News

Afternoon Showers Forecast; Rough Seas Expected Due to Low-Pressure System

The Department of Meteorology Sri Lanka has predicted mainly fair weather across much of the island today, with rain expected in selected areas after 2.00 p.m.

Showers or thundershowers are likely to develop in parts of the Southern Province, as well as in the districts of Ratnapura, Monaragala, and Kalutara during the afternoon hours. The public has been advised to take precautions against localized strong winds and lightning that may accompany thundershowers.

Meanwhile, a low-pressure system situated over the Bay of Bengal, northeast of Sri Lanka, is gradually moving in a northeasterly direction and is expected to weaken further. However, its influence could still result in heavy showers or thundershowers and strong winds reaching speeds of 50–60 kmph in certain areas.

As a result, sea conditions may turn rough at times. Naval personnel and fishing communities have been urged to remain alert.

Rain or thundershowers may also occur in sea areas extending from Galle to Pottuvil via Hambantota during the evening or night. Winds around the island’s coastal waters are expected to be north-westerly, with speeds ranging between 20 and 40 kmph.

Overall, sea conditions will be moderate, but temporarily strong gusts and very rough seas can occur during thundershowers, according to the department.

Mexican drug lord killing sparks revenge attacks; cars and businesses set ablaze, highways blocked

Within hours of the killing of Mexican drug lord Nemesio Oseguera, better known as El Mencho, in a military raid on Sunday, gunmen suspected to be his supporters blocked highways across several states and set cars and businesses ablaze.

In some towns tourists and residents were urged to stay indoors, while truckers were advised to take safe routes or return to their depots until the violence abated.

Several airlines, including Air Canada, United Airlines and Aeromexico, on Sunday cancelled flights to Puerto Vallarta, a beachside resort town where stunned tourists filmed plumes of smoke rising into the sky from fires.

The burst of violence across more than half a dozen states painted a familiar scene for Mexicans who have spent two decades watching successive governments wage war on drug cartels, ravaging broad swaths of the country.

A member of Oseguera’s Jalisco New Generation Cartel told Reuters that the blazes and sporadic gunfire were carried out in revenge for the government’s killing of Oseguera, and warned of further bloodshed as groups move to take control of his cartel.

“The attacks were carried out in revenge for the leader’s death, at first against the government and out of discontent,” the person said, speaking on condition of anonymity.

“But later the internal killings are coming, by the groups moving in to take over.”

In Mexico’s Pacific coast, a five-hour drive from the military operation in the town of Tapalpa that took down the leader of the powerful Jalisco New Generation Cartel, stunned beachgoers on a pier in Puerto Vallarta took out their cell phones to film thick waves of smoke obscuring blue ocean views, showed a video shared with Reuters.

Daniel Drolet, a Canadian who has wintered in Puerto Vallarta for years, said in a phone interview that he was concerned of a new era of violence taking root in the typically placid resort zone.

“I have never seen anything like this before,” he said.

In the state of Jalisco, authorities reported that gunmen had attacked a base for the National Guard military police, and recommended guests remain inside hotels and suspended public transit.

Other scenes of criminal activity and military response were captured in videos shared by government security sources with Reuters: A green military tank made its way through a residential neighborhood in the state of Aguascalientes. Roadblocks paralyzed the highly transited Mexico-Puebla highway. In the state of Colima, cartel members standing in pick-up trucks blocked a road.

A trucking industry group said in a statement it was “profoundly worried” by the highway violence and recommended that truckers keep to safe areas or return to their operating yards until conditions improved.

The state of Guanajuato, a CJNG stronghold, reported 55 incidents across 23 municipalities, with 18 arrests, but said by evening all incidents were under control.

Carlo Gutierrez, who lives in Guadalajara, Jalisco’s capital, said that friends on WhatsApp groups were encouraging people to stay home.

“There is fear and a lot of caution,” he said of the city, one of three main Mexican venues for World Cup soccer matches this summer.

VIOLENCE IN WAKE OF CARTEL ARRESTS, KILLINGS

Authorities have not reported any casualties beyond several cartel members and officials killed during the military operation.

Previous cartel arrests and killings have led to outbreaks of violence - whether by members avenging their fallen leader or rival gangs muscling in on their territory - prompting Mexican authorities to hesitate before launching major campaigns.

In 2019, Ovidio Guzman, a son of Sinaloa Cartel kingpin Joaquin “El Chapo” Guzman, was detained but quickly released, setting off widespread gun battles. His arrest in 2023 set off more violence.

The 2024 arrest of Sinaloa Cartel boss Ismael “El Mayo” Zambada triggered a bloody power struggle in the criminal group that continues unabated more than a year later.

“I’m watching the scenes of violence from Mexico with great sadness and concern,” said U.S. Deputy Secretary of State Christopher Landau, who previously served as ambassador to Mexico, in a post on social media.

“It’s not surprising that the bad guys are responding with terror. But we must never lose our nerve.”

Mexico’s President Claudia Sheinbaum in a social media post acknowledged the violence, but struck a tone of calm.

“In most of the national territory activities are happening with absolute normalcy,” she said.

Source:adaderana.lk

Oxford, Cambridge Unions cancel Namal Rajapaksa speaking events

The Oxford Union has cancelled a planned speaking event featuring Sri Lanka Podujana Peramuna (SLPP) MP Namal Rajapaksa, following backlash from Tamil student groups and campaigners.

The Cambridge Union had previously cancelled his scheduled appearance, citing security concerns linked to planned protests.

According to UK student newspaper Cherwell, Oxford Union President Katherine Yang said the decision was taken after concerns were raised about students’ ability to participate freely.

“A core part of the Union’s purpose is enabling direct, open questioning from students. In this case, a significant number of the students most closely connected to the subject matter communicated that they did not feel safe asking questions openly,” Yang was quoted as saying.

She added that while alternative formats were considered, the inability of those most affected to participate directly undermined the substance of the forum.

“An event where key stakeholders cannot engage on equal footing does not produce the kind of robust debate the Union is intended to facilitate,” she said.

Rajapaksa is currently on a visit to the United Kingdom and earlier paid homage at the London Buddhist Vihara, which is marking its 100th anniversary this year.

Diaspora advocacy group Tamil Solidarity had called on both unions to cancel Rajapaksa’s scheduled speaking engagements, arguing that providing him a platform amounted to political rehabilitation. The organisation also warned of protests if the events proceeded.

Tamil Solidarity, established in 2009, campaigns on issues related to alleged war crimes, accountability and the rights of Tamil-speaking people.

(Source:Newswire)

PM Harini Urges Scouts to Lead with Discipline and Responsibility

Prime Minister Harini Amarasuriya called on members of the Scouting Movement to take an active and responsible role in shaping the country’s future while addressing a special event held to commemorate the 169th birth anniversary of Robert Baden-Powell, the founder of global scouting, and World Scout Thinking Day.

The event took place on February 22 at the Sri Lanka Scout Association National Scout Headquarters, with the participation of scouts and officials from across the country.

In her address, the Prime Minister emphasized that scouting is not about titles or ranks but about building strong character, discipline, and a commitment to helping others. She encouraged scouts to become responsible citizens who contribute positively to society, respect diversity, and make productive use of modern technology.

She also highlighted the importance of environmental protection, urging scouts to take part in initiatives such as tree planting and conserving water resources.

As part of the ceremony, laptops were symbolically handed over to selected districts under the Scout Digitalization Project, along with first-aid kits to support scouting activities. Chief Scout Commissioner Manoj Nanayakkara presented the Prime Minister with a commemorative stamp collection and special cover to mark the occasion.

The event was attended by Secretary to the Prime Minister Pradeep Saputhanthri, senior officials of the Sri Lanka Scout Association, and scouts representing various regions of the country.

EU says it will accept no increase in US tariffs after Supreme Court ruling: ‘a deal is a deal’

The European Commission demanded on Sunday that the United States stick to the terms of an EU-U.S. trade deal reached last year, after the U.S. Supreme Court struck down Donald Trump’s global tariffs and he responded with new levies across the board.

The Commission, which negotiates trade policy on behalf of the 27 EU member states, said Washington must provide “full clarity” on the steps it intends to take following the court ruling.

After the court struck down Trump’s global tariffs on Friday, the U.S. president announced temporary, across-the-board tariffs of 10%, which he then hiked to 15% a day later.

“The current situation is not conducive to delivering ‘fair, balanced, and mutually beneficial’ transatlantic trade and investment, as agreed to by both sides” in the joint statement setting out the terms of last year’s trade agreement, the Commission said. “A deal is a deal.”

The comments were far more strongly worded than the Commission’s initial response on Friday, which had said only that it was studying the outcome of the Supreme Court decision and keeping in contact with the U.S. administration.

Last year’s trade deal set a 15% U.S. tariff rate for most EU goods, apart from those covered by other sectoral tariffs such as on steel. It also allowed zero tariffs on some products such as aircraft and spare parts.

The EU agreed to remove import duties on many U.S. goods and withdrew a threat to retaliate with higher levies.

“In particular, EU products must continue to benefit from the most competitive treatment, with no increases in tariffs beyond the clear and all-inclusive ceiling previously agreed,” the EU executive said, adding that unpredictable tariffs were disruptive and undermined confidence across global markets.

It said that EU Trade Commissioner Maros Sefcovic had discussed the issue with U.S. Trade Representative Jamieson Greer and Commerce Secretary Howard Lutnick on Saturday.

Source:Adaderana.lk

Government Releases 100,000 Gas Cylinders to Ease Shortage; New Shipments Expected Soon

Minister of Trade, Commerce, Food Security and Cooperative Development Wasantha Samarasinghe stated that 100,000 LP gas cylinders, amounting to approximately 1,500 metric tons, will be distributed today in an effort to address the current supply shortage in the market.

He also confirmed that two more gas shipments are scheduled to arrive in the country in the coming days. One vessel carrying 3,900 metric tons of LP gas is expected on February 25, followed by another shipment of 3,700 metric tons on February 28.

In addition, ministry officials are set to hold a special discussion today with representatives from LAUGFS Gas PLC to review the ongoing supply concerns and explore solutions.

The Minister emphasized that strict legal measures will be taken if the company fails to restore adequate gas distribution. He added that the company has been given until March 12 to ensure sufficient availability of LP gas for consumers.

NBRO Lifts Red Landslide Alerts; Amber and Yellow Warnings Still Active in Several Districts

The National Building Research Organisation has removed the previously issued Red-level landslide warnings for several districts after observing a decline in rainfall over the past 24 hours.

NBRO scientist Suminda Ratnayake explained that the decision was made after evaluating recent weather patterns and updated forecasts, which indicated an improvement in conditions.

Despite the removal of the highest-level warning, Level 2 (Amber) alerts, urging residents to remain alert, are still in place for several Divisional Secretariat divisions. These include Yatinuwara, Doluwa, Ududumbara, Ganga Ihala Korale, Pathadumbara, and Medadumbara in Kandy District; Yatiyanthota, Kegalle, Dehiowita, Aranayaka, and Mawanella in Kegalle District; Rattota, Ambagamuwa Korale, Laggala Pallegama, Wilgamuwa, and Ukuwela in Matale District; Walapane, Ambagamuwa, and Nildandahena in Nuwara Eliya District; Kalawana, Ayagama, Kiriella, and Ratnapura in Ratnapura District; Badalkumbura in Monaragala District; Haldummulla in Badulla District; and Niyagama in Galle District.

In addition, Level 1 (Yellow) warnings, advising vigilance, have been issued for 23 Divisional Secretariat divisions across the districts of Badulla, Galle, Hambantota, Kandy, Kegalle, Kurunegala, Matale, Monaragala, Nuwara Eliya, and Ratnapura.

Dr. Ratnayake cautioned that although rainfall has reduced, the ground in previously affected areas remains heavily saturated. He warned that even light showers could trigger landslides, rockfalls, or earth slips. Residents and travelers in vulnerable areas have been urged to stay alert, monitor official advisories, and take precautionary measures to ensure their safety.

Postal Department Targets Rs. 15 Billion Revenue Amid Modernization Drive

Minister of Health and Mass Media Nalinda Jayatissa announced that the Sri Lanka Postal Department has the capacity to reach a revenue target of Rs. 15,000 million this year.

He made these remarks during the opening ceremony of the newly renovated Madawala Ulpotha Post Office yesterday (22), which was upgraded at a cost of Rs. 5.1 million.

The Minister highlighted that an earlier investment of Rs. 2,000 million in the Postal Department helped increase its income to Rs. 13,450 million. Building on this progress, the Department is now aiming for higher earnings in the current year.

He further explained that multiple projects are currently being implemented to modernize postal operations and enhance efficiency. These include allocating Rs. 27 million to install 209 CCTV cameras, Rs. 74 million to purchase 225 computers, and Rs. 101 million to supply 1,500 tablet devices to the Central Mail Exchange.

Additionally, solar energy systems are being installed at key facilities such as the Batticaloa and Polonnaruwa post offices, the Central Mail Exchange, and Postal Headquarters, with an investment of Rs. 24 million.

The Minister also confirmed that renovation work at the Polonnaruwa Post Office has been completed. Furthermore, Rs. 31 million has been allocated to procure 657 fingerprint recognition devices, which will be introduced across post offices islandwide to improve operational efficiency and security.

New York, other US states under state of emergency as snow falls amid blizzard warning

New York, New Jersey, Connecticut and Massachusetts governors issued state of emergency orders and a halt to non-essential travel as a major storm was expected to bring up to 24 inches of snow and strong winds to the region.

• Around 15,247 flights were delayed by early afternoon on Sunday, and 3,509 were cancelled. The largest number of cancellations were at JFK, La Guardia and Newark airports.

• New York City Mayor Zohran Mamdani ordered the closure of city streets to non-essential vehicular traffic, including bicycles and scooters, from 9 p.m. Sunday to 12 p.m. Monday and closure of all school buildings.

• Similar restrictions were adopted by Connecticut, as Governor Ned Lamont banned commercial vehicles on highways in the state from 5 p.m. on Sunday.

• Massachusetts Governor Maura Healey has declared a state of emergency and activated up to 200 National Guard members to help. The state also restricted non-essential travel from Sunday evening.

• New York Governor Kathy Hochul activated 100 National Guard members to deploy in Long Island, New York City and the Lower Hudson Valley.

Source:adaderana.lk

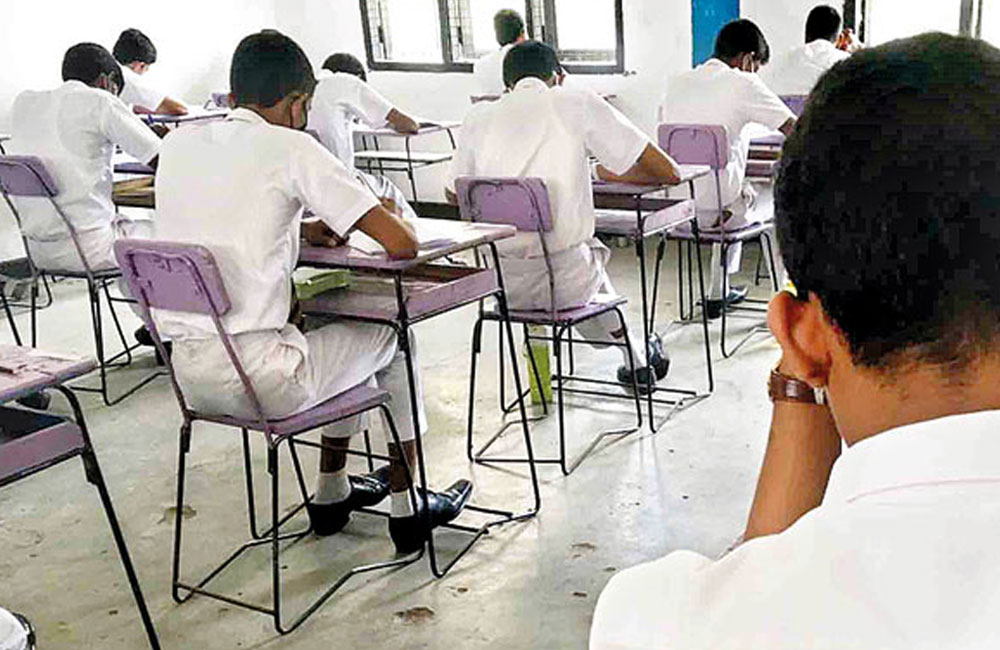

Red Landslide Alerts Lifted in Most Districts; O/L Exam to Proceed as Planned

The Disaster Management Centre Sri Lanka (DMC) has announced that previously issued Red-level landslide warnings for multiple districts have now been lifted.

DMC Director Pradeep Kodippili stated that residents who were earlier evacuated from high-risk areas have been permitted to return to their homes following safety assessments conducted in the affected locations.

He noted that the National Building Research Organisation (NBRO) has maintained Red warnings only for several Divisional Secretariat divisions within the Kandy District.

According to Kodippili, most roads have been cleared and restored, with the exception of the Somawathiya road, which remains inundated as of this morning.

Meanwhile, he confirmed that the G.C.E. Ordinary Level Examination scheduled for today (23) will proceed without interruption. The DMC, in coordination with the Department of Examinations Sri Lanka, has put in place a joint emergency response mechanism to address any unforeseen developments.

Authorities have assured that arrangements are ready to provide immediate support if required, including transportation assistance for students and measures to ensure examinations continue smoothly.

All emergency operation centres remain fully active, with officers manning the 117 emergency hotline around the clock. District disaster management units, the Tri-Forces, Police, and technical response teams are also on alert to respond swiftly to any incidents.

The public has been urged to remain attentive to official weather updates and follow safety advisories issued by relevant authorities.

25 Sri Lankan students land in Pakistan for medical studies

Twenty-five Sri Lankan students have landed in Pakistan to study MBBS in top medical universities through the Allama Iqbal Scholarships for Sri Lankan Students.

The students were welcomed upon their arrival at Jinnah International Airport, Karachi.

These fully-funded scholarships are a part of the larger Pak-Sri Lanka Higher Education Cooperation Programme, which is managed by the Higher Education Commission (HEC) of Pakistan.

Through this initiative, the students will be able to carry out their medical studies at top universities, including Dow University of Health Sciences (DUHS) Karachi and Liaquat University of Medical & Health Sciences (LUMHS), Karachi.

Both of these universities are properly recognized by the Sri Lankan Medical Council (SLMC), which will make the degrees internationally recognized.

Apart from the students who have just arrived, there are over 430 Sri Lankan students who are currently enrolled in Pakistani universities through this scholarship program in a variety of disciplines, including Medicine, Engineering, Business Studies, Natural Sciences, and Social Sciences.

All of these students have been selected through a competitive process, as per the eligibility criteria for admission to Pakistani higher education institutions. Through the same scholarship program, one hundred more Sri Lankan students are set to arrive in Pakistan.

Source:adaderana.lk

Landslide ‘Red’ warnings issued for four districts extended

The National Building Research Organisation (NBRO) has extended ‘Level 3 (Red)’ landslide warnings issued to several Divisional Secretariat Divisions (DSDs) across four districts due to prevailing heavy rainfall.

In addition, Level 2 (Amber) and Level 1 (Yellow) landslide early warnings have been issued for multiple areas across several districts.

The warnings, issued by the NBRO at 8:30 a.m. today (22), will remain in effect for the next 24 hours.

Level 3 — Evacuate (Red Warning)

- Kandy District: Yatinuwara, Doluwa, Ududumbara, Ganga Ihala Korale

- Kegalle District: Yatiyanthota, Kegalle, Dehiowita, Aranayaka, Mawanella

- Matale District: Rattota, Ambagamuwa Korale, Laggala Pallegama, Wilgamuwa, Ukuwela

- Ratnapura District: Ratnapura

Level 2 — Be Alert (Amber Warning)

- Badulla District: Haldummulla

- Galle District: Niyagama

- Kandy District: Medadumbara, Pathadumbara

- Monaragala District: Badalkumbura

- Ratnapura District: Kiriella, Ayagama, Kalawana

Level 1 — Remain Vigilant (Yellow Warning)

- Badulla District: Meegahakivula, Kandaketiya, Haputale, Passara, Bandarawela

- Hambantota District: Walasmulla

- Kandy District: Udadumbara, Udapalatha, Udunuwara, Pasbage Korale, Pathahewaheta

- Kegalle District: Deraniyagala, Bulathkohupitiya

- Kurunegala District: Rideegama, Mallawapitiya

- Monaragala District: Wellawaya

- Nuwara Eliya District: Kotmale West, Hanguranketha, Kotmale East, Mathurata

- Ratnapura District: Nivithigala, Eheliyagoda, Kolonna(

(Source:adaderana.lk)

Page 9 of 684