Economic

Fitch revises ratings on 11 Sri Lankan financial institutions

The National Ratings of the Sri Lankan banks consider their creditworthiness relative to other issuers in the country. The recalibration of the Sri Lankan National Rating scale has resulted in the upward revision of the National Long-Term Ratings of the following Sri Lankan financial institutions:

Banks

Commercial Bank of Ceylon PLC (CB) to 'AA+(lka)' from 'AA(lka)'

Hatton National Bank PLC (HNB) to 'AA+(lka)' from 'AA-(lka)'

Sampath Bank PLC to 'AA-(lka)' from 'A+(lka)'

Seylan Bank PLC to 'A(lka)' from 'A-(lka)'

Cargills Bank Limited to 'A+(lka)' from 'A-(lka)'

Amana Bank PLC to 'BB+(lka)' from 'BB(lka)'

Non-Bank Financial Institutions

Serendib Finance Limited to 'AA-(lka)' from 'A+(lka)' (please see http://www.fitchratings.com/

HNB Finance Limited to 'AA-(lka)' from 'A(lka)'

Siyapatha Finance PLC to 'A(lka)' from 'A-(lka)'

Richard Pieris Finance Limited to 'A-(lka)' from 'BBB+(lka)' (please see http://www.fitchratings.com/

Fintrex Finance Limited to 'B+(lka)' from 'B(lka)'

The National Ratings of Bank of Ceylon (BOC) and People's Bank (Sri Lanka) (PB) have been affirmed at 'AA+(lka)' but the Outlook remains Negative. The Outlook on the National Ratings of Commercial Bank (CB) and Hatton Nationa Bank (HNB) are also Negative.

The Negative Outlooks are aligned with the Negative Outlooks on both the sovereign rating and Sri Lanka's operating environment mid-point. They reflect Fitch Ratings' expectation of sovereign support benefitting BOC's and PB's overall credit profiles while CB's and HNB's ratings are constrained by the sovereign's credit profile.

Meanwhile, The Outlook on Serendib Finance and HNB Finance reflect the Negative Outlook on the ratings of their respective parents, CB and HNB. The Outlook on Sampath Bank, Seylan Bank, Cargills Bank, Amana Bank, Siyapatha Finance, Richard Pieris Finance and Fintrex Finance is Stable.

SME debt relief credit negative for banks, sovereign: Moody’s warns

The one-year debt moratorium announced by the government for the small and medium-sized enterprises (SMEs) is credit negative for the Sri Lankan banks and sovereign as it would undermine the banks’ asset quality and may not support the country’s overall economic growth, Moody's rating agency warned.

“The debt moratorium is credit negative for Sri Lankan banks and the sovereign because it risks increasing SMEs’ risk appetite and relaxing their attitude toward debt repayments, ” the rating agency said in a research note.

This in turn will undermine banks’ asset quality and constrain the sovereign’s credit profile.

SME activities made up for about half of Sri Lanka’s gross domestic product and employment.

“However, similar to our expectation on any macroeconomic benefits from the tax cuts announced for businesses and households, they are similarly unlikely to lead to significant and sustained acceleration in economic activity,” the agency said.

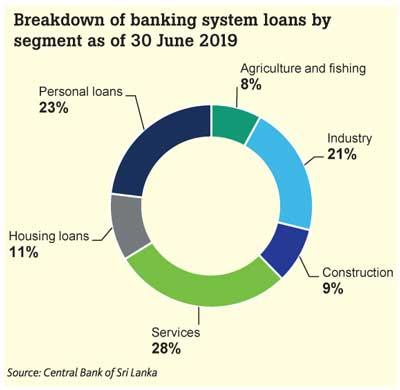

Moody’s noted that the scope of this debt moratorium is much wider than last year’s moratorium for the tourism sector, given that the SME loans constitute a significant part of the banking system’s gross loans.

Moody’s said among the Sri Lankan banks it rates, Hatton National Bank and Sampath Bank would be the most affected, given that SME banking is one of their core businesses. Bank of Ceylon (BOC) will be the least affected because its loan book is largely exposed to state-owned enterprises and large local corporates, the rating agency pointed out.

“The debt moratorium will help slow the banks’ nonperforming loan formation this year, but we anticipate an increase in bad debts when the grace period ends, especially if the domestic economic conditions remain weak,” Moody’s said.

Fitch recalibrates Sri Lanka National Rating Scale

Fitch Ratings says today that it has recalibrated its Sri Lanka National Rating scale to reflect changes in the relative creditworthiness among Sri Lankan issuers following Fitch's downgrade of the country's sovereign rating to 'B-' from 'B' on 24 April 2020.

"The Outlook on Sri Lanka's Long-Term Issuer Default Rating is Negative," Fitch Ratings said.

The recalibration will result in rating actions for some issuers with Sri Lankan national ratings. These rating revisions will be announced soon, the ratings agency added.

National scale ratings are a risk ranking of issuers in a particular market designed to help local investors differentiate risk. Sri Lanka's national scale ratings are denoted by the unique identifier '(lka)'.

Fitch adds this identifier to reflect the unique nature of the Sri Lankan national scale. National scales are not comparable with Fitch's international ratings scales or with other countries' national rating scales.

Sri Lanka's credit outlook downgraded to negative on account of tax cuts: S&P

Credit rating agency Standard and Poor (S&P) has downgraded Sri Lanka’s credit rating to negative from stable. The agency downgraded Sri Lanka's ‘B’ rating to ‘negative’ from stable on account of the various tax cuts by implemented by the new administration.

As a result, Sri Lanka's sovereign dollar-denominated bonds came under pressure on Tuesday citing increased risks from a deteriorating fiscal position. The negative outlook reflects their view that a larger-than-expected fiscal deficit will increase the government’s financing needs and concerns over debt sustainability.

“The negative outlook reflects our view that Sri Lanka’s fiscal trajectory over the next two to three years could deviate from a fiscal consolidation path,” the rating agency said adding that the sizable deficits will add to Sri Lanka’s already-large debt stock at a faster pace.

Sri Lanka must also repay US$ 4.8 billion, as external foreign debt this year, which is thus far the largest debt repayment in the history of Sri Lanka.

Fitch Ratings downgrade

Meanwhile, Fitch Ratings had previously revised the outlook on Sri Lanka’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'Negative' from 'Stable' in December 2019 citing rising risks to debt sustainability from a significant shift in fiscal policy and the potential for roll-back of fiscal and economic reforms in the aftermath of Presidential elections in November.

The need for using scarce money prudently

Former Central Bank Deputy Governor Dr. W. A. Wijewardena recently in an op ed observed that the new government is seeking a Parliamentary majority in the upcoming general election and as a result, all governmental resources are now being diverted to attaining that goal at the expense of sound economic policies.

"At a time when the Treasury was limping with a huge cash shortage, (The President) has offered a costly tax cut to citizens and jobs for 100,000 Samurdhi kids. The first would drain the Treasury of a promised revenue flow of about Rs. 600 billion and the latter would impose an unexpected cost of Rs. 42 billion on his already fragile budget numbers. That latter amount is a lot of money equal to the annual administration budgets of some 14 state universities," he said.

"This is a serious choice to be made by a government which is planning to increase the university admissions by about a quarter by establishing 300 odd university colleges. The government does not have money for this and, hence, the available moneys will have to be spent prudently," he pointed out.

Colombo stock exchange to implement new stock market circuit breaker

The Securities and Exchange Commission (SEC) has directed the Colombo Stock Exchange (CSE) to implement the new circuit breaker structure when the market reopens after its closure on 20 March.

The SEC has introduced a new three-tier circuit breaker system on the CSE in a bid to strengthen the country’s capital market and prevent excessive price distortions in the S&P SL20 Index.

Under the new system:

- The first circuit breaker will trigger a 30-minute market halt if the S&P SL20 index drops 5%.

- The second circuit breaker will trigger a second 30-minute market halt if the S&P SL20 index drops a further 2.5%.

- The third circuit breaker will trigger a third market halt if the S&P SL20 index drops a further 2.5% – closing the market for the day.

The SEC has directed the CSE to implement the new circuit breaker structure when the market eventually reopens.

The CSE has been closed since 20 March amid a nationwide lockdown to curb the spread of Covid-19.

“The SEC if of the view that the prevailing conditions are not conducive for the stock market to function in a fair, orderly and equitable manner,” the regulator said at the time

Rupee falls, recent VAT cuts likely to widen deficit in 2020

Sri Lankan rupee fell 0.22% to 181.25/35 per dollar on Monday, compared to Friday's close of 180.85/181.00, Refinitiv data showed. It is up 0.7% so far this year.

Meanwhile, foreign investors were net buyers of government securities on a net basis for the sixth straight week, purchasing a net 4.3 billion rupees worth of government securities in the week ended Nov. 27.

Total foreign outflows from government securities through Nov. 27 stood at 43.7 billion rupees, according to central bank data.

The government said on Wednesday it had decided to reduce value-added tax (VAT) to 8% from 15% from Dec. 1, and abolish some other taxes as well, in its attempt to boost economic growth that has fallen to a near two-decade low.

Emerging Asia Economics said in a note on Monday that the tax cut decision would provide a significant boost to the economy, but put increased strain on the country's fragile public finances.

“Unless Sri Lanka raises taxes elsewhere or cuts spending, the VAT cuts will lead to around $2 billion in lost revenue (around 2% of GDP) and the deficit is likely to widen to around 6.5% of GDP in 2020," it said.

“This is much larger than the 5.3% deficit target agreed with by the IMF (International Monetary Fund), who could withhold future loan payments unless the government reverses course."

CBSL says Coronavirus likely to affect economic performance

The Monetary Board of the Central Bank of Sri Lanka has decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 6.50 per cent and 7.50 per cent, respectively, and thereby continue its accommodative monetary policy stance.

The Board arrived at this decision following a careful analysis of the current and expected developments in the domestic economy and the financial market as well as the global economy. The decision of the Monetary Board is consistent with the aim of maintaining inflation in the 4-6 per cent range while supporting economic growth to reach its potential over the medium term.

Coronavirus will affect Sri Lanka's economic performance

The exact impact on the Sri Lankan economy would depend on the extent of the global spread of the COVID-19 outbreak, its persistence and policy responses of major economies andtrading partners, the Central Bank said.

Sri Lanka’s economic links with China could be directly affected as significant volumes of consumer goods, intermediate goods and investment goods are imported from China. The likely slowdown of the global economy and disruptions to the supply chain could affect Sri Lanka’s merchandise and service exports as well as related logistics.

The slowdown in global tourist movements will affect Sri Lanka’s tourism sector, in addition to the direct impact of lower arrivals from China. The spread of the virus to countries with a significant number of Sri Lankan migrant workers could affect remittance inflows as well. These adverse implications are likely to outweigh any marginal benefit arising from reduced global energy prices and international interest rates.

IMF approves disbursement of USD 164 million

The Executive Board of the International Monetary Fund (IMF) has stated that Sri Lanka’s economy is on the road to recovery after the Easter Sunday attacks and approved the disbursement of US$ 164 million as part of the Extended Fund Facility (EFF).

The Executive Board had met on Friday (1) and completed the Sixth Review of Sri Lanka’s economic performance under the programme supported by an extended arrangement under the EFF.

The completion of the Sixth Review, upon the granting of a waiver of non‑observance for the end‑June 2019 performance criterion on the primary balance, enables the disbursement of SDR 118.5 million (about US$ 164 million), bringing the total disbursements under the arrangement to SDR 952.23 million (about US$ 1.31 billion).

Sri Lanka’s extended arrangement was approved on 3 June 2016, in the amount of about SDR 1.1 billion (US$ 1.5 billion), or 185% of quota in the IMF at that time of approval of the arrangement. On 13 May 2019, the Executive Board approved an extension of the arrangement by one additional year, until 2 June 2020, with rephasing of remaining disbursements.

Following the Executive Board’s discussion of the review, Deputy Managing Director and Acting Chair of the Board Mitsuhiro Furusawa said that the Sri Lankan economy was gradually recovering from the impact of the Easter Sunday terrorist attacks.

He said that growth was projected to strengthen to 3.5% in 2020, from 2.7% in 2019, as tourist arrivals and related activities gradually recover.

“Sustained efforts to mobilise revenues will be needed in 2020 to place public debt on a downward path, while preserving space for critical social and investment spending. The new fiscal rule framework and the establishment of an independent public debt management agency over the medium term will help anchor public debt sustainability. Advancing SOE reforms in the electricity sector will also be critical to reduce fiscal risks,” he said.

He also said that the Central Bank of Sri Lanka should maintain a data-dependent monetary policy.

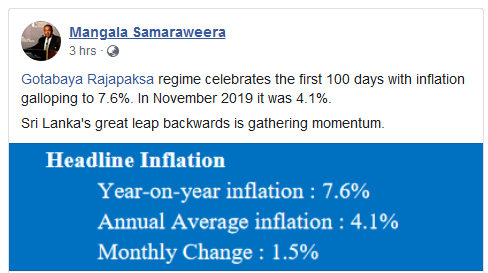

Inflation rises to 7.6% in January

Sri Lanka’s headline inflation as measured by the year-on-year change in the National Consumer Price Index has increased to 7.6 percent in January from 6.2 percent in December, the Statistics Office of the Sri Lanka Central Bank (CBSL) said.

The rise in inflation was driven by the monthly increase in prices of items in both Food and Non-food categories.

Food inflation has increased substantially from 8.6 percent in December 2019 to 13.7 percent in January 2020, the highest since November 2017. Non-food inflation has stood at 3.0 percent in January 2020.

The change in the NCPI measured on an annual average basis increased to 4.1 percent in January 2020 from 3.5 percent in December 2019.

The monthly change of NCPI recorded at 1.5 percent in January 2020 and it was due to the price increases observed in the items of both Food and Non-food categories.

The core inflation, which reflects the underlying inflation in the economy, decreased from 5.2 percent in December 2019 to 3.9 percent in January 2020, on a year-on-year basis, recording the lowest since January 2019.

Sri Lanka's total debt increase by 71% due to Rajapaksa borrowings

Sri Lanka government’s total debt has increased by a staggering by 71 percent since the taking over of administration in 2015 from previous Rajapaksa regime, official statistics showed.

The present administration has to borrow money since 2016 to repay the massive loans taken by the previous regime, sources from the Treasury said.

The most significant borrowing in 2013 was the US $750 million obtained from international markets at the highest ever interest rate of 8.9 percent at a time when the global benchmark rate for that type of loan was around 1.3 percent.

According to Finance Ministry data, public debt has increased to over Rs. 8000 billion in 2015 from Rs. 4000 billion in 2009.

While the government went on a borrowing spree on international capital markets, government revenue nose-dived.

In 2005, Sri Lanka's tax-to-GDP ratio was 13.7 percent. By 2014, it was 10.1 percent, one of the lowest in the world.

As a result, expenditure necessary for long-term growth in sectors such as health and education suffered. As a result, Sri Lanka needed to borrow more just to repay the loans of previous regime.

In 2014, interest payments amounted to Rs. 436 billion, approximately 24 percent of government expenditure.

Sri Lanka’s public debt has continued to escalate putting huge pressure on the Government budget as well, official sources said.

External debt in Sri Lanka averaged USD 45.88 billion from 2012 until 2019, reaching an all time high of USD 55.47 billion in the second quarter of 2019 and a record low of USD 37 billion in the fourth quarter of 2012.

To pay interest and principal obligations of the existing stock of foreign debt, Sri Lanka will need $ 5-6 billion in each of the next five years.

Loan repayments between 2019 and 2022 would be around USD 21 billion. The country’s foreign debt is estimated at USD 55 billion.

Sri Lanka’s public debt amounted to Rs. 12 trillion at the end of 2018 .The total debt was Rs. 12.6 trillion as of June 2019. Public debt is 83 percent of the economy (83% GDP)

As of the end of 2018, Rs. 6 trillion of Rs. 12 trillion or 50% of total debt was foreign debt. As of June 2019, Rs. 6.3 trillion of Rs. 12.6 trillion debt is foreign debt. As a result, foreign vs domestic debt is now 50/50.

Foreign debt declined from 37% of the GDP in 2009 to 30% in 2014. Since then, foreign debt-to-GDP ratio has increased by 11% percentage points to 41% as of the end of 2018.

The domestic debt-to-GDP ratio has declined from 50% of the GDP in 2009 to 42% in 2018.

Central Bank clarifies misreporting on forensic audit reports

The Central Bank of Sri Lanka (CBSL) in a statement clarified several instances of misreporting in the media with respect to the forensic audits that were carried out.

The Central Bank noted that the Monetary Board, in consultation with the Auditor General and the Attorney General, took measures to commission six forensic audits pursuant to the recommendations of the Presidential Commission of Inquiry appointed to investigate and inquire into and report on the issuance of Treasury bonds during the period of 01st February 2015 to 31st March 2016 and matters that had come to light over the recent years in audit reports and in findings of internal investigations pursuant to the exercise of certain regulatory and agency functions undertaken by the CBSL.

The procurement of the five forensic audits were carried out by a Cabinet Appointed Consultant Procurement Committee and the contracts were awarded to audit firms with a global practice and international experience in forensic auditing with the approval of the Cabinet of Ministers.

Out of the six forensic audits initiated, five forensic audits have been completed so far at a cost of Rs 275 million (approximately), contrary to various amounts stated in the media, the Central Bank said adding that the procurement process of the sixth forensic audit is currently underway.

Some mainstream media had reported that the cost of the forensic audits had exceeded Rs. 900 million.

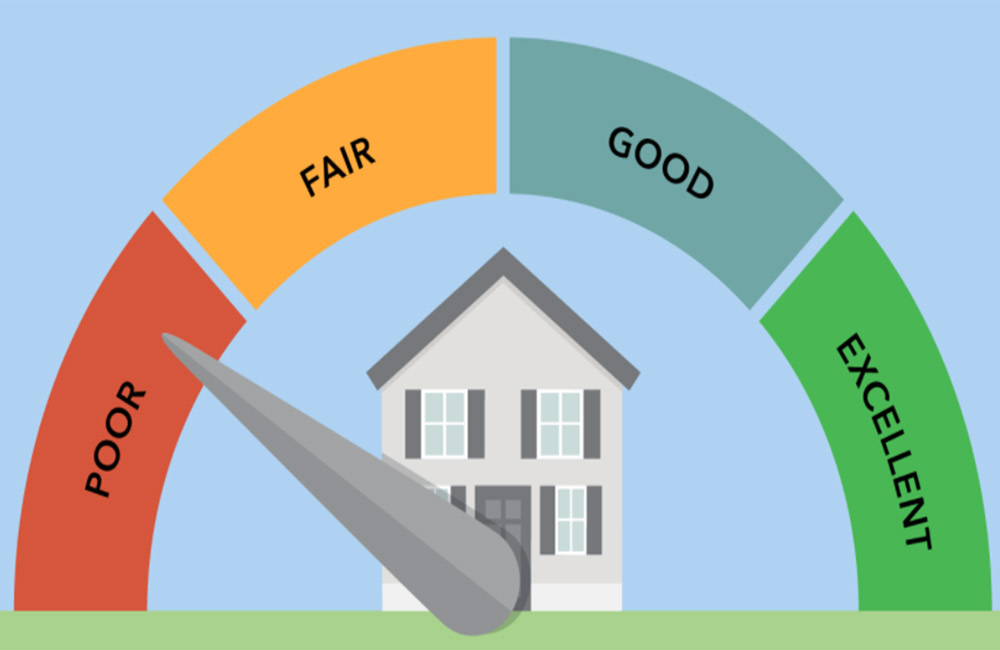

Licensed banks to operate under stringent operational framework

Sri Lanka’s licensed banks are to be operated under more stringent legal and regulatory framework with the implementation of the new Banking Act, Central Bank Governor Dr.Indrajit Coomaraswamy told a media conference recently.

The Central Bank (CB) is now reviewing the current Banking Act and several amendments will be made to strengthen the Act and one of those amendments is to empower the director of bank supervision of the CB to impose fines on banks for irregularities and malpractices, he disclosed.

“At present, the Central Bank as the regulator has no way to impose fine on errant banks. It can only restrict their business in certain ways. We can restrict the role of board members etc. But we can’t impose fines so that is what would be introduced,” he said.

The key areas to be included into the proposed new Banking Act are an overall mandate for supervision and regulation, and a differentiated regulatory framework to facilitate proportionality, strengthening corporate governance, and consolidated supervision

A resolution framework, the capacity to impose monetary penalties/fines, ring-fencing of banks to mitigate contagion risk, strengthening provisions for mergers, acquisitions and consolidation of large foreign banks and holding company structure for banks will also be included in the new act.

Bank examination methodology will continue to be enhanced focusing on the efficiency, effectiveness and sustainability of individual banks and the banking sector.

A new supervisory rating model (The Bank Sustainability Rating Indicator-BSRI) is being developed by the Central Bank with a view to facilitating a risk based supervision framework to enable early intervention and prompt corrective action.

A regulatory framework on consolidated supervision will be formulated and provisions in this regard will also be brought into the Banking Act, official sources said.

Page 10 of 22