologies became a catalyst for the telecom industry to prefer digital platforms, and deliver emerging digital experiences to changing consumer demands in an unprecedented way, a senior official of the SLT said .

The SLT’s board of directors has taken a decision at its meeting held on November 27 to initiate a 3–year Strategic Business Plan for SLT Group and have detailed business plans for the year 2021.

It has approved the provision of 5,000 FTTH (fiber-to-the-home) new connections to Sri Lanka Telecom Services Ltd. Insurance cover has been introduced for the first time in SLT history to cover property, risks, cyber security risks, and commercial general liabilities.

This will help SLT to ensure its business continuity and develop customer confidence while complying with industry best practices, standards, and requirements of SLT strategic business partners and customers.

These details were disclosed in a memorandum (Ref No 01/2020) sent to all SLT employees on November 27 by SLT CEO K.A. Kiththi Perera outlining the board decisions taken on the same day.

Accordingly the SLT Board has approved the new SLT Group Organisation Structure which was developed by consolidating Finance, Human Resources, Legal, and IT/Cyber security functions as group functions.

Measures will also be taken to restructure SLT subsidiary companies and a new leadership team was appointed for SLT Services, which is better aligned with business interests and its execution within the SLT Group.

The SLT board decided to transfer all remaining SLT Human Capital Solutions (Pvt) Ltd (HCS) staff to Talent-Fort (which provides HR solutions) and close HCS business before the end of 2020 as previously agreed with trade unions, he revealed. Existing procurement processes have been reviewed in view of eliminating inefficiencies in the process, whilst strengthening good governance and transparency.

This will help SLT Group to realise its business objectives by fast-tracking procurements for key projects and programmes and implement a succession plan for senior management positions and such a programme will be launched to implement the same.

The SLT Board approved the establishment of the Research and Development Division and decided to provide necessary resources for research activities in view of creating value for SLT group business, he disclosed

NSB steers towards modernisation expansion and digitisation

It is now in the process of expanding its branch network country wide with more than 4,000 service points, including branches, post offices and ATMs.

NSB Katuwana branch declared open recently at No: 43/1, New Kandy Road, Weliweriya under the patronage of Minister of Tourism, Prasanna Ranatunga as the chief guest.

The Chairperson of National Savings Bank, Keasila Jayawardena, and General Manager/CEO, Ajith Peiris, were amongst the distinguished guests present on the occasion.

The new branch, which consists of a spacious premise and modern banking amenities including an ATM will ensure a quality customer service by catering to all financial needs of the people of the area.

National Savings Bank, the only bank in the country that offers 100% government guarantee, has commenced expanding its branch network substantially and accordingly, the Weliweriya branch marks the 259th Branch of the NSB Branch network.

The bank sought to implement a comprehensive intelligence and financial crime detection management solution, aimed at protecting its customers in real time.

In addition to card-based transactions, ACI’s fraud management capabilities allow the bank to address emerging digital payment channels, including internet and mobile banking, mobile wallets and real-time payments, solidifying its position as one of the country’s leading financial innovators.

NSB reported a deposit base of LKR 1,113 Bn as of Jun-20 as compared to LKR 1,017 Bn reported as of Dec-19 (LKR 953 Bn as of Dec-18). The NSB Act provides explicit government guarantee for the deposits and interest payable thereon.

The Bank processed the 100% Government ownership, which provides a strong likelihood of sovereign support and, the 100% explicit guarantee provided by the Government for the money deposited with the Bank and the interest thereof through the National Savings Bank Act (NSB Act).

Government urged to strengthen the back end structure of agriculture sector

The government has been urged to strengthen the back end structure of the local agriculture sector by identifying the key points of both public and private institutions and addressing them by actively engaging in discussions with relevant stakeholders of the industry.

This appeal was made by Sunshine Holdings Group Managing Director Vish Govindasamy at the Sri Lanka Economic Summit ‘Road-map for Takeoff: Driving a People-Centric Economic Revival’, organised by the Ceylon Chamber of Commerce (CCC),

Govindasamy stressed that fortifying this framework would prepare the agriculture sector to leverage numerous post-COVID opportunities, bring prosperity for all parties involved and make the sector resilient for any future disruption.

“COVID-19 has brought several opportunities for the Agri sector, and the government and private sector have ambitious plans on being self-sufficient in agriculture, dairy and fishery.

The government, with right inputs coming from industry stakeholders, has to re look at these processes and understand where the gaps are.

Bridging these gaps will not only prepare the Agri sector to latch on to post-pandemic opportunities but also make the sector more resilient to change,” commented Govindasamy.

Taking the dairy industry as an example, Govindasamy said, “The country has a great vision for the local dairy industry intending to make Sri Lanka self-sufficient in milk by 2023.

However, the backend framework has to be perfect before even try to bring a herd. Also, the animals need to have enough feed, which means that we have to clear land for farmers to grow.

This needs to be done through a transparent land clearing process. Furthermore, the industry needs to deploy enough machinery and bring in modern technologies to meet this target.

There are so many aspects to be looked at from a back-end operations perspective to make front-end operations of the dairy industry successful,” said Govindasamy.

During the panel discussion, Govindasamy praised the government for the measures taken to uplift the agriculture sector including the recent pledge by President Gotabaya Rajapaksa on empowering the local dairy industry and increasing domestic liquid milk production in the next decade.

He commended the initial steps that the Ministry of Agriculture has taken to modernise the existing animal quarantine laws.

Page 8 of 29