Economic

Sri Lanka draws up new entry strategy for the Chinese market

Sri Lanka’s Export Development Board (EDB) has drawn up a new entry strategy for the Chinese market to pre-identify products using an international consultancy firm/consultant, as most of Sri Lanka’s SMEs and ministries fail to complete export orders to China.

The EDB is compelled to seek the consultancy assistance following the failure of local authorities to fulfill Chinese requirements of a massive banana export order. Sri Lanka makes another attempt to export bananas China signing fresh agreement with the Chinese government following the failure to supply even a single kilo of bananas to that country under the 2016 agreement.

The Agriculture Ministry will sign an agreement with the Chinese Government to supply banana to the Chinese market, Agriculture Minister Mahinda Amaraweera said. The Ministry will export high quality Ambul kesel (sour plantains), Rath kesel (red banana) and Kolikuttu to China under the new agreement.

Agriculture Ministry in 2016 signed an agreement with China to export more than 10,000 tons of bananas.According to the 2016 agreement, the Ministry was to send a list of 150 banana cultivators to the Chinese government and it had failed to prepare a list as of yet.

The Chinese government had previously made an order to purchase the Ambun, Ambul and Kolikuttu varieties from Sri Lanka.

The Ministry could not supply the varieties demanded by China and officials were still studying the matter.The Chinese Authorities have agreed to provide market opportunities for Papaw, Pineapple, Mango and Rambutan as well.

Several public–private partnership projects in the pipeline: NAPPP

Chairman of National Agency for Public Private Partnership (NAPPP) Thilan Wijesinghe said yesterday (28), that the NAPPP is looking at public-private partnerships in order to make state-owned entities viable in the country.

Wijesinghe cited the Kandy Mahaiyawa urban housing project, Pettah multimodel hub, Ekala aero city project, convention centre port city, medical complex port city, school at port city, Dedduwa integrated tourism development project, Colombo port cruise terminal, renewable energy park in Pooneryn and a barge mounted power plant as some of the PPP projects in the pipeline. He made these remarks while addressing the 31st Annual Conference of OPA on the theme of ‘Innovative Digitalization’, held at Cinnamon Lakeside Hotel yesterday.

Talking about technological aspects, Wijesinghe said the delay in implementing the Transit Smart Card Project in Sri Lanka is a major concern.

“Transit Smart Card project has been gravitating among Information and Communication Technology Agency of Sri Lanka (ICTA) ICTA, Central Bank of Sri Lanka, Ministry of Transport and various other line ministries over the last two and a half years.”

“However, we have thrown our hat into the ring and taken some control of it. What we have today is a brilliant technical solution. But it is sad that there is no idea how this project can be implemented from a financial model perspective,” he said. He also revealed that the NAPPP or any other line ministries currently don’t have a single, tangible , large scale digital infrastructure project that’s under the implementation stage.

He said the government should be essential partners in shaping the transition to new scientific, technological, economic and social framework.

“Subsequently, NAPPP would be able to play a catalytic role in facilitating PPPs in digital infrastructure and act as a leading partner for generating economic productivity,” he said.

Wijesinghe also underscored Sri Lanka's successful track record with regard to the implementation of PPPs with no failed transactions.

“Also, the government must not over- estimate what it can do,” he said, adding that Sri Lanka has financially closed over USD 5 billion worth of PPP projects in the last 20 years.

“If you go back to the 1996-2000 era when I was the Board of Investment (BOI) Chairman, that was the time when Sri Lanka embarked on the PPP journey and financially closed almost a USD1 billion worth of PPP projects over a five-year period,” he said.

Sri Lanka gears up to face massive debt burden

Sri Lanka is gearing up to face the massive debt burden now at a critical stage as the bunching effect of loans will come into play in 2019.

Sri Lanka’s government revenue as a share of GDP is lower than many peers, while the government debt-to-GDP ratio is much higher, international rating agencies warned.

Debt-to-GDP ratio in Ethiopia, Uganda and Ghana among other countries is lower than Sri Lanka even though the revenue-to-GDP ratio in these countries higher than Sri Lanka, they claimed.

However, Central Bank Governor Indrajit Coomaraswamy noted that Sri Lank is a middle-income country striving to transition to an upper middle-income country and therefore its debt-to-GDP ratio cannot be compared with countries like Ethiopia, Uganda and Ghana.

A sum of Rs.2, 057 billion has been allocated for debt servicing in 2019. This is the largest amount of money a government in the history of this country is compelled to bear in repaying its borrowings.

Out of this amount, Rs.1, 271 should be paid locally next year while Rs.786 billion, which is equal to 4,650 million US dollars should be paid to foreign lenders.

Accordingly, the Government expects to borrow Rs.1, 944 billion from local and foreign sources for its debt servicing including the financing of the budget deficit in 2019.

Sri Lankan commercial banks restrict foreign currency borrowings

In the wake of rupee depreciation to a new high, Sri Lanka’s commercial banks have been restricted of excessive foreign currency borrowings and maintaining foreign exchange reserves with the aim of preventing unwarranted macroeconomic and financial stability concerns.

The rupee closed at 168.50 ton Monday (24), after falling to an all-time low of 169.00 per dollar week.

The Monetary Board of the Central Bank has introduced a policy framework for foreign currency borrowings of licensed banks, reliable official sources said.

The objective is to address the high dependence on foreign currency borrowings and the resulting exposure of licensed banks to foreign exchange risk.

This action is also aimed at minimizing the pressure on the reserves and exchange rate of the country arising from large borrowings in foreign currency.

The Sri Lankan rupee is depreciating rapidly but it has been maintained at a stable level following intervention by the central bank, market sources said.

The Central sank has intervened to curb excess volatility in the exchange rate, sources said.

Sri Lankan tea smallholders facing a major crisis

Sri Lanka's tea smallholders, who account for 76% of the national tea output, are facing serious problems which they say could adversely affect the whole industry.

The price of the green leaf has been dropped to Rs.70 to 80 at present from Rs.90 to 105, they claimed. "Tea smallholders are facing some serious problems due to a rapid drop in prices and high maintenance costs that will directly contribute towards reducing the national tea output in the future.

Unless prudent measures are taken to resolve these problems, Sri Lanka's tea industry is at risk of collapsing according to a senior member of the Sri Lanka Federation of Tea Smallholder Development Societies.

This situation has arisen following sanctions imposed by the US against Iran and its impact on Ceylon tea purchasing countries in the Middle East, Russia and Turkey, he said.

The currency depreciation due US economic policy has hit the countries in the Middle East he said adding that Turkey’s currency has depreciated 4 o per cent.

Tea smallholders are facing serious issues of increasing cost of production, mainly driven by higher labour costs, which is making the sector unsustainable. This is also preventing re-investment in land development and replanting, which is expected to hurt industry productivity and quality of "Ceylon" tea, in the future.

CBSL will intervene aggressively to curb rupee volatility - official

Sri Lanka’s central bank will intervene aggressively to curb excess volatility in the rupee exchange rate, Senior Deputy Governor Nandalal Weerasinghe told Reuters on Friday.

“We will not tolerate excess volatility that we have seen in the market during the last couple of days. We will intervene aggressively,” he told Reuters.

(Reuters)

Ample measures taken to stabilise the economy: CBSL

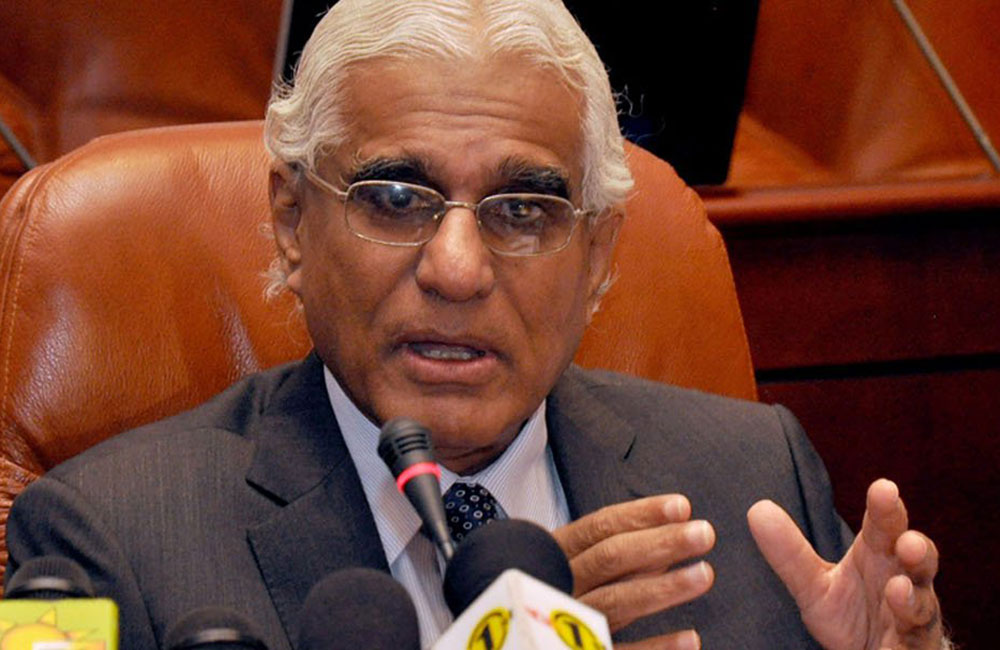

The Central Bank debunked speculation that the country’s economy was collapsing and requested the public not to panic. “The Central Bank is confident that it can professionally handle the country’s current exchange rate issue and debt situation,” Central Bank Governor Dr. Indrajith Coomaraswamy told at a press conference at the Central Bank (CB) auditorium yesterday (02).

“We have now come to a better position through aggressive intervention in the market and through various measures to curtail luxury imports.The pressure on the exchange rate will abate,” Dr Coomaraswamy said. “There is enough technical excellence in this organisation to come out of the situation we are now in and we will,” he said.

According to the Central Bank, the exchange rate had depreciated at a faster rate of 9.7 percent so far in 2018. “The Government and the Monetary Board of the CB adjusted the gold and vehicle duties and most recently introduced a raft of measures to cut the non-essential imports,” the Governor said briefing on the interventions made to defend the Rupee.

“These are intended to be temporary measures. As soon as there is stability in the market, these can be taken off,” he commented. “Let me recall that in 2015 about USD 3.2 billion was spent to defend the Rupee, but the Rupee depreciated by 9.5 percent. In 2011-2012 USD 4.1 billion was spent, but the Rupee depreciated by 15 percent.At that time, there was also a credit ceiling imposed without discriminating luxury goods, essential goods, intermediate goods and capital goods,” the CB Governor said.

“In 2018, so far we have had 9.7 percent depreciation of Rupee, but on net basis we have only sold USD 184 million to the market.We have protected the reserves. The measures orchestrated this time have been very carefully selected, and we have not touched capital goods, essential imports and intermediate goods. This is a far more nuance and sophisticated intervention compaird to that crude credit ceiling which was imposed in 2012,” Dr. Coomaraswamy remarked.

“In 2015 and in 2012, there were fiscal slippages which contributed to the currency depreciation, but this time there had been no slippage. This situation arose basically due to external developments,” he added.“I hope that the situation would stabilise now.There is tremendous amount of misunderstanding and ignorance about the exchange rates in this country. I have worked in about 20 countries.The attitude to the exchange rate in this country is unique. People think if the currency is depreciated the economy is about to collapse. Our reserves, growth and inflation are ok. From where does this economy collapse then?” he asked.

“Our reserves have come down a little because of debt repayments and some interventions in the currency market, but we are anticipating USD 1 billion within a week from the China Development Bank and we are hoping to raise USD 500 million more from the Panda Bond and Samurai Bond. We are planning to have another International Sovereign Bond issuance before the end of this year. There is plenty of money that is going to come in terms of reserves,” the Governor said explaining that the CB hopes to increase foreign reserves from the current USD 7.3 billion to USD 8.3 billion towards the end of the year.

The CB Governor stressed that having competitive exchange rate is crucial to increase exports, adding that increasing exports is necessary to come out of the debt, which is “a major millstone around the economy”. “Without getting exports up, we are going to be in this mess in terms of debt forever and ever” he noted.

“Now it has actually come to a competitive rate, but I understand that it can have impact on the cost of living. We have to take that into account. Fortunately, this currency depreciation has come at a time when inflation pressures are muted in the economy. Food price inflation is very low. Though currency depreciation may lead to bus and train fare hikes and prices of imported goods going up, its impact is relatively low. The domestic production is competitive and this limits the import prices of imported goods going up,” the CB Chief analyzed.

The CB Governor stressed the need to stop subsidising foreign producers at the expense of our local producers. “Our imports have doubled compared to our exports because of the overvalued exchange rate, which we had for years and years. Having a competitive exchange rate is critical to support our domestic producers. There is nothing wrong in importing goods, but we must be able to earn to pay for the imports,” he added.

He announced that the Central Bank decided to maintain policy interest rates at current levels at 7.25percent and 8.50 percent because of the relatively slow economic growth, tight liquidity conditions in the market, high nominal and real interest rates and keeping the inflation rate within the target.“Tight monetary policy conditions are observed globally with the continuous strengthening of the US dollar. These have accelerated capital outflows from emerging economies resulting in depreciation of local currencies,” the Central bank announced.

“There had been arguments in favour of increasing interest rates as other countries such as India, Indonesia and Philippines have done that, but we must keep in mind that those countries have very high economic growth and lower nominal and real interest rates where as Sri Lanka’s current economic growth rate was only 3.7 percent in the first half of the year,” the Governor commented.

“Given that Sri Lanka is a twin deficit country, in terms of budget deficit and current account deficit, the chances that Sri Lanka attracting new money at this juncture is very minimal indeed. By increasing interest rates, we will not be able to attract new money or keep the money already invested,” the Governor justified the decision to keep the policy interest rates on hold.

He also said that the country’s economic growth would not exceed 4 percent this year.Responding to a question by a journalist on the purpose of suspending duty free vehicle permits for MPs for one year in a context where all MPs have already purchased their duty free vehicles, the Governor said the policy had to be imposed in common to public officials, professionals and politicians. “What would have been your reactions, if we excluded politicians from the category? I don’t have the data as to how many MPs have utilized the permit, but we did not want to specifically leave them out,” he replied.

Senior Deputy Governor Dr. Nandalal Weerasinghe said USD 467 million of foreign exchange had gone out from Government Securities this year. He said last year there was an addition of USD 440 million of foreign investment to the Government Securities.

Are we about to face a new Asian financial crisis?

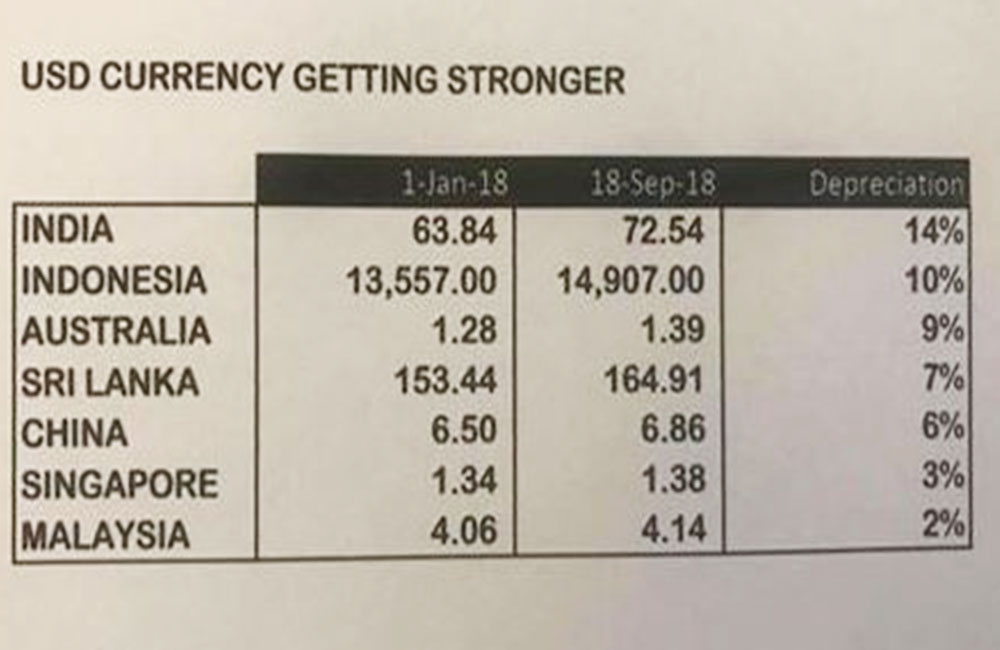

Emerging market economies and their currencies have come under severe stress in recent weeks, as rising US interest rates and trade fears prompt investors worldwide to shun their assets and move money to the US.

A strengthening American economy, a strong US dollar and growing trade tensions have led to a rout in emerging markets over the past several weeks, as investors are increasingly shifting their money to the US.

Inflows of foreign investment into emerging economies shriveled to $2.2 billion (€1.9 billion) in August, the Institute of International Finance (IIF) said in a report. In July, these markets saw portfolio inflows of $13.7 billion (€11.8 billion).

As the US central bank remains on course to normalize monetary policy, by hiking its benchmark interest rates two more times before the end of this year, financial conditions in other parts of the world appear to have tightened.

Some Asian countries have been hit hard by the selloff of emerging market assets, with their currencies plunging in value against the US dollar. The situation has stoked fears that Asia is on the verge of facing another financial crisis like the one seen during 1997-98.

The Indonesian rupiah has slumped to its lowest level since the Asian financial crisis in the late nineties. Since the start of the year, the rupiah has been down by 9.2 percent against the greenback.

But the worst performing Asian currency this year has been the Indian rupee, which has lost about 12 percent against the dollar.

Winners and losers

Not all Asian nations have been negatively affected, however. Thailand's currency, the baht, for instance, has remained resilient in the face of the emerging-market rout. Economists say Thailand's large current account surplus and adequate foreign exchange reserves might have cushioned the country's currency from the current turmoil on the markets.

Thailand's current account surplus is expected to be around 9 percent of GDP this year, on top of the double-digit levels in the past two years. The baht's present performance is in stark contrast to its fate in 1997, when it collapsed over 50 percent during the six-month period after the panic set in.

But unlike Thailand, countries like India and Indonesia suffer from high current account deficits. These deficits occur when the value of the goods and services they import exceeds the value of the goods and services they export. This weakens a nation's currency, making them more vulnerable to global market fluctuations.

"Supporting the rupiah is increasingly becoming the central pre-occupation for Bank Indonesia and the government," Gareth Leather, Senior Asia Economist at London-based Capital Economics, said in a research note.

The Southeast Asian nation's central bank has been aggressively intervening in the forex markets to defend the value of the rupiah. In fact, the bank has spent almost 10 percent of its foreign reserves this year to bolster the currency. Indonesia's reserves fell to about $117.9 billion (€101.4 billion) in August, the lowest since January 2017. The reserves are still enough to finance over six months of imports and service the government's external debt, according to the central bank. Nevertheless, the situation has underscored Indonesia's vulnerable financial position.

"The Indonesian economy is facing some structural weaknesses," Rizal Ramli, an Indonesian politician and economist, told DW, pointing to the country's high deficit and debt figures.

The Indonesian rupiah has slumped to its lowest level since the Asian financial crisis in the late nineties

The Indonesian rupiah has slumped to its lowest level since the Asian financial crisis in the late nineties

If the central bank keeps raising interest rates without any support from the government in introducing structural reform measures, it wouldn't be useful in resolving the problem, said Ramli, who served as coordinating minister for maritime affairs under President Joko Widodo administration as well as coordinating minister for economic affairs and minister of finance.

The current way of doing things "will lead to an increase in non-performing loans and credit problems in financial institutions," he stressed.

Problems even for growing economies

Meanwhile, India's current account deficit this year is going to be worse than that of Indonesia, according to the International Monetary Fund (IMF). The IMF estimates the South Asian nation's deficit to be around 2.6 percent of GDP this fiscal year, up from 1.9 percent last year.

India's fiscal deficit is also one of the worst, with the government reporting a deficit of $62.57 billion (€53.85 billion) for the April-June quarter. The nation's economic growth, though, seems to be robust, with GDP expanding by 8.2 percent in the quarter ending June. It also boasts a large foreign exchange reserve, amounting to some $400 billion as of August.

Despite the depreciation in their values, Asian currencies like the rupee and rupiah sit somewhere in the middle of the list of emerging currencies that have been bashed by the markets. They haven't been as resilient as currencies such as the Thai baht; but they have also not been smacked in the same way like the Turkish lira or the Argentine peso.

To support their currencies and curb inflation, officials in some Asian countries have resorted to raising interest rates. The central banks of the Philippines and India have already raised rates by 100 basis points (1 percent) and 50 basis points respectively this year.

Experts believe Indonesia and the Philippines will likely tighten monetary policy aggressively in the coming months, as they both struggle to get a grip over soaring inflation.

Dollars and sense

Still, the recent developments in the global currency markets are unlikely to cause another Asian financial crisis, Charlie Lay, emerging markets analyst at Germany's Commerzbank, told DW.

"The landscape in Asia today is a lot different compared to 1997," Lay said. "Companies have less leverage now and are less exposed to dollar-denominated debt," the expert noted, adding that "improved macroeconomic management, a more flexible exchange rate regime and current account surpluses in most Asian economies" mean that they are less vulnerable today than two decades ago.

Although many countries have made significant progress in modernizing and reforming their financial, labor and product markets, they have fallen short of implementing the deep-rooted structural reforms needed to boost productivity and output growth in the long run.

Furthermore, the deteriorating macroeconomic conditions as a result of increasing protectionist tendencies worldwide could adversely affect them, say observers. That's particularly the case for economies in Southeast and East Asia, which are heavily reliant on global trade flows for their prosperity.

"The best way for Asia to prepare against a further spike in volatility and ructions in the financial markets is to ensure sound economic management, including preventing excessive leverage, ensuring fiscal discipline and allowing exchange rate flexibility," said Lay.

By Srinivas Mazumdaru via DW.com. Additional reporting by Yusuf Pamuncak.

Central Bank to maintain policy interest rates at current levels

The Monetary Board of the Central Bank of Sri Lanka, at its meeting held on Monday, decided to maintain policy interest rates at their current levels.

Accordingly, the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank will remain at 7.25 per cent and 8.50 per cent, respectively.

The Board arrived at the above decision after carefully considering current and expected developments in the domestic and global economy, with the aim of stabilising inflation at midsingle digit levels in the medium term to support growth. Tight monetary policy conditions are observed globally with a continuous strengthening of the US dollar.

The broad based strengthening of the US dollar subsequent to the increase in policy interest rates by the Federal Reserve and expectations of further interest rate hikes have exerted pressure on emerging market economies (EMEs).

In response, EMEs with significant pressure on local currencies have tightened their monetary policy stance by raising policy interest rates. Meanwhile, the recent upward trend observed in international oil prices is likely to exacerbate challenges faced by the global economy.

Central Bank issues clarification on Nomura Holdings' erroneous report

Several international media sites have recently quoted an analysis by Nomura Holdings Inc., which shows that seven emerging economies including Sri Lanka are at risk of an exchange rate crisis.

The said media sites further quoted the report as saying Sri Lanka’s short term external debt is as high as US dollars 160 billion. As Sri Lanka’s short term external debt is nowhere near this figure, the Central Bank of Sri Lanka requested Nomura to correct the errors in their computations.1

In response, according to Bloomberg, Nomura has “corrected their ‘Damocles’ report to fix Sri Lanka’s short term debt figure to be US dollars 7.5 billion” in an emailed statement to media. Nomura has, however, kept the ‘Damocles score’ for Sri Lanka unchanged.

The Central Bank wishes to point out that the ‘Damocles score’ published by Nomura is a rudimentary attempt to build an index based on eight indicators and threshold values for the selected indicators. The score is then used to show the likelihood of crisis in a country in the period ahead. A score of above 100, according to Nomura, suggests a country is vulnerable to an exchange rate crisis in the next 12 months, while a reading above 150 signals that a crisis could erupt at any time. Nomura has computed Sri Lanka’s score at 175, while assigning lower values to countries that are currently facing severe economic and financial strains. Any methodology that yields outcomes whereby Sri Lanka’s score is substantially worse than countries like Argentina, Turkey, and South Africa does not appear to be sufficiently nuanced to capture market realities and dynamics.

A closer look at Nomura’s ‘Damocles score’ for Sri Lanka shows that it has remained above the 100 continuously since 2012 except for a few months in 2013/14. At times, the ‘score’ has even hit the upper bound of 200. Therefore, it is evident that in the case of Sri Lanka, this rudimentary index cannot be considered an indicator/predictor of crisis. It is because the score does neither consider a particular country’s distance from threshold values nor the country-specific circumstances, that Sri Lanka is listed as a country that is at greater risk of crisis than countries like Argentina and Turkey.

For example, in the Nomura analysis, the short term external debt to exports ratio includes goods only. Services, including tourism, and remittances are excluded. By not focusing on all current account flows, the ‘score’ exaggerates the country's vulnerability. Moreover, the broad money to foreign reserves ratio does not properly interpret the cause of the increase in the former. The recent increase in broad money was due to an increase in the net foreign assets (NFA) of the banking system, which has, in fact, reduced the country's external vulnerability. The real short-term interest rate indicator for Sri Lanka is also marginally above Nomura’s threshold. This has been caused by a reduction in inflation rather than an increase in interest rates. These examples demonstrate how the binary methodology used by Nomura could be misleading.

Nomura’s error in relation to Sri Lanka’s short term external debt figure itself shows that the said report has not undergone a thorough review before publication. Indeed, the rigourousness of any analysis based on the predictive power of an index, which cannot differentiate between short term debt of US dollars 7.5 billion and US dollars 160 billion, in an economy with a GDP of around US dollars 90 billion and gross official reserves of around US dollars 8.6 billion, is questionable.

Therefore, the investors and the general public are advised to form their own informed opinion with regard to Sri Lanka’s macroeconomic conditions and potential.

1:Sri Lanka’s short term external debt and liabilities, based on the general definition that uses original maturity, are currently estimated at around US dollars 7.7 billion, while these liabilities are estimated at around US dollars 14.3 billion under the broadest definition that includes long term debt falling due in the next one year period and the total foreign holding of rupee denominated long term Government bonds.

Sri Lanka government revenue declines in first half this year

Sri Lanka government revenue declined as a percentage of estimated GDP to 6.4 percent from 6.7 percent recorded in the corresponding period of 2017 Finance, Ministry report revealed. In nominal terms, total revenue increased by 5.1 per cent to Rs. 920.8 billion during this period under consideration from Rs. 876.3 billion recorded in the corresponding period of 2017.

During the first half of 2018 total expenditure and net lending declined to 8.8 percent of estimated GDP from 9.3 per cent recorded in the corresponding period of 2017. Recurrent expenditure declined to 6.9 percent of estimated GDP during the same period under consideration from 7.1 per cent in the corresponding period of 2017.

Capital expenditure and net lending declined to 1.9 percent of estimated GDP from 2.2 per cent recorded in the same period of 2017.As a per percentage t of estimated GDP, the overall budget deficit declined to 2.4 per cent (Rs. 345.8 billion) in the first half of 2018 from 2.6 per cent (Rs. 332.6 billion) recorded in the corresponding period of the previous year, the Finance Ministry disclosed.

The primary account, as a percent of estimated GDP, improved to 0.3 per cent from 0.1 per cent in the corresponding period of 2017. During the first half of 2018 net domestic financing declined to Rs. 184.9 billion compared to Rs. 269.5 billion in the corresponding period of 2017, whereas net foreign financing (NFF) increased to Rs. 161.0 billion during the period under review in comparison to Rs. 63.1 billion recorded in the same period of 2017

India commits US$ 3 billion for Sri Lanka people-oriented development projects

India’s overall commitment of assistance to Sri Lanka for people-oriented development partnership projects stands at a total of around US$ 3 billion, out of which US$ 550 million is pure grant assistance.

Indian government is implementing housing programmes in the North and East for the benefit of the people affected by the ethnic conflict.

In a special ceremony held at Batticaloa District on Friday, High Commissioner of India. Taranjit Singh Sandhu dedicated houses built under the Indian Housing Project in Batticaloa for possession by beneficiaries.

Government of India has committed a total of 4000 houses in the Eastern Province. This is in addition to 42000 houses built under grants by Government of India in the North and 14000 currently constructing also under grants in the Upcountry.

High Commissioner also visited the Trade Facilitation Center by first ever cooperative society of war affected women in the eastern province in Kallady. Self Employed Women’s Association (SEWA) –an Indian based community based organization, with the grant assistance of Rs 197 million from the Government of India has executed the project.

The objective is to empower war affected women by building their capacities in vocations, leadership, entrepreneurial and management skills by setting up Trade Facilitation Center and Community Learning Centre in Batticaloa and Ampara.

This project helps them to provide skills and value chain support to provide livelihood opportunities.

Page 15 of 22