Economic

Sri Lanka’s economic escape

Sri Lanka’s recovery over the past year reads like a narrow escape rendered into a cautious, albeit unfinished success story. After the calamitous months of 2022, when foreign-exchange reserves and fuel imports evaporated and the country teetered on the brink of sovereign default, the island has staged a visible turnaround.

But the recovery remains fragile, uneven and is to some extent still dependent on external lifelines and domestic reforms.

The clearest headline is growth. After contracting sharply during the crisis, the economy expanded robustly in 2024, with GDP growth estimated at around 5%, according to the IMF and Sri Lanka’s Department of Census and Statistics (IMF Country Report No. 24/87) at the time - a figure that surprised many international forecasters and reflected a rebound in services and agriculture.

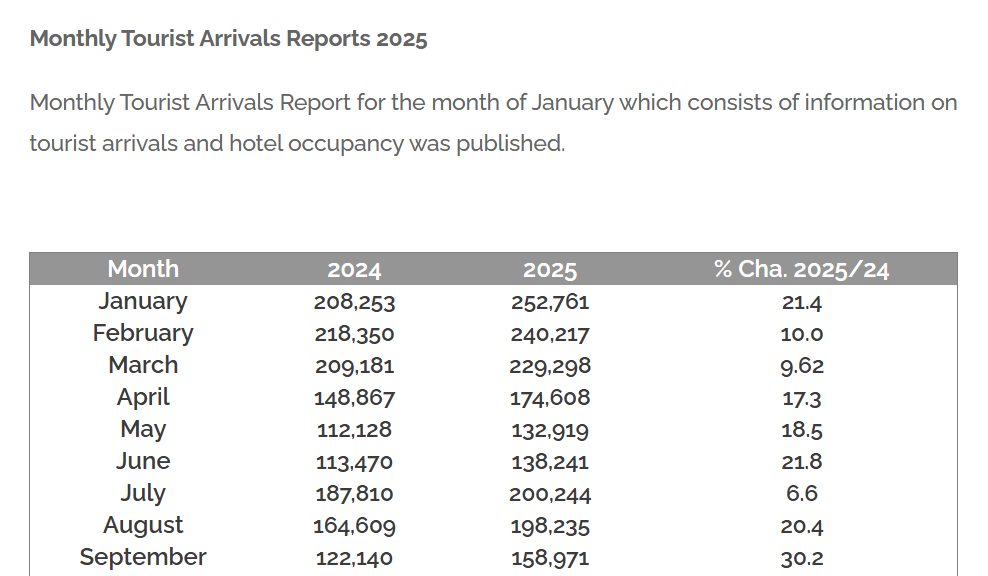

That recovery has continued into 2025: domestic demand has revived, manufacturing output has climbed, and tourism arrivals exceeded 2mn in the first eight months of the year, according to Reuters a month ago – in the process bringing much-needed foreign currency back to the island.

Authorities in Colombo have also succeeded in meeting key IMF programme conditions, and unlocking successive tranche disbursements under the $2.9bn Extended Fund Facility (EFF) approved in 2023. Those funds, alongside stronger remittance inflows which rose to $6.4bn in 2024, up 12% year on year, according to Central Bank of Sri Lanka (CBSL) data, have helped rebuild official foreign-exchange buffers and stabilise the rupee after years of volatility.

“We are now in a position of relative stability,” Central Bank Governor Nandalal Weerasinghe told Reuters, adding that “discipline and structural reforms” were key to avoiding backsliding.

Yet beneath the surface, macroeconomic stability remains a work in progress. Both the IMF and the World Bank’s Sri Lanka Development Update of June 2025, stress that near-term gains rest on continued fiscal consolidation and structural reform rather than a one-off rebound.

As such, the World Bank cautions that, while inflation has turned positive again and consumer demand is firming, financing pressures persist. The government in Colombo faces steep short-term refinancing needs, and public debt remains above 100% of GDP even after restructuring. The Bank warned that “growth without sustained fiscal repair would be precarious,” noting that one in four Sri Lankans remains vulnerable to poverty.

The banking sector tells a similar story of cautious improvement. The Central Bank’s Financial Stability Review 2025 highlights that profitability, capital adequacy and liquidity ratios have strengthened from crisis lows, aided by lower provisioning and improved net interest margins.

Market liquidity also improved during the first half of 2025, while non-performing loans (NPLs), which peaked at 13% in 2023, have fallen to below 9%, helped by restructuring and recovery. The CBSL’s Banking Soundness Index shows a more stable system than at any time since 2021.

But vulnerabilities remain. Local banks’ exposure to government securities, which account for nearly 40% of total assets, leaves them highly sensitive to fiscal risks. Lending growth, particularly to small and medium enterprises, remains subdued. The IMF’s second review of August 2025, urged Colombo to strengthen banking supervision and diversify capital markets to reduce systemic risk. “The scars of 2022 haven’t fully healed,” one senior banker reportedly told Reuters. “The sector is stronger, but still wary.”

Foreign-exchange reserves – a key aspect of the economy for an import-dependent island - have recovered from near-zero levels in 2022 to roughly $5bn by mid-2025, according to CBSL monthly balance reports. This rebound reflects IMF disbursements, improved remittances, and resumed access to international capital markets following debt restructuring with China, India and Paris Club creditors. The improvement has reduced the acute risk of import stoppages that once led to nationwide fuel queues and the much-hated rolling blackouts.

However, reserves remain modest relative to import requirements, covering just over three months of imports, according to IMF data, and any deterioration in the balance of payments could again prove destabilising. Fiscal consolidation, particularly through improved tax collection, remains vital. The government’s goal of raising tax revenue to 15% of GDP by 2026 (from 9.1% in 2023) will be crucial to maintaining debt sustainability, according to the Finance Ministry’s 2025 Budget Statement.

To this end, the energy sector encapsulates both the progress and fragility of the recovery. The Ministry of Power and Energy in Sri Lanka reported that total electricity generation reached approximately 17,364 GWh in 2024, with renewables - primarily hydro and solar - accounting for nearly 48%. The Ceylon Electricity Board’s (CEB) Long-Term Generation Expansion Plan (2024–2043) outlines a shift towards renewables, with 70% of generation expected to come from non-fossil sources by 2030.

Yet the grid’s weaknesses were exposed again in early 2025 when a nationwide blackout plunged the island into darkness for nearly 48 hours, Reuters reported at the time. The outage underscored the urgent need to modernise transmission systems and improve grid resilience. The government has since pledged a $200mn grid modernisation plan, partly financed by the Asian Development Bank, but implementation has lagged.

Another issue is that for ordinary Sri Lankans, the recovery’s texture remains uneven. Inflation, which had soared above 70% in 2022, has now stabilised at around 4–5%, according to CBSL’s September 2025 inflation report. Food and fuel prices have moderated, and the Central Bank has cautiously reduced policy rates from 11% to 9% to spur consumption. Yet fiscal consolidation has come with painful trade-offs. Increases in VAT (to 18%) and cuts to fuel and electricity subsidies have disproportionately affected lower-income households. The World Bank estimates that national poverty, while improving, remains above the 25% mark, underscoring the recovery’s social fragility.

The government of President Anura Kumara Dissanayake faces a delicate balancing act: maintaining fiscal discipline without igniting social unrest ahead of elections expected in 2026. Investor confidence has strengthened with Fitch Ratings signalling potential upgrades if reform momentum continues, but the risk of populist policy reversals looms large.

So where does Sri Lanka go from here? The optimistic path is clear: maintain IMF-backed fiscal discipline, broaden the tax base, accelerate investment in renewable energy and digital infrastructure, and strengthen social safety nets to ensure inclusive growth. But the darker scenario of reform fatigue, renewed external shocks, or pre-election spending unravelling much of what has been rebuilt, is an ever present danger.

(Mark Buckton - Intellinews)

Cover photo - KlikX Photography

Locally assembled new motorcycles donated to President’s office

Brand new SENARO GN 125 motorcycles were donated to the President’s Office this morning (15). The assembly of these bikes followed the Standard Operating Procedure (SOP) that was introduced by the Ministry of Industry for manufacturing, assembling, and producing vehicle components in Sri Lanka.

President Ranil Wickremesinghe was officially given the keys and accompanying documents by Senaro Motor Corporation Managing Director Mr. Roshana Waduge.

The newly built assembly factory in the Yakkala area has been producing the SENARO GN 125 motorcycle with 35% value addition through locally produced spare parts, thanks to Senaro Motor Company Pvt. Ltd. The company has invested Rs. 1.5 billion in this venture, with the full financial support of the Bank of Ceylon. The goal is to increase the value addition to 50% in the near future and create more than 160 direct job opportunities.

Introduced to the Sri Lankan market, the SENARO GN 125 motorcycle is now a force in reviving the local economy and adding new energy to local enterprise.

Chairman of the Bank of Ceylon, Ronald C. Perera (PC), General Manager Russell Fonseka, Deputy General Manager Rohana Kumara, Director, Senaro Motor Company Mohan Somachandra and other officials were present on this occasion.

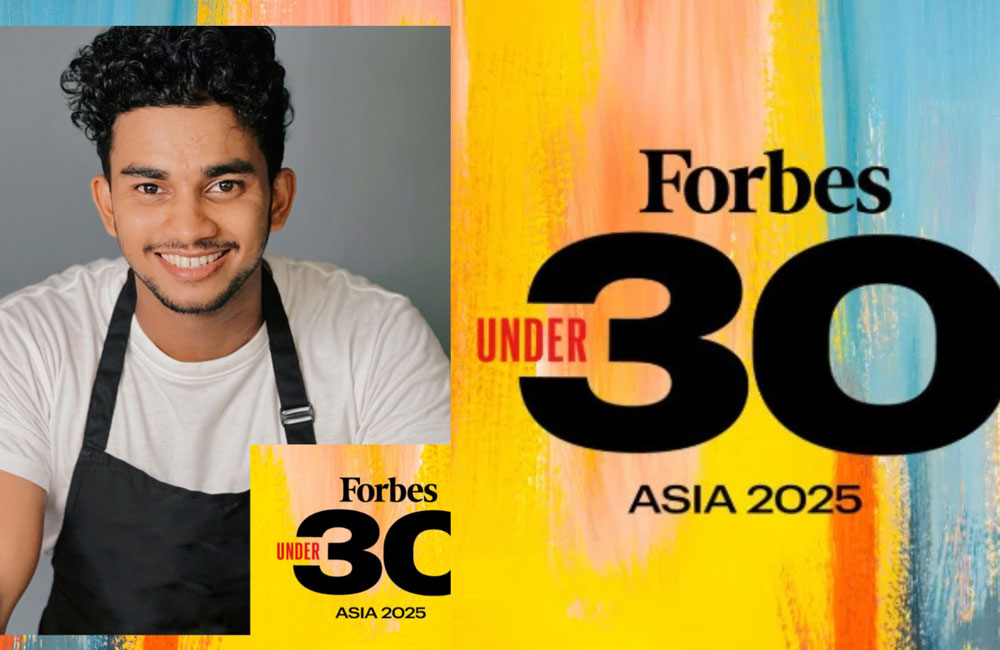

Charith Silva of 'Wild Cookbook' fame named to Forbes 30 Under 30

Charith Silva, the visionary behind Sri Lanka’s most-watched YouTube channel Wild Cookbook, has earned a coveted spot on the Forbes 30 Under 30 Asia list under the Art category, a milestone achievement that places Sri Lankan digital creativity on the global map.

Silva, whose rustic outdoor cooking videos have captivated millions, launched Wild Cookbook in 2020, during the height of the COVID-19 pandemic.

What began as a modest project born out of passion and necessity has since become a cultural and digital sensation, with over 10 million YouTube subscribers and 2.3 million Instagram followers.

Recognized by Forbes for his artistic storytelling and innovative approach to content creation, Silva joins a select group of young trailblazers across Asia celebrated for pushing boundaries and shaping the future of the arts.

His videos often blend traditional Sri Lankan recipes with contemporary twists, offering global audiences a window into the island’s rich culinary heritage.

To date, Silva has produced more than 600 videos, each one combining authenticity, creativity, and a deep reverence for nature.

“This recognition is not just about me. It’s about Sri Lankan food, culture, and the power of staying true to your roots,” Silva said in a recent post following the announcement.

In November 2024, Silva took his vision offline, opening Wildish, a rustic-themed restaurant in Colombo designed to bring the spirit of his wild cooking experience into the heart of the city.

The eatery has since become a hotspot for food lovers seeking a taste of his unique style in a curated, immersive setting.

Silva's rise reflects a broader shift in how Sri Lankan creators are engaging global audiences with local stories.

His journey is a testament to how digital platforms, when used with originality and purpose, can elevate national identity and creativity onto the world stage.

USD selling rate increases to Rs.365/-

The selling price of the US dollar which was at Rs. 380 in commercial banks yesterday (12) morning has come down to Rs. 365 today (13).

With the appointment of Ranil Wickremesinghe as the new Prime Minister, the optimistic situation regarding political and economic stability seems to have contributed to the strengthening of the rupee.

Wild Cookbook : First Sri Lankan YouTuber to hit 10M subs

Charith N. Silva, the creator behind the popular YouTube channel Wild Cookbook, has become the first Sri Lankan content creator to surpass 10 million subscribers on the platform.

Since launching his channel in 2020, Charith has uploaded over 600 videos, amassing more than 4 billion views. His unique outdoor cooking style and authentic Sri Lankan recipes have drawn a global audience, setting a new benchmark in the local digital content space.

This milestone marks a significant achievement in Sri Lanka’s YouTube history.

Stock market temporarily closed next week

The Securities and Exchange Commission of Sri Lanka (SEC) has decided to direct the Colombo Stock Exchange (CSE) to temporarily close the stock market for a period of five business days commencing from 18th April 2022.

The Board of Directors of the Colombo Stock Exchange (CSE) by way of a communication dated 15th April 2022 has called upon the Securities and Exchange Commission of Sri Lanka (SEC) to temporarily close the stock market citing the present situation in the country. Many other stakeholders of the securities market including the Colombo Stock Brokers Association have also sought the temporary closure of the market on the same grounds.

The SEC has carefully considered the grounds that have been adduced by them and has evaluated the impact the present situation in the country could have on the stock market, in particular the ability to conduct an orderly and fair market for trading in securities.

The SEC is of the view that it would be in the best interests of investors as well as other market participants if they are afforded an opportunity to have more clarity and understanding of the economic conditions presently prevalent, in order for them to make informed investment decisions. Therefore, acting in terms of the provisions contained in Section 30 of the Securities and Exchange Commission Act No. 19 of 2021, the SEC has decided to direct the CSE to temporarily close the stock market for a period of five business days commencing from 18th April 2022.

Launch of 'Worky' - A Revolutionary Platform Transforming Sri Lanka’s Job Market

20th March 2024 –

In a significant boost to Sri Lanka’s employment landscape, especially during its challenging economic times, a groundbreaking platform named 'Worky' is set to launch on March 20, 2024. Designed to bridge the gap between job seekers, part-time workers, students, and service seekers, 'Worky' is poised to revolutionize the way people find work and hire for services in Sri Lanka.

At its core, 'Worky' is a location-based service platform that allows prospective job seekers and part-time workers, including students, to register free of charge. This innovative app enables service seekers to log in and locate the nearest available worker, facilitating immediate bookings for a wide array of services. From traditional roles like plumbers and carpenters to new-age job functions such as dog walking and pet grooming, 'Worky' caters to a diverse range of employment opportunities, directly addressing the varied needs of Sri Lankan households. In light of the current economic downturn in Sri Lanka, where individuals are striving to make ends meet, 'Worky' offers a beacon of hope. By promoting a part-time job culture, the platform not only aids in finding jobs but also significantly boosts productivity across the nation. The convenience of locating talented workers for home needs, which was once a daunting task for many Sri Lankans, is now effortlessly managed through the 'Worky' app.

What sets 'Worky' apart is its user-friendly approach - the services on the platform are offered free of charge. Job seekers and workers can directly settle fees with the employers without any intermediation costs, ensuring transparency and fairness in the employment process.

As 'Worky' gears up for its launch, it is expected to rapidly become a household name, synonymous with productivity and prosperity at all societal levels in Sri Lanka. The platform anticipates attracting over a million members to its community within the first few weeks post-launch, a testament to its necessity and potential impact.

Gone are the days of tireless searching for job opportunities or the right talent for specific tasks. With 'Worky', a new era dawns on the Sri Lankan work culture, promising prosperity and ease for both job seekers and service seekers alike. Registering on 'Worky' is seamless and free of charge, offering an unparalleled opportunity for Sri Lankans to enhance their livelihoods and meet the evolving demands of the labor market.

About 'Worky':

'Worky' is a pioneering platform designed to meet the dynamic needs of the Sri Lankan job and service market. It enables job seekers and part-time workers to connect with service seekers efficiently, fostering a culture of productivity and growth. For more information, visit www.worky.lk -

ENDS- For media inquiries, please contact: This email address is being protected from spambots. You need JavaScript enabled to view it. Join us in transforming the future of work in Sri Lanka. Discover more at www.worky.lk

Both CSE indices record losses

Closing at 8,244.55 points today (04), Colombo Stock Exchange’s All Share Price Index (ASPI) lost 226.88 basis points during the day's trading.

The S&P SL20 Index ended the day 146.11 basis points lower at 2,684.82.

The turnover for the day was Rs. 1.96 billion.

Sri Lanka’s inflation rate rises to 4.2% in December

Sri Lanka’s consumer price inflation rate rose to 4.2% year-on-year in December from 2.8% in November, the statistics department said on Monday.

The National Consumer Price Index (NCPI) captures broader retail price inflation and is released with a lag of 21 days every month.

Food prices rose 1.6% in December after falling 2.2% in November on the year, the Department of Census and Statistics said in a statement.

Prices for non-food items, however, fell 6.3% in December from 7.1% year-on-year in November.

Sri Lanka racked up record high inflation last year after its economy was pummelled by the worst financial crisis in decades, triggered by a plunge in foreign exchange reserves.

Source - Reuters

- Agencies

CSE temporarily halts regular trading

The Colombo Stock Exchange (CSE) has temporarily halted regular trading due to the S&P SL20 Index dropping over 5 percent from the previous close, as set out in the CSE Directive dated April 30, 2020.

Trading has been halted for 30 minutes while the halt will be lifted at 2.14 p.m.

Website of Sri Lanka’s control body for Organic Agriculture unveiled – nocu.lk

Sri Lanka’s control body for organic agriculture - the National Organic Control Unit (NOCU), operating under the aegis of the Sri Lanka Export Development Board (EDB), has taken a significant step towards promoting and regulating Sri Lanka's organic agriculture sector with the launch of its official website - www.nocu.lk. This website development was done through the project support to Small and Medium Enterprises in the Organic Agriculture Sector in Sri Lanka which was jointly co-financed by the EU and BMZ implemented by GIZ Sri Lanka. The inauguration ceremony was held at the EDB headquarters with the presence of dignitaries.

Honourable dignitaries included the Head of Cooperation at the EU delegation to Sri Lanka and the Maldives, Dr. Johann Hesse, and representatives from the GIZ (Deutsche Gesellschaft für Internationale Zusammenarbeit GmbH), EDB Chairman Dr. Kingsley Bernard, and Acting Director General Ms. Malani Baddegamage. Officials graced the momentous occasion.

The objectives of NOCU are manifold, including safeguarding the credibility of organic agriculture products within the domestic and international markets, the implementation of Sri Lanka Organic Regulations, as well as the promotion of organic agriculture systems. The establishment of an official website was deemed imperative to facilitate communication with stakeholders and provide essential information, thereby fostering a sustainable organic agriculture ecosystem in Sri Lanka.

The website - www.nocu.lk - will serve as the primary interface for NOCU to directly engage with stakeholders. This digital platform will enable NOCU to implement an effective communication strategy, ensuring transparent and efficient interactions with all the relevant parties and the online registration of stakeholder The launch of www.nocu.lk represents a significant milestone in Sri Lanka's organic agriculture journey, solidifying its commitment to ensure the highest standards of organic practices and fostering sustainable organic agricultural systems. With this dedicated online platform, NOCU is poised to connect with stakeholders, disseminate vital information, and fortify Sri Lanka's reputation as a trusted source of organic agricultural products in the local and international marketplace.

Budget 2022: Cigarette price to increase

Finance Minister Basil Rajapaksa, in his budget speech for the fiscal year 2022, said the tax on cigarettes is proposed to be increased with immediate effect.

Accordingly, the current retail price of a stick of a cigarette will be moved up by Rs. 5.00.

The government expects a revenue of Rs. 8 billion through this initiative, he noted.

In addition, the excise tax is proposed to be increased with immediate effect. An additional revenue of Rs. 25 billion is expected through this tax increase.

Page 3 of 22