News

‘If they rise, they rise’: Trump says he’s not concerned about rising gas prices amid Iran war

US President Donald Trump said he is not worried about rising petrol prices in the United States during the ongoing conflict involving Iran, saying the military campaign remains his main focus, according to Reuters.

In an interview with Reuters, Trump said the increase in fuel prices linked to tensions in the Middle East was not his immediate concern and expected prices to fall once the conflict ends.

“I don’t have any concern about it,” Trump said when asked about higher prices at petrol stations.

“They’ll drop very rapidly when this is over, and if they rise, they rise, but this is far more important than having gasoline prices go up a little bit,” he told Reuters.

Global oil prices have increased since the conflict began, raising concerns about supply disruptions in the Middle East.

The region is a major source of oil exports, and tensions can affect shipments through the Strait of Hormuz, a key route for global oil transport.

According to the American Automobile Association, the average price of petrol in the US has risen by 27 cents in the past week to about $3.25 per gallon. This is about 15 cents higher than a year ago.

Trump said the rise was limited.

“They haven’t risen very much,” he said in the interview with Reuters.

Trump said he was not planning to release oil from the country’s emergency stockpile, the Strategic Petroleum Reserve, which is the world’s largest reserve of crude oil held for emergencies.

He also said he expected oil shipments through the Strait of Hormuz to continue.

Officials in the White House are discussing possible ways to reduce fuel prices if they continue to rise.

White House press secretary Karoline Leavitt said Chief of Staff Susie Wiles and Energy Secretary Chris Wright have spoken with oil company leaders to discuss possible responses.

A White House official, speaking anonymously, told Reuters that government teams were looking at measures that could help lower prices if needed.

Officials believe the price increase could be temporary as the conflict continues.

Source:adaderana.lk

Japan Foreign Minister confirms two Japanese detained in Iran

Two Japanese nationals are currently detained in Iran, but Japan is in contact with them, Foreign Minister Toshimitsu Motegi said Friday.

“We are sure they are safe at this time,” Motegi said at a House of Representatives Foreign Affairs Committee meeting on the day.

One of the two is believed to be the head of NHK’s Tehran bureau who was detained in Tehran in January by Iranian authorities.

Source:adaderana.lk

Gulf carriers resume limited flights, but missile fire fuels uncertainty

Emirates and Etihad Airways were resuming limited flight schedules to key global cities from their United Arab Emirates hubs on Friday, though the threat of missile fire piled pressure on airlines as they scramble to accommodate travellers.

With most airspace in the Middle East still closed over missile and drone concerns since the start of the U.S.-Israel war against Iran, authorities have been arranging charter flights and securing seats on limited commercial services to evacuate tens of thousands of people.

A government-chartered Air France flight to bring French nationals back from the United Arab Emirates was forced to turn back on Thursday due to missile fire in the area, French Transport Minister Philippe Tabarot said.

“This situation reflects the instability in the region and the complexity of repatriation operations,” he said.

Britain’s first repatriation flight from Oman landed at London’s Stansted Airport early on Friday after being rescheduled due to operational issues, including delays in boarding passengers.

Abu Dhabi-based Etihad said on Friday it would resume a limited flight schedule through March 19. The flights will operate to and from Abu Dhabi and around 70 destinations including London, Paris, Frankfurt, Delhi, New York, Toronto and Tel Aviv.

As of Thursday, traffic at Dubai airport, normally the world’s busiest, had almost doubled from Wednesday, but remained only about 25% of normal levels, flight-tracking website Flightradar24 said.

Dubai-based Emirates said late on Thursday it was operating a reduced flight schedule to 82 destinations including London, Sydney, Singapore and New York until further notice, and customers transiting in Dubai would only be accepted if their connecting flight was operating.

The limited operations at Middle Eastern hubs have hit travellers on routes from Europe to the Asia-Pacific region particularly hard.

Combined, Emirates, Qatar Airways and Etihad normally fly about one-third of passengers from Europe to Asia and more than half of all passengers from Europe to Australia, New Zealand and nearby Pacific Islands, according to Cirium data.

Qatar’s Doha hub remains shut, though it has been arranging a limited number of relief flights from Oman and Saudi Arabia.

Data from Cirium showed that from February 28 - when the conflict started - to March 5, there were more than 44,000 flights scheduled in and out of the Middle East, with more than 25,000 flights cancelled so far.

Malaysia Airlines said it would add extra flights from Kuala Lumpur to London and Paris from Friday to Sunday to support disrupted travellers, while SriLankan Airlines said it would operate an additional flight between Colombo and London on Sunday.

JET FUEL PRICES SOAR, SHARES FALL

Higher oil prices have sent jet fuel costs soaring, with Singapore jet fuel reaching a record high of $225 a barrel this week, which traders attributed to concerns about supply shortages from Middle Eastern refiners. The price eased on Thursday to about $195 a barrel after some profit-taking but remained nearly double that of last week.

“As well as lost revenue, airlines are likely to be affected by higher fuel prices,” Fitch Ratings said.

Fuel hedging varies by airline, but Fitch said most carriers in Europe, the Middle East and Africa were about 50% to 80% hedged for the next three months.

In Asia, shares of Qantas Airways fell more than 1% on Friday, Air New Zealand plunged 6.4%, Hong Kong’s flagship carrier Cathay Pacific dropped 1%, Singapore Airlines was down 0.6%, while Korean Air Lines fell 2%.

The Hong Kong-listed shares of major Chinese carriers including Air China, China Eastern Airlines , and China Southern Airlines were mostly flat, as were Japan Airlines’ shares.

TRAVELLERS DESCRIBE CHAOS IN SCRAMBLE TO LEAVE

With the conflict showing little sign of easing, wider aviation and air cargo disruption looked set to linger.

Passengers have been forking out huge sums of money to get out of the Middle East, with some who managed to travel back by commercial flight on Thursday from Oman saying it had been “absolute chaos” to find their way back home from Dubai.

“We paid 1,500 pounds ($2,005.05) to get across to Muscat (Oman) to get on the plane,” said Ed Short after he arrived at London’s Heathrow Airport on a British Airways flight.

“We’d spent about 20,000 pounds booking Emirates flight instead. So we’re hoping we get those back.”

Source:adaderana.lk

Man Arrested at BIA with Over 11kg of Kush and Hashish

Officers attached to the Police Narcotics Bureau (PNB) have arrested a suspect at the Arrival Terminal of Bandaranaike International Airport (BIA) for possessing a large quantity of illegal narcotics.

According to police, the individual was carrying a total of 11 kilograms and 500 grams of drugs, including 6 kilograms and 590 grams of Kush and 4 kilograms and 910 grams of Hashish.

The suspect has been identified as a 35-year-old resident of Colombo 14.

Authorities stated that the Airport Unit of the Police Narcotics Bureau has launched further investigations to determine additional details related to the case.

UNP Raises Concerns Over Iranian Vessel Incident in Sri Lanka’s EEZ

The United National Party has voiced concern over what it describes as the Sri Lankan government’s lack of response to the reported sinking of an Iranian ship by a United States submarine within Sri Lanka’s Exclusive Economic Zone.

In a special statement, the party called on the government to clarify whether it had been informed in advance by the United States about the military operation. It also questioned whether the action was conducted under the framework of the Colombo Security Conclave.

According to the UNP, such incidents risk turning Sri Lanka’s EEZ into a conflict zone, which could negatively affect the country’s commercial and maritime activities. The party warned that shipping and insurance costs could rise as a result, potentially increasing the overall cost of living and placing additional strain on the economy.

The party further urged the government to seek clear assurances from the United States that no similar military actions will take place in waters close to Sri Lanka. It also recommended engaging with international shipping operators and insurance providers to assess and address the possible economic consequences of the situation.

Trump fires Kristi Noem as homeland secretary after storm over shootings, spendin

U.S. President Donald Trump fired Homeland Security Secretary Kristi Noem on Thursday after months of controversy, including the fatal shootings of two U.S. citizens by federal officers in Minneapolis and lawmakers’ questions over a $220 million advertising contract.

The Republican president will tap Oklahoma Senator Markwayne Mullin to replace her by the end of the month, he said on his Truth Social platform on Thursday. The appointment would require U.S. Senate confirmation.

Noem, a former governor of South Dakota, became one of Trump’s most high-profile Cabinet secretaries with social media posts that portrayed immigrants in harsh terms, highlighted alleged criminal offences and used vitriolic language.

Her departure, after emerging as the face of an aggressive immigration crackdown that had grown unpopular according to recent polling, could allow Trump to reset his approach on immigration policy, a centerpiece of his agenda.

Shortly after Trump announced Noem’s replacement, she posted on X: “We have made historic accomplishments at the Department of Homeland Security to make America safe again.”

During congressional hearings this week, Democrats and some Republicans criticized Noem for her approach to immigration enforcement and management of her department, including concern over a $220 million advertising campaign that featured Noem heavily and had been awarded to two longtime Republican operatives without a standard bidding process.

Noem’s personal life also came under scrutiny, with a Democratic lawmaker on Wednesday asking whether she had a sexual relationship with top aide Corey Lewandowski. Both are married.

Noem called the question from U.S. Representative Sydney Kamlager-Dove “tabloid garbage.” Lewandowski did not respond to a Reuters request for comment.

Trump told Reuters on Thursday that he did not sign off on the ad campaign, which prominently featured Noem and included a scene of her on horseback at Mount Rushmore, in her home state of South Dakota.

In one congressional hearing this week, Noem told Republican U.S. Senator John Kennedy that Trump had approved the ad campaign.

FIRST SENATE-CONFIRMED CABINET MEMBER FIRED IN TRUMP 2.0

Noem is the first Senate-confirmed member of Trump’s Cabinet to be removed this term. In Trump’s 2017-2021 term in office, 14 confirmed Cabinet appointees, who serve in the line of succession to the presidency, quit or were fired.

Noem faced criticism in January when she quickly accused two U.S. citizens fatally shot by federal immigration agents in Minneapolis of “domestic terrorism.” Videos that emerged after the deaths undercut the assertion by Noem and other Trump officials that the two deceased - Renee Good and Alex Pretti - were violent aggressors.

The public backlash over the deaths led the Trump administration to adopt a more targeted approach on immigration enforcement in Minnesota, after months of sweeps through U.S. cities that sparked violent clashes between federal agents and residents who opposed the crackdown.

Two Trump administration officials, speaking on the condition of anonymity to discuss a personnel matter, said the fallout over the fatal shootings, the $220 million contract, the mismanagement of DHS and the allegations of the affair all contributed to her firing.

Democrats in the U.S. House of Representatives moved to impeach Noem, and at least two Republicans in Congress called for her to lose her job after the shootings in Minnesota.

Trump said on Truth Social that Noem would be appointed envoy to a planned summit in Miami to reinforce his Western Hemisphere policies.

Within minutes of Trump’s post about her replacement, Noem spoke at a law enforcement event in Tennessee for 40 minutes but did not mention her departure.

Noem was aware she would be removed before she spoke at the event, one of the officials and another person familiar with the matter said, both of whom spoke on the condition of anonymity.

They added that Lewandowski was also expected to leave the department. DHS and the White House did not immediately comment when asked about Lewandowski’s future.

STRONG EMBRACE OF TRUMP’S HARDLINE IMMIGRATION APPROACH

Mullin, who spent a decade in the House of Representatives before becoming a senator in 2023, also supports Trump’s hardline immigration agenda.

Speaking to reporters on Thursday, Mullin said he had not been expecting the call from Trump. He described Noem as a friend and said he had not had a chance to call her yet.

“She was tasked to do a very difficult job,” Mullin told reporters.

Democrats in Congress have blocked funding for DHS since mid-February, saying federal immigration enforcement must be reformed.

Senate Democratic Leader Chuck Schumer said Noem’s firing would not be enough to break the stalemate.

“The problems at ICE transcend any one person,” he told reporters. “The president has to end the violence and rein in ICE.”

Trump’s immigration approach lost popularity as agents detained U.S. citizens and tear-gassed streets in an attempt to drive up deportations, which last year fell short of the administration’s goal of 1 million per year.

While Noem, 54, served as a prominent proponent of Trump’s agenda, White House Deputy Chief of Staff Stephen Miller, a longtime Trump aide, controls Trump’s immigration policy.

Noem was quickly confirmed to lead the 260,000-employee department in January 2025 after Trump took office. On social media, she referred to immigrants convicted of crimes as “scumbags” even as the number of non-criminals arrested by immigration authorities rose under Trump.

She joined immigration enforcement operations on the ground in New York City and visited a maximum-security prison in El Salvador where Venezuelan immigrants deported by the Trump administration were being held without charges or access to lawyers.

Source:adaderana.lk

South Korea says it will receive 6 million barrels of oil from UAE

South Korea says it reached an agreement with the United Arab Emirates to receive 6 million barrels of crude oil, aiming to stabilize energy prices spiked by the escalating war in the Middle East.

Kang Hoon-sik, chief of staff for South Korean President Lee Jae Myung, said in a briefing Friday that the emergency supplies are intended to curb fuel costs which surged this week.

Source:adaderana.lk

US military says it has sunk over 30 Iranian ships so far

The U.S. military said on Thursday it has sunk over 30 Iranian ships so far during the U.S. and Israel’s war against Iran, including an Iranian drone ship that is on fire.

Ballistic missile attacks by Iran have decreased by 90% since the first day of the war, U.S. Admiral Brad Cooper, who leads U.S. forces in the Middle East as the head of Central Command, told reporters.

Source:adaderana.lk

celebrates Lord Swraj Paul’s 25th Anniversary as Chancellor

UNIVERSITY OF WOLVERHAMPTON

To celebrate the 25th anniversary of Lord Swraj Paul’s chancellorship, the University of Wolverhampton hosted Sri Lanka President Ranil Wickremesinghe and Prof Maithree Wickramasinghe, the First Lady of Sri Lanka, recently.

The visit coincided with the award of honorary professorship to the First Lady of Sri Lanka. Mrs Saroja Sirisena, High Commissioner of Sri Lanka to the UK; Dr Shashank Vikram, Consul General of India, Birmingham; Mayor of Wolverhampton Councillor Dr Michael Hardacre; Lynn Plant, Mayoress of Wolverhampton; and Angela Spence, Chair, University of Wolverhampton Board of Governors, were among the dignitaries present on the occasion.

Lord Swraj Paul of Marylebone, PC, has been Chancellor of the University of Wolverhampton for 25 years, taking on the role from the Earl of Shrewsbury, who stepped down in 1998. Chairman of the Caparo Group, Lord Paul is a leading businessman and an active member of the House of Lords.

A generous benefactor

A significant philanthropist, Lord Paul is a generous benefactor supporting hundreds of students and graduates at the University of Wolverhampton, which has three buildings named for his family: the Lord Swraj Paul building and the Ambika Paul building (City Campus Wolverhampton) and the Angad Paul building (Telford Campus).

Speaking on the occasion, Spence said, “It’s a real pleasure to have welcomed our esteemed guests from Sri Lanka. The university has enjoyed a close partnership with Sri Lanka for decades, offering qualifications in Engineering and Built Environment disciplines since 2006 through Colombo International Nautical and Engineering College. In those 17 years, we have expanded our teaching portfolio, introducing IT and Computing Courses, Business and MBAs, and most recently undergraduate Law degrees.

“Without a doubt, Lord Paul’s generosity to this institution and our students knows no bounds and it’s wonderful to welcome him back to the university for such a prestigious occasion.

“I was particularly pleased to approve the Honorary Professorship for Professor Wickramasinghe after reading the biography of her achievements. We are honoured to recognise such an esteemed international academic.”

Growing and flourishing

Lord Swraj Paul, said: “It has been an immense pleasure for me, as Chancellor for the past 25 years, to have watched the university grow and flourish and I have been honoured and privileged to have supported thousands of students on their journey of opportunity in Wolverhampton.

“As well as offering financial support with the naming of key buildings across the university campuses, I have offered assistance, advice and guidance for students on their employability path, have encouraged enterprise through awards and bursaries, have made contributions to invest in innovative research projects, helped PhD students, and I have provided emergency funding for students experiencing financial hardship

“It has been a long and fulfilling journey for me and one that I have enjoyed. I hope our relationship continues for years to come,” he said. The university awarded an Honorary Professorship to Prof Maithree Wickramasinghe in recognition of her extensive research, training and policy work on gender equity and equality.

Gender equity policies

Prof Wickramasinghe (PhD) is the Chair and Senior Professor of English at the Department of English and the founding Director of the Centre for Gender Studies at the University of Kelaniya, Sri Lanka.

An expert on gender, she is a scholar whose work interfaces research, teaching/training, policy development, evaluation, advocacy, and activism. She has almost thirty years’ experience formulating gender equity and equality polices/strategies, conducting gender sensitisation training, and evaluating women’s and gender programmes for higher educational institutions and organisations.

Prof Wickramasinghe said: “I am delighted at the recognition given to my work – both as an academic and a practitioner in the spheres of gender and higher education. My contribution is part of a continuum of work by feminist and women academics in Sri Lanka and abroad who have transformed research into teaching, training, advocacy, policy and programming within higher education as well as in other domains.

“I am greatly indebted to those who have paved the way and those who have walked with me. It is an honour, and I would like to thank the University of Wolverhampton wholeheartedly for this distinction.”

Sri Lanka Navy Rescues 204 Crew Members from Iranian Naval Vessel Near Territorial Waters

The Sri Lanka Navy has successfully carried out a rescue operation to evacuate 204 crew members from the Iranian naval vessel IRIS Bushehr located close to Sri Lanka’s territorial waters.

According to the Navy, the evacuation was conducted safely and efficiently by naval personnel. After being rescued, all crew members were transported to the Port of Colombo.

A Navy spokesperson confirmed that the operation was completed without incident, ensuring the safe transfer of the rescued individuals to Colombo following the evacuation mission.

Sri Lanka Warns of Possible Service Delays Amid Middle East Tensions

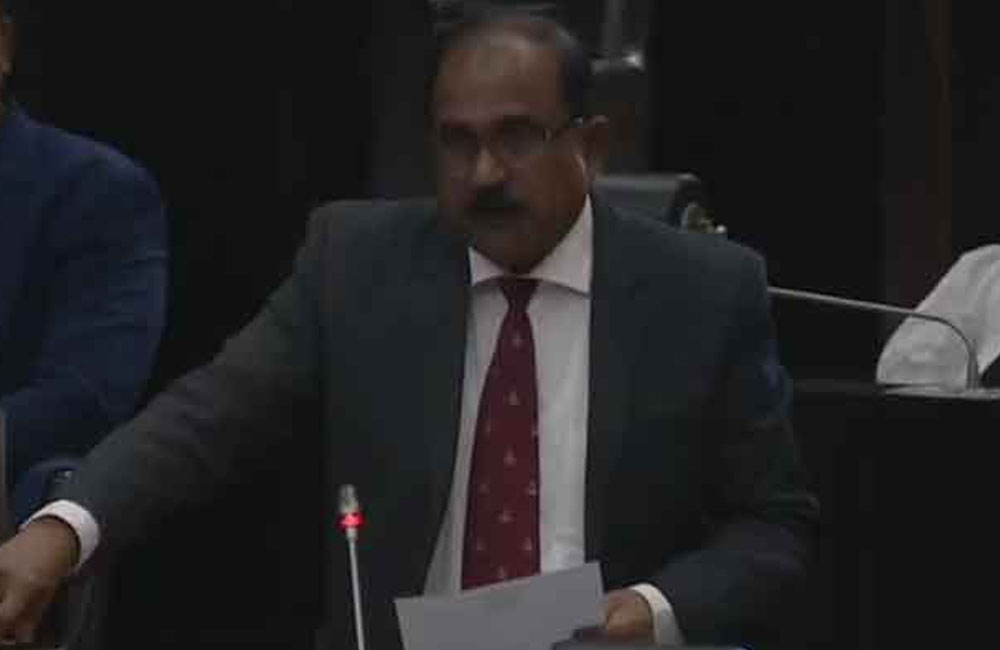

Sri Lanka’s Deputy Minister of Defence Aruna Jayasekera told Parliament on Thursday (06) that the next few weeks could be a critical period for the country as military tensions continue to escalate in the Middle East.

Speaking during a parliamentary session, the minister cautioned that Sri Lanka may face delays in receiving certain essential services in the near future. According to him, these possible disruptions are linked to restrictions placed on maritime and air transport routes due to the ongoing regional conflict.

Jayasekera further explained that the government has taken steps to extend the current State of Emergency in order to safeguard the uninterrupted functioning of vital services during this uncertain period.

He noted that limitations affecting both sea and air transportation could slow the arrival of supplies and services that the country depends on. Therefore, the government believes careful management of essential services is necessary in the weeks ahead as the situation develops.

Iran’s internet blackout hits 120 hours

Iran’s internet blackout has now passed 120 hours, with connectivity in the country flatlining at around 1% of its typical levels, according to independent watchdog organization NetBlocks.

Netblocks added that Iranian telecommunications companies are engaging in “Orwellian” behavior, threatening legal action against users attempting to access the global internet.

The move has made it difficult to obtain a full picture of what’s happening within Iran.

Meanwhile, explosions rocked Tehran again this morning leaving more residents unsure whether to leave or stay put, a man who fled the city told CNN.

Loud bangs were heard in the Iranian capital Thursday morning, the semi-official state news agency Tasnim reported.

“The bombing is everywhere - north, south, east, west. They seem to be going for anything and everything,” a resident told CNN, speaking anonymously for fear of reprisals.

The man – who fled Tehran with his wife, a doctor, a few nights ago – described the uncertainty of living under continuing attacks. “You never know what or who is a target.”

Earlier this week, a TV and radio antenna near their home was hit, shaking the entire neighborhood.

Now they are settled in a small town near Damavand, Iran’s tallest peak, he said the nights are filled with the sound of fighter jets, though no impacts have reached their area.

“A lot of friends and family are staying put in Tehran for now, because the thinking is no matter where you go, something there will be targeted,” he said.

Heading south means fearing foreign forces at the borders, while going north risks getting trapped on the congested Chalus highway, he added. “Many people are thinking it’s better to just stay where you are.”

Source: adaderana.lk

Page 2 of 685