Economic

Sri Lanka's trade deficit narrows significantly

Sri Lanka continued to perform moderately in merchandise exports as the country recorded gains in exports during the month of November last year while the deficit in the trade account narrowed significantly (year-on-year) following the noteworthy decline in the import expenditure, Central Bank announced.

The latest data released by the country’s monetary regulator showed earnings from merchandise exports increased moderately by 4.1 per cent (year-on-year) to US dollars 980 million in November 2018. Expenditure on merchandise imports declined by 9.1 per cent (year-on-year) for the first time since June 2017 to US dollars 1,765 million in the same month narrowing the trade deficit. Exports grew by 4.1 per cent while imports contracted by 9.1 per cent in November 2018 (year-on-year).

The decline in consumer and investment goods contributed to the drop in import expenditure reflecting mainly the impact of restrictions on personal vehicles and non-essential consumer goods imports

The relatively larger depreciation of the Sri Lankan rupee may also have contributed to curtailing imports, Central Bank said. The growth in exports was driven by industrial exports while agricultural exports continued to decline.

Under industrial exports, export earnings from textiles and garments increased notably in November 2018 mainly driven by exports to the USA.

In addition, garment exports to non-traditional markets such as India, Canada and Australia as well as the EU market increased along with textile and other readymade garments.

Earnings from petroleum products increased significantly during the period under review reflecting higher bunker and aviation fuel prices despite a slight reduction in export volumes in comparison to that of November 2017.

Export earnings from machinery and mechanical appliances food, beverages and tobacco, rubber products and base metals and articles rose in November 2018.

However, export earnings from printing industry products, gems, diamonds and jewellery and leather products, travel goods and footwear declined.

Central Bank begins consolidated risk-based supervision

The Central Bank of Sri Lanka (CBSL) entered into a Memorandum of Understanding (MoU) with the Securities and Exchange Commission of Sri Lanka (SEC) and the Insurance Regulatory Commission of Sri Lanka (IRCSL) on 31 December 2018 at CBSL, to conduct effective consolidated risk-based supervision and for CBSL to be the lead supervisor in this regard.

Consolidated supervision is an essential tool for supervising financial groups.

It involves assessment of group-wide risks that may emanate from relationships among members of a corporate group operating across different financial sub-sectors.

Group-wide consolidated supervision of such institutions is necessary in order to evaluate and assess contagion and reputation risks posed by such entities to the financial system and to contain systemic risk.

In the presence of Dr. Indrajit Coomaraswamy, Governor of CBSL, representatives of the three regulators, viz, Mr. H A Karunaratne, Deputy Governor of CBSL, Mr. Vajira Wijegunawardane, Director General of SEC and Mrs. Damayanthi Fernando, Director General of IRCSL signed the MoU on consolidated risk-based supervision on behalf of the respective institutions.

Sri Lanka’s inflation trends down in December

Sri Lanka’s prices of food and non-food items have come down in December last year, Central Bank announced on Monday releasing last month’s head line inflation report.

A street opinion poll however, revealed that everybody is cutting back on their spending with the the lower middle class and the poor struggling to make ends meet.

Analysts say that food prices often change at a greater rate than overall inflation.

Food prices tend to be more volatile because they are determined by factors, such as the weather. Also, with inelastic supply and demand, this makes prices more volatile, they added.

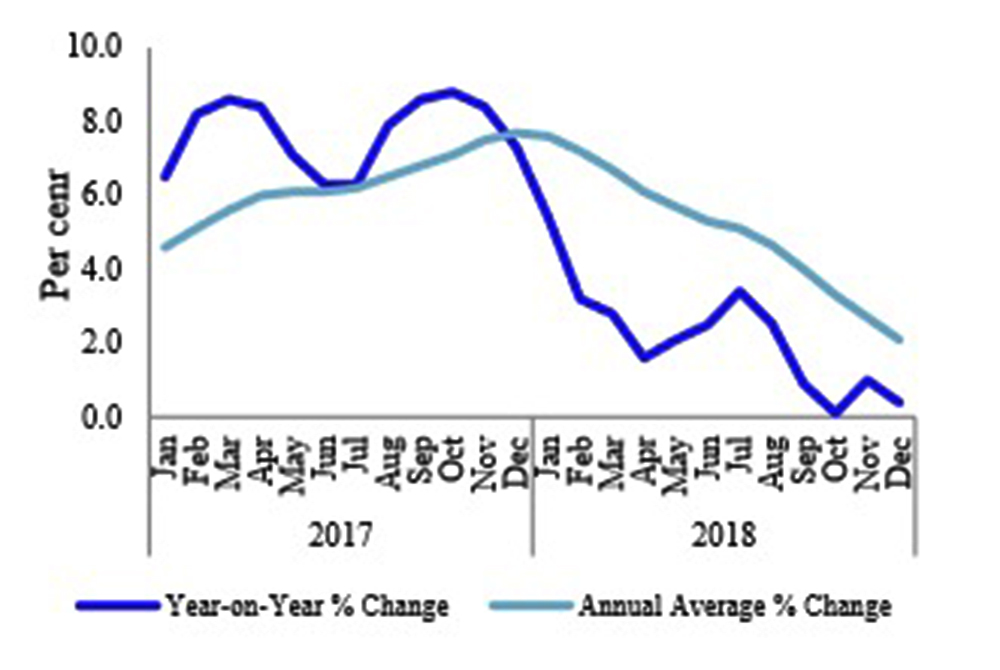

Headline inflation as measured by the year-on-year change in the National Consumer Price Index (NCPI, 2013=100)1 decreased to 0.4 percent in December 2018 from 1.0 percent in November 2018.

The decrease observed in year-on-year inflation in December 2018 is driven by the decrease of prices of items in both Food and Non-food categories, Central Bank said.

Year-on-year food inflation decreased to -4.5 percent in December 2018 from -3.9 per cent in November 2018 while year-on-year Non-food inflation also decreased from 5.2 percent in November 2018 to 4.7 percent in December 2018.

The change in the NCPI measured on an annual average basis decreased to 2.1 per cent in December 2018 from 2.7 per cent in November 2018.

The month on month change of the NCPI was -0.5 per cent in December 2018. This was mainly due to decrease in the prices of the items in the Non-Food category where Transport sub-category (Petrol, Diesel and Bus fare) recorded the highest decrease.

Moreover, prices of items in the Communication; and Alcoholic Beverages and Tobacco sub-categories also reported decreases during the month.

At the same time, prices of items in the food category decreased where vegetables, limes, big onions, bananas and coconuts recorded prominent decreases.

The core inflation, which reflects the underlying inflation in the economy, remained at 3.1 percent in December 2018 on year-on-year basis. Meanwhile, annual average core inflation also remained unchanged at 2.4 percent in December 2018.

Sri Lanka’s export earnings slide amidst a drop in US demand

Sri Lanka’s earnings from merchandise exports increased by 0.4 percent to USD 979 million in October 2018 mainly reflecting the decline in agricultural exports by 11.5 percent which offset the 4.5 percent growth of industrial exports, the Central Bank disclosed.

Analyzing the external sector performance, the economic research department of the bank noted that industrial exports, export earnings from textiles and garments, increased marginally in October 2018 due to higher earnings from textile exports despite the slight decline registered in garment exports.

The reduced earnings from garment exports was mainly driven by the lower demand from the USA as the sentiment of buyers of Sri Lankan garment buyers badly hit by the political coup instigated by the president, economic analysts said.

However, there was an increase in exports to the EU market and non-traditional markets such as India, Canada, Japan and Hong Kong. Further, reflecting the combined impact of both volume and export prices.

Earnings from petroleum products increased significantly in October 2018. Export earnings from food, beverages and tobacco and base metals and articles increased substantially during October 2018 due to improved performance in most of their sub categories.

In addition, export earnings from animal fodder, machinery and mechanical appliances and transport equipment rose in October 2018, contributing towards the increase in industrial exports.

Be that as it may, export earnings from rubber products, gems, diamonds and jewellery and leather, travel goods and footwear declined in October 2018.

Meanwhile, earnings from agricultural exports were lower during the month owing to the poor performance in almost all sub categories except seafood, vegetables and rubber.

Reflecting lower average export prices and exported volumes, export earnings from tea declined in October 2018.

Export earnings from spices also reduced during the month due to the poor performance in most categories of spices.

Further, despite an increase in earnings from coconut non-kernel products, earnings from coconut exports decreased due to the drop in earnings from coconut kernel products such as desiccated coconut and coconut oil.

However, owing to higher exports to the EU market, earnings from seafood exports rose during the month.

Sri Lanka seeks regional bailout as balance of payments crisis looms

Sri Lanka is turning to key Asian allies for a financial lifeline as a balance of payment crisis looms over the debt-strapped South Asian island. It is in discussions with India and China in a desperate effort to meet unprecedented foreign debt obligations.

The Reserve Bank of India agreed earlier this month to provide a $400 million currency swap facility to the Central Bank of Sri Lanka. "The RBI's very rapid and timely assistance will serve to boost investor confidence by supporting Sri Lanka to maintain an adequate level of external reserves," CBSL said in a statement.

The Bank of China is meanwhile reported to have offered a $300 million loan.

On Thursday, Indrajit Coomaraswamy, the governor of Sri Lanka's Central Bank, told a public forum in Colombo that both the RBI and the Bank of China are considering plans to scale up their respective offers to $1 billion each. "Sri Lanka's friends, the two regional giants, have stepped up to support us in this time when we were pushed into a rather difficult corner," he told the meeting hosted by the Ceylon Chamber of Commerce.

Sri Lanka's foreign exchange reserves were down to $6.9 billion at the end of last year, when investors were spooked by political turmoil that brought down the island nation's ratings.

This week, CBSL revealed that Sri Lanka has paid back a $1 billion international sovereign bond by dipping into foreign exchange reserves after attempts to raise funds from the international bond market failed. There is a record debt of $ 5.9 billion that must be met by the end of 2019, and foreign reserves will be severely depleted if Sri Lanka has to carry on in this way.

The $87 billion economy is saddled with unprecedented debt. Banking sources in Colombo estimate maturing loans between 2019 and 2022 to be around $20.9 billion.

China is emerging as Sri Lanka's lender of last resort. Bank of China opened an office in Colombo last year, and financial industry insiders here told the Nikkei Asian Review that China offered to help when Sri Lanka tried to raise dollars from international capital markets. "They once offered to buy an entire sovereign bond issue because they have so much cash," one source said. "But that was declined in the interest of diversity."

Chinese banks have financed a number of major infrastructure projects in recent years. Verite Research, a Colombo-based think tank, estimates that China accounts for nearly 15% of Sri Lanka's external debt, which was estimated to be around $53.1 billion at the end of 2018.

The largest part of the country's foreign loan portfolio is in dollar-denominated international sovereign bonds, estimated to be nearly 50%, followed by debts to Japan, the Asian Development Bank and the World Bank.

Last year, Sri Lanka secured a $1 billion loan from China Development Bank. China's central bank also offered the equivalent of $250 million in Panda bonds. "There are advantages for Sri Lanka to borrow from China, with an interest rate of 2%, [compared to] international sovereign bonds, where interest rates are expensive, at 6.29%," Nishan de Mel, executive director of Verite Research, said at a seminar last week in Colombo when the Chinese debt situation was discussed.

In recent years, RBI has stepped in to help Sri Lanka meet various liquidity and balance of payment crises. In 2016, it offered $700 million for a three-month period. The latest $400 million in financial assistance reflects New Delhi's desire to protect close bilateral relations.

The financial packages from China and India reflect their rivalry for influence in the strategically located Indian Ocean island. Since a civil war ended there in 2009 after nearly 30 years, China has been building a presence in what was traditionally India's backyard.

Sri Lanka's many economic woes have been aggravated by self-inflicted political wounds. A "constitutional coup" staged by President Maithripala Sirisena towards the end of 2018 precipitated a major political crisis. The president summarily dismissed the prime minister in his coalition government and replaced him with a more politically popular successor who nevertheless lacked a parliamentary majority.

Three top ratings agencies -- Fitch Ratings, Standard & Poor's, and Moody's Investor Services -- have downgraded Sri Lanka, raising the cost of international borrowing. Fitch moved Sri Lanka from B+ to B, which leaves it just four notches above default status.

The country saw around $1 billion drain from the stock and securities markets because of political instability. The Sri Lankan rupee, which had been depreciating at 4% annually, slumped 16% against the dollar by the end of the year due to a poor economic performance aside from the political upset.

The International Monetary Fund reduced Sri Lanka's prospects for raising money in international capital markets after it froze the final payment of a $1.5 billion bailout implemented in 2016. This week, the IMF agreed to review the suspended program after a Sri Lankan government delegation met with officials in Washington.

"The IMF remains ready to support the Sri Lankan authorities in these endeavors and an IMF team is scheduled to visit Colombo in mid-February to resume program discussions," Managing Director Christine Lagarde said in a statement on Tuesday.

But analysts say the government must do more to swell the capital account through boosting exports and attracting FDI, both of which are anemic. "There is no dollar revenue coming in to help pay the dollar debt," said one analyst, pointing to the drop in exports from 33% of gross domestic product 20 years ago to 13% currently. "It is a dollar crisis that Sri Lanka is really facing." (Nikkei Asian Review)

Central Bank creates awareness on Sri Lanka’s macroeconomic policy

The Central Bank of Sri Lanka held its 11th International Research Conference under the theme of "Inflation targeting and Bank’s Independence, Accountability and Transparency," at the John Exter International Conference Hall in Colombo.

This conference is held annually, with the objective of promoting theoretical and empirical research in fields related to contemporary macroeconomic policy, providing an opportunity for researchers from diverse backgrounds to share their findings and experiences.

Dr. Indrajit Coomaraswamy, Governor of the Central Bank of Sri Lanka, delivered the inaugural address of the conference highlighting the need to consider the increasing complexity of the economy and markets in formulating macroeconomic and financial sector policies.

He summarised the progress made in relation to Sri Lanka’s move to flexible inflation targeting as the Central Bank’s new monetary policy framework.

The keynote address of the conference was delivered by Prof. Chetan Ghate, Professor of Economics in the Economics and Planning Unit of the Indian Statistical Institute (ISI), who is also a member of the Monetary Policy Committee of the Reserve Bank of India. Prof. Ghate highlighted the importance of an efficient monetary policy transmission mechanism in the successful implementation of an inflation targeting framework.

An invited presentation, titled “On the Role of the Exchange Rate in an Inflation Targeting Strategy," was delivered by Dr. Hans Genberg, Executive Director of the SEACEN Centre.

Dr. Genberg noted that the Central Bank mandates should be broadly aligned with ultimate objectives of macroeconomic and financial system stability and that the exchange rate should be considered as a tool to help achieve these ultimate objectives of a Central Bank.

Central Bank subscribes to LKR 90 billion in treasury bills

The Central Bank of Sri Lanka (CBSL) subscribed to Treasury bills (T-bills) amounting to LKR 90 billion in January 2019, at the request of the Treasury, to assist financing needs of the government due to the delay in receiving expected foreign currency financing arrangements as envisaged in the Treasury’s cash flow for the month of January 2019.

The Monetary Board has acceded to the Treasury’s request in the national interest and under exceptional circumstances, the Central Bank said in a statement.

"Having reviewed the macroeconomic consequences of subscribing to T-bills by the CBSL, the Government has agreed to reverse part of the transaction in February and the balance during the first quarter of 2019 once the Government's borrowing programme is brought back on track with realisation of expected financial arrangements," the Central Bank said.

Sri Lanka risks dipping in economic freedom index

Sri Lanka’s economic freedom has been threatened by the arbitrary actions taken by president Maithripala Sirisena when he decided to remove the democratically elected Prime Minister Ranil Wickremesinghe and Cabinet of Ministers and replacing them with former strongman Mahinda Rajapaksa and his allies.

As result of this act, the country’s public sector services came to a standstill with the bureaucracy adopting a wait and see attitude without carrying out directives issued by the president, new prime minister and his cabinet of ministers.

The country‘s public machinery came to a grinding halt for more than one month following current political impasse instigated by the president, official sources confirmed.

Under this set up, president Sirisena has advised all Ministry Secretaries today (04) to continue all public services without any delays and interruptions according to the existing law.

Amidst this economic turmoil, Sri Lanka’s economic freedom index for 2018 has pushed the country to the 111th position out of 186 countries.

The Index published by The Heritage Foundation, Washington's No. 1 think tank covers 12 freedoms – from property rights to financial freedom – in 186 countries. Sri Lanka’s economic freedom score is 57.8, making its economy the 111th freest according to the 2018 index. Its overall score has increased by 0.4 points, with improvements in investment freedom, business freedom, and judicial effectiveness outweighing a lower score for fiscal health. Sri Lanka is ranked 25th among 43 countries in the Asia–Pacific region, and its overall score is below the regional and world averages.

Sri Lanka taps forex reserve to whittle down debt

Sri Lanka paid back USD 1 billion of its external debt on Monday by tapping its foreign currency reserve, Central Bank of Sri Lanka Governor Dr. Indrajit Coomaraswamy said, after attempts to raise the funds from the international bond market failed.

The country had USD 6.9 billion in foreign exchange reserves at the end of 2018. Using those assets to repay the additional USD 4.9 billion in debt due by the end of 2019 would leave nothing.

In the Indian Ocean sea lanes connecting the Middle East and East Asia, Sri Lanka is strategically located for China's Belt and Road infrastructure initiative. Having stumbled in repaying debt, the government handed over the operating rights of the key southern port of Hambantota to the Chinese in late 2017. According to local financial experts, nearly 15% of Sri Lanka's total debt is owed to the Chinese.

he country's external debt increased 7% over a year to $53.1 billion by the end of 2018. Interest payments account for 38% of government revenue, the world's third-highest portion after Lebanon and Egypt, according to S&P Global.

Recent political turmoil has only exacerbated the situation. President Maithripala Sirisena unilaterally dismissed Prime Minister Ranil Wickremesinghe in October to replace him with a former president, Mahinda Rajapaksa.

The policy paralysis that lasted until Wickremesinghe was restored to office in December saw the Sri Lanka rupee tumble and the forex reserve drop by USD 1 billion.

Fitch downgrades Sri Lanka due to continuing political crisis

Fitch has downgraded Sri Lanka’s long-term debt rating as the country grapples with the ongoing political turmoil.

The ratings agency on Tuesday said it had downgraded Sri Lanka's long-term foreign-currency issuer default rating to B from B+.

The move reflected “heightened external refinancing risks, an uncertain policy outlook, and the risk of a slowdown in fiscal consolidation as a result of an ongoing political crisis” following president Maithripala Sirisena’s sudden replacement of prime minister Ranil Wickremesinghe in late October, Fitch said in a statement.

“Fitch believes the ongoing political upheaval, which has disrupted the normal functioning of parliament, exacerbates the country's external financing risks, already challenged by the tightening of global monetary conditions amid a heavy external debt repayment schedule between 2019 and 2022.”

Analysts have warned about Sri Lanka’s weak fiscal position and urgent refinancing needs amid low foreign exchange reserves and high near-term debt obligations – including to China.

While authorities plan to raise cash through bilateral and commercial borrowing and foreign-currency swaps, risks “could arise from a prolonged period of political uncertainty accompanied by an adverse shift in investor sentiment”, Fitch said.

RBI provides $400 million to Central Bank under swap arrangement

Sri Lanka's Central Bank on Wednesday said that the Reserve Bank of India (RBI) has agreed to provide $400 million under a swap arrangement to boost the island nation's reserves.

"The RBI's very rapid and timely assistance will serve to boost investor confidence by supporting Sri Lanka to maintain adequate level of external reserves while accommodating outflow related to imports, debt servicing and if necessary support for the currency to avoid disorderly adjustment," it said in a statement.

It said that a further request to the RBI for another SWAP arrangement of $1 billion is "under consideration". These are to be made available under the SAARC SWAP facility.

The RBI has agreed to provide the funds under its SAARC (South Asian Association for Regional Cooperation) Swap Facility, the Central Bank said.

Analysts said the RBI's assistance would be much appreciated by Sri Lanka given that the island is still recovering from the political and constitutional crisis in October and November which had an adverse impact on the economy with poor investor sentiment and foreign outflows of capital.

Available Central Bank data showed that in 2018, foreign investors had pulled out a net Rupees 22.8 billion out of stocks, and Rupees 159.8 billion from government securities. The Sri Lankan rupee ended last Thursday at an all-time low of 183 against the US dollar. The rupee fell 19% in 2018, making it one of the worst-performing currencies in Asia.

Central Bank Governor Indrajith Coomaraswamy last week said that the nearly two-month long political crisis had an adverse impact on the country's economy.

Due to the political crisis, the big three credit rating agencies — Fitch Ratings, Standard & Poor's (S&P) and Moody's — downgraded Sri Lanka's sovereign rating.

President Maithripala Sirisena's dramatic move on October 26 to sack Prime Minister Ranil Wickremesinghe and install former strongman Mahinda Rajapaksa in his place following differences over policy issues, left the country without a functioning government for nearly two months. However, a Supreme court verdict forced Sirisena to reinstate Wickremesinghe.

The Central Bank also announced that Finance Minister Mangala Samaraweera will visit Washington next week to resume negotiations on the IMF's assistance. The IMF had held back discussions on Lanka's next loan tranche due to the political impasse.

After completion of the IMF's fifth review Lanka would expect to receive a sixth tranche of about $250 million. The total loan was expected to have been disbursed with a seventh tranche by mid-2019. Sri Lanka is hoping to complete a 3-year programme with the IMF this year.

Export earnings surpass USD 1 Billion for the fourth consecutive month

Sri Lanka’s export earnings have surpassed USD 1 billion for the fourth consecutive month, latest data from the Central Bank showed.

However, a higher growth in import expenditure has outpaced the increase recorded in export earnings.

The latest Central Bank’s External Sector Performance data highlights that the widening deficit in the trade account and the strengthening of the US dollar, which resulted in outflows of portfolio investments, adversely impacted the balance of payments during the month. In the financial account, foreign investments in the government securities market recorded outflows responding to the firming up of global financial markets.

Meanwhile, the Colombo Stock Exchange (CSE) also witnessed some outflows of foreign investments during September. Consequently, the Sri Lankan rupee which depreciated against the US dollar by 5.3 per cent in the first eight months of the year, showed a further depreciation of 4.6 per cent in September, reflecting the pressure on the domestic foreign exchange market.

These developments necessitated intervention by the Central Bank to curtail excessive volatility in the exchange rate. The country’s gross official foreign reserves stood at USD 7.2 billion at the end of September 2018 which was equivalent to 3.8 months of imports.

Earnings from industrial exports, which account for 77 percent of the total export earnings, grew by 9.4 percent during September 2018, while earnings from agricultural exports fell by 10.8 percent, reflecting the poor performance in almost all categories except seafood.

Industrial export earnings from textiles and garments increased in September 2018 reflecting considerable high demand for garments from the USA and non-traditional markets such as Canada, India and Japan although a slight reduction was recorded in exports to the EU market.

Earnings from petroleum products increased substantially in September 2018 due to higher export prices of bunker and aviation fuel, despite low export volumes. Export earnings from leather, travel goods and footwear, and base metals and articles increased in September 2018 contributing towards the increase in industrial exports.

Page 13 of 22