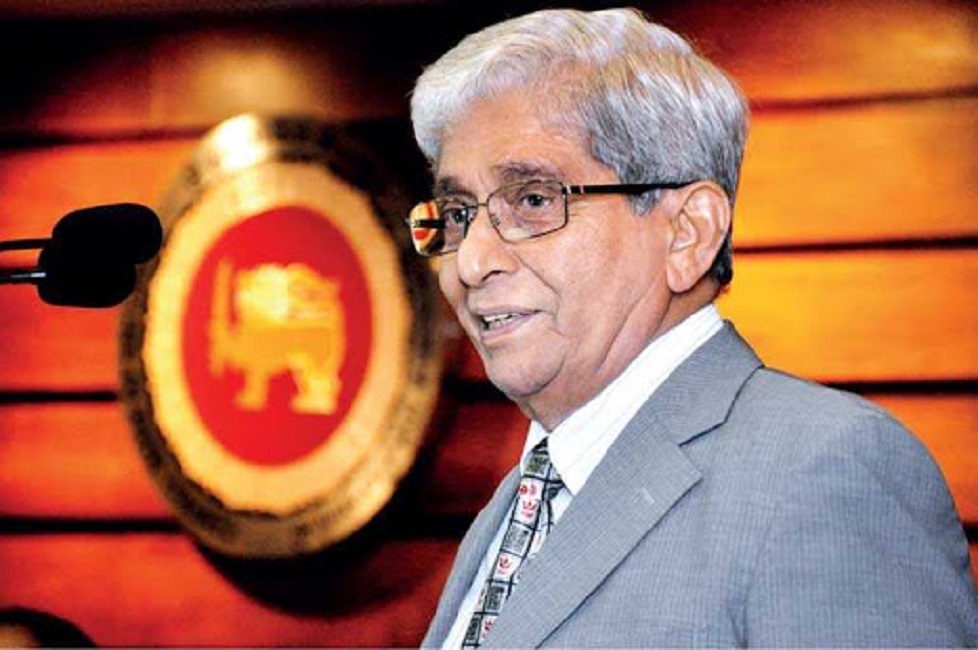

Sri Lanka’s economic growth is likely to ‘strongly rebound’ in 2021 to around 5 to 6 per cent even amidst the Covid-19 pandemic-related disruptions continuing to take a toll on the island nation’s fragile economy, Central Bank Governor Prof. W.D. Lakshman said.

Addressing the first Monetary Policy review press conference conducted online for the year 2021 on Tuesday (26), he noted that the country’s economy continues to be resilient despite ‘unfounded’ sovereign rating downgrades that the country experienced in 2020.

“The resurgence in Sri Lanka sovereign bond yields and a new boom in the stock market indices display the confidence that the global and domestic investors have placed on Sri Lankan economic prospects going forward,” he noted.

Prof. Lakshman revealed that that the Monetary Board considered the current monetary policy environment to be appropriate to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 4.50 and 5.50 per cent, respectively.

“Lending rates have declined sharply in 2020 and the Central Bank expects a further reduction in market lending rates with the high level of excess liquidity that is being maintained in the domestic money market,” he said.

Priority sector lending targets will be introduced for Micro, Small and Medium Enterprises (MSMEs) to propel the rapid economic expansion.

There was speeding up in private sector credit growth in response to the improving business environment and low interest rates, the CB Governor emphasised.

The external sector of the economy has recorded remarkable developments during the year.

Workers’ remittances have exceeded the USD 7 billion beyond expectations. In spite of meeting the government’s foreign debt service obligations of USD 4.5 billion, official reserves have been maintained at USD 5.7 billion by the end of 2020, Prof. Lakshman disclosed.

“With the COVID pandemic tourism inflows and financial inflows were severely affected during the period of 2020 and the Central Bank anticipates these inflows to recover in 2021,” he predicted.

Sri Lanka has reiterated its unwillingness to avail itself of the International Monetary Fund’s (IMFs) Rapid Credit Facility of USD 800 million introduced to help countries deal with the fallout from the COVID-19 pandemic, Prof. Lakshman emphasised.

He noted that the government’s policy was to ensure economic stability by taking sustainable foreign financing measures and increasing non debt foreign exchange inflows into the country.

This strategy is quite out of way from the interventional approach of international financial agencies, he said, pointing out that the low interest rate regime will continue with enhanced market liquidity.

Leave your comments

Login to post a comment

Post comment as a guest