Singer (Sri Lanka) PLC, one of the country’s most recognizable consumer brands, is facing mounting allegations of unethical overcharging and financial manipulation in its dealings with major corporate clients — a practice that insiders say has quietly inflated profits, deceived stakeholders, and evaded the tax authorities.

Evidence obtained by Lanka-e-News reveals that the company has been issuing two separate invoices for the same corporate transactions — one through its official accounting system and another “manual” version reflecting a higher amount. The difference, which in some cases exceeds a million rupees per transaction, is allegedly retained as off-book profit, with no corresponding record in the company’s tax filings or financial statements.

Industry observers warn that if these claims are substantiated, they could expose serious violations of the Companies Act, the Inland Revenue Act, and the listing rules of the Colombo Stock Exchange — as well as significant lapses in corporate governance under the watch of the parent conglomerate, Hayleys PLC.

A Case Study: The SLT Air Conditioner Transaction

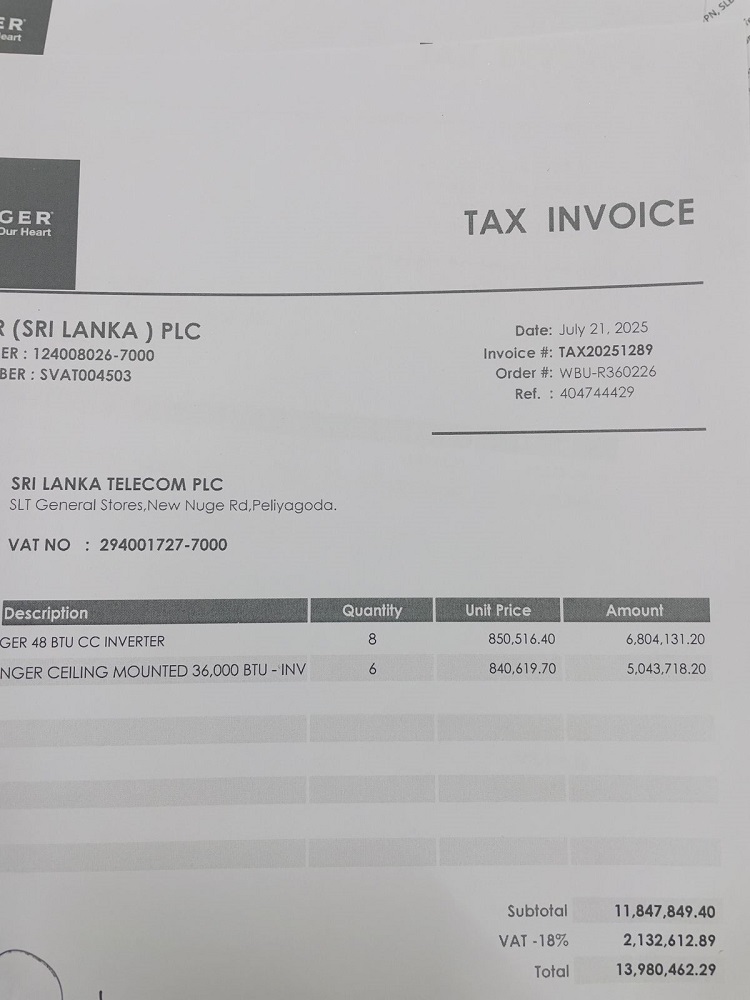

The clearest evidence of this practice appears in a transaction involving Sri Lanka Telecom (SLT), the state-owned telecommunications giant.

According to internal records reviewed by Lanka-e-News, Singer billed SLT Rs. 12,528,800 for the supply of 14 air conditioners through its official system. The corresponding invoice, issued under Singer’s registered VAT number, included statutory VAT and CESS (CCSL) contributions.

However, a separate manual invoice — bearing the same purchase order number — was issued to SLT for Rs. 13,980,400, inflating the price by over Rs. 1.45 million. This excess amount, insiders allege, was collected directly by Singer and retained without being declared to the Inland Revenue Department or accounted for in Singer’s audited financials.

An internal source familiar with the transaction said:

“Everything looks clean on paper until you match the PO number to the manual invoice. That’s when you see the hidden margin. It’s systematic, not a one-off mistake.”

If this pattern has been replicated across multiple SLT branches — as suggested by sources in both companies — the total unrecorded revenue could run into tens of millions of rupees.

The Individuals Behind the Scheme

Two senior figures have been repeatedly named by employees and former managers as being directly involved: Indika Gunatilake, a senior corporate sales executive, and Mahesh Wijewardene, the company’s Chief Executive Officer.

Both individuals are said to have played key roles in introducing and maintaining the dual-invoice system, ostensibly to “accelerate” sales growth and meet aggressive quarterly performance targets set by Hayleys Group management.

An internal whistleblower told Lanka-e-News:

“After Hayleys took over Singer, there was tremendous pressure to show double-digit growth every quarter. When real sales couldn’t keep up, the easiest way was to adjust the numbers — not in the system, but outside it.”

When similar allegations surfaced last month on Lanka-e-News, Wijewardene and Gunatilake reportedly met with Mr. Mohan Pandithage, Chairman and Chief Executive of Hayleys, and dismissed the claims as baseless — even mocking the publication for getting Wijewardene’s alma mater wrong. Yet, Lanka-e-News can now confirm that credible information has since come from within Singer’s own senior management, as well as from individuals close to Hayleys’ internal audit division.

Mr. Mohan Pandithage

Mr. Mohan Pandithage

A Pattern, Not an Anomaly

Documents seen by Lanka-e-News suggest that this SLT incident is not an isolated case. The practice of issuing manual invoices — often printed on plain letterhead without official numbering — appears to have been used in multiple corporate sales, particularly those involving public sector institutions and large private clients.

One former finance officer described the process:

“A corporate order comes in, and the official invoice is entered at a lower value to match system thresholds and tax compliance. But a second invoice is raised manually with an inflated value — that’s what the client actually pays. The extra goes to a ‘special adjustment account’ controlled by a few senior managers.”

While Lanka-e-News could not independently verify the full scope of the alleged “special account,” internal sources estimate that this scheme may have inflated Singer’s reported corporate revenue by up to 8–10% annually — a figure significant enough to mislead auditors and investors.

The Role of Hayleys Group

Singer (Sri Lanka) PLC was acquired by Hayleys PLC, one of Sri Lanka’s largest conglomerates, in 2017. Hayleys’ takeover was meant to modernize Singer’s operations and integrate its retail network with the group’s broader manufacturing and logistics interests. However, insiders now claim that post-acquisition financial pressure and unrealistic performance expectations have led to questionable practices being normalized within Singer’s corporate sales division.

A former mid-level executive told Lanka-e-News

“Hayleys wanted Singer to look like a miracle acquisition — a turnaround story. But the numbers just didn’t match the reality. The double-invoicing system became a tool to close that gap.”

If proven, such manipulation could expose Hayleys itself to regulatory risk under the Colombo Stock Exchange’s corporate governance rules and Sri Lanka’s Financial Reporting Standards (SLFRS).

Tax and Regulatory Implications

Experts say the alleged practice could amount to tax evasion, financial misrepresentation, and breach of fiduciary duty by senior officers.

Under Section 208 of the Companies Act No. 07 of 2007, directors and officers are legally obliged to ensure that financial statements give a “true and fair view” of the company’s position. Meanwhile, the Inland Revenue Act mandates strict VAT compliance and full disclosure of all taxable revenue. Any deliberate concealment of income constitutes a criminal offence punishable by fines and imprisonment.

A senior tax consultant, speaking on condition of anonymity, said:

“If Singer is inflating invoices and pocketing the difference without declaring VAT, that’s a serious offence. It’s not merely a civil issue — it’s criminal. The authorities can freeze accounts, issue penalties, and even prosecute responsible officers.”

The consultant added that manual invoicing to circumvent VAT reporting was a “common but dangerous” loophole exploited by some Sri Lankan corporates:

“They think the paper trail is invisible. But every manual invoice eventually meets an auditor’s desk.”

Impact on Shareholders and Market Integrity

As a publicly listed company, Singer’s financial transparency is not merely an internal matter. Thousands of shareholders, including institutional investors, rely on the company’s audited statements to make informed decisions. Artificially inflating turnover through unrecorded profits would constitute a serious misrepresentation of financial performance, potentially affecting share prices and investor confidence.

A senior official from the Securities and Exchange Commission of Sri Lanka (SEC) told Lanka-e-News:

“Any evidence of financial manipulation, especially by a listed entity, would warrant immediate inquiry. Misleading disclosures undermine the credibility of our entire market.”

Singer’s last annual report, released in 2024, highlighted “strong performance in corporate sales” as a key driver of profitability — a claim that now appears questionable in light of the allegations.

The Silence from Singer

When Lanka-e-News sought comment from Singer (Sri Lanka) PLC regarding the allegations, the company’s communications department declined to respond to specific queries, stating only that “Singer operates under the highest standards of corporate governance and ethical conduct.” Repeated attempts to reach Mr. Mahesh Wijewardene and Mr. Indika Gunatilake were unsuccessful. A spokesperson for Hayleys PLC said the company was “unaware of any irregularities” but would “take appropriate action if credible evidence is presented.”

However, employees within Singer claim internal auditors have already flagged “unusual variances” in several recent transactions. One insider noted:

There’s a quiet panic in the finance department. They know the numbers don’t add up. It’s just a matter of time before the auditors connect the dots.”

A Systemic Problem in Corporate Sri Lanka

Analysts argue that the Singer case underscores a broader malaise in Sri Lanka’s corporate culture, where companies often prioritize short-term optics over long-term ethics.

A business ethics lecturer at the University of Colombo, commented:

“Corporate Sri Lanka has a transparency problem. When profits become the only metric of success, creative accounting becomes the norm. The Singer case — if proven — is a symptom of that disease.”

She added that Sri Lanka’s regulatory bodies often act reactively rather than proactively:

“By the time authorities intervene, the evidence is diluted or destroyed. What we need is stronger forensic auditing and whistleblower protection.”

A Call for Accountability

Singer’s reputation as a household brand has been built over decades — synonymous with trust, reliability, and service. But behind that glossy public image, insiders describe a corporate structure increasingly driven by profit manipulation and internal cover-ups.

One long-serving employee, now nearing retirement, reflected:

“This isn’t the Singer I joined twenty years ago. We were proud to serve customers honestly. Now it’s about numbers and optics. Ethics went out the window.”

Regulators, investors, and the public will now be watching closely to see whether Hayleys PLC and Singer’s board act decisively to investigate these claims — or whether they choose the path of denial until external pressure forces their hand.

Until then, a question lingers in Colombo’s business circles: How many other invoices lie hidden — and how many more Sri Lankan consumers are unknowingly paying for a culture of deception?

If Singer continues to engage in these unethical billing practices, insiders warn, a full list of corporate clients subjected to overcharging through manual invoicing could soon emerge — triggering what could become one of Sri Lanka’s most significant corporate scandals since the Ceylon Petroleum fraud of the early 2000s.

By LeN Investigations Correspondent

Leave your comments

Login to post a comment

Post comment as a guest