Business

Microsoft aligns with John Keells IT to bring SAP to life

Microsoft has entered into a strategic partnership with John Keells IT in an effort to accelerate digital transformation strategies across both Asia Pacific and Middle East and North Africa (MENA) regions.

The Sri Lanka-based provider and Microsoft have been partnering since 2012, with the IT consultancy the site of the vendor's first-ever Office 365 deployment in-country.

As part of this partnership, the tech giant will host SAP S/4HANA on Microsoft Azure, representing John Keells' first-ever deployment on the platform and one of the first in the Asia Pacific region to deploy SAP S/4HANA on Azure.

"SAP HANA on Azure will give John Keells IT a joint ecosystem that brings unique insights and rich product integration to help their customers make the most out of running SAP solutions and applications in the cloud — accelerating their performance, productivity, and innovation with seamless enterprise-class support,” said Hasitha Abeywardena, country manager for Microsoft Sri Lanka and Maldives.

"John Keels IT has been at the forefront of digital transformation and innovation and we are happy to have them as our partner and see them driving this transformation across Sri Lanka and beyond."

This is part of the consultancy’s efforts to realise its bi-modal IT strategy as part the push towards digital transformation.

"Building innovative and transformative solutions based on a bi-modal strategy and design thinking philosophy requires collaboration, co-innovation and co-creation,” added Ramesh Shanmuganathan, executive vice president and group CIO John Keells Group and CEO, John Keells IT.

Kishu Gomes resigns as CEO of Chevron Lubricants Lanka

Chevron Lubricant Lanka's long standing CEO and Managing Director, Kishu Gomes has stepped down from his post with immediate effect, the firm said yesterday (22).

Gomes has been replaced by Rochana Kaul as the acting CEO of the company. Kaul is the General Manager of Chevron Lubricants for Indonesia, Malaysia, Pakistan, Philippines, Singapore, Sri Lanka, Thailand and Vietnam.

Uswatte opens state-of-the-art biscuit factory in Millaniya

Uswatte Confectionery Works, Sri Lanka’s oldest confectionery manufacturer with a history of 63 years, opened their latest factory in their premises at Millaniya. The state-of-the-art factory will focus exclusively on the manufacturing of biscuits and signifies the entry of Uswatte into Sri Lanka’s biscuit market. The factory was be declared open by Honourable Prime Minister Ranil Wickremesinghe including other distinguished Ministers and Deputy Ministers.

In order to provide high-quality biscuits, the company has imported the best machinery available for the manufacture of biscuits and utilises both local and foreign expertise. The factory consists of the latest laminator available for the production of biscuits.

Chairman, S. Quintus Perera - Chairman/Managing Director of Uswatte Confectionery Works stated, “From the very beginning, our priority was to give high-quality and hygienic products at a reasonable price to the consumer. Our innovative products have become iconic family treats loved by all age groups for generations. This new factory will help us to enter the biscuit market and we are confident our premium quality biscuits will soon become a hit with our consumers. We will continue to innovate and will introduce novel, exciting products for our trusted consumers to enjoy.”

Uswatte has a well-established sales and distribution network covering all parts of the island. The entire product range is available in over 80,000 sales outlets including both general trade and modern trade. The company also exports to Canada, Australia, UK, India, Italy, France, Seychelles and the Maldives.

Source : Ada Derana Business

DIMO Chairman Pandithage receives Germany’s Highest Tribute

Ranjith Pandithage (Chairman and Managing Director of Diesel & Motor Engineering PLC) was recently bestowed with the Order of Merit of the Federal Republic of Germany, one of the most prestigious recognition an individual can receive from the German Government at a ceremony held at the German Embassy in Colombo.

The Order of Merit of the Federal Republic of Germany was instituted in 1951 by Federal President Theodor Heuss. It is the only honour that may be awarded in all fields of endeavour and is the highest tribute the Federal Republic of Germany can pay to individuals for services to the nation.

The awarding of the Order of Merit was done by His Excellency Jörn Rohde. The Ambassador went on to mention why and how Mr Pandithage was chosen for this honour. Pandithage spoke at the event where he traced his roots and his connections to Germany – as an engineering student and as a businessman.

DIMO has been representing the best of engineered German brands in Sri Lanka since 1939. DIMO represents more than 25 world class German brands including Blaupunkt, Bomag, Bosch, Claas, Demag, Detroit Diesel, Drager, Dremel, Fischer, Kaeser, KSB, Mercedes-Benz, Meditron, MTU, Osram, RZB, Schafer, SchwingStetter, Siemens, Still, thyssenkrupp, Vossloh-Schwabe and Zeiss.

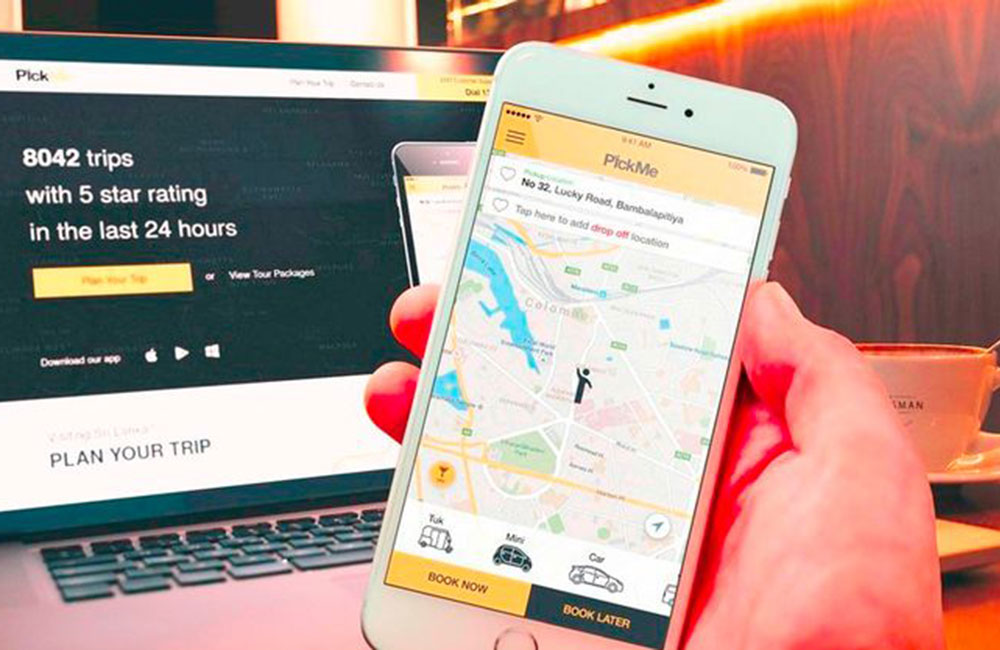

IFC invests USD 2.5m in PickMe

International Finance Corporation (IFC), a member of the World Bank Group, on Tuesday announced a $2.5-million equity investment in Sri Lankan ride-hailing app PickMe, marking its foray into the country’s venture capital space.

The investment will help the company expand across the island and increase access to affordable, safe, and efficient transportation, it said in a statement. IFC had first disclosed its intent to invest in PickMe, operated by Digital Mobility Solutions Lanka, in April this year.

PickMe, which launched operations in 2015, was founded by serial entrepreneur Jiffry Zulfer. The platform helps customers call anything from an autorickshaw to a luxury car using its smartphone app. It is currently operational in four districts of the country including Colombo, Kandy, Gampaha and Kalutara, and claims to cater to the travel needs of over a million users. Sri Lanka has as many as 31 people for each registered car and 20 for each autorickshaw.

The sharing economy —especially ride-hailing — has the potential to better serve women, IFC said. “We at PickMe have a strong expansion program in place as we enter new cities and diversify our operations to reach more customers, and serve them better,” said PickMe CEO Zulfer. “We are excited to be able to draw from the best practices and global knowledge that IFC brings.” Sri Lanka’s venture ecosystem is growing, but funding options are still limited. A mere 5 per cent of the startups that get seed funding manage to raise Series A rounds.

IFC’s entry into this space is expected to attract more capital, domestic and international, for the country’s technology startups, the statement said. “Sri Lanka possesses many of the building blocks for a thriving digital startup ecosystem, but has been held back by a lack of global expertise and funding,” said Amena Arif, IFC Country Manager for Sri Lanka and Maldives.

“Through this partnership, we want to help make travel safer, increase revenues for the company’s driver partners, and support the growth of Sri Lanka’s startup ecosystem.”

IFC invests $27m in Sri Lanka’s Melwa Hotels and Resorts

IFC, a member of the World Bank Group, on Wednesday announced an investment of $27 million in Sri Lanka’s Melwa Hotels and Resorts Private Limited. The financing will help Melwa Hotels, a subsidiary of Melwire Rolling Private Limited, develop three new hotels outside of Colombo, in Yala, Kosgoda, and Negombo.

The hotels will be operated by Hilton Hotels. Melwa Hotels and Hilton had last year signed an agreement for the development of six Hilton-branded – three Hilton and three Doubletree by Hilton — properties in Sri Lanka. The entire project is estimated to cost over $100 million.

The investment from IFC will improve tourism in Sri Lanka, create jobs, and generate more foreign exchange, the development institution said in a statement.

“In addition to the funding, Melwa will also benefit from IFC’s expertise and advice as we diversify into tourism,” said Melwa managing director PP Muruganandhan. “The access to global experts and sectoral knowledge and best practices will be key to ensure that we build hotels that are profitable, sustainable and contribute to the local economies where they are located.”

The project is in line with the Sri Lankan government’s goal to grow the tourism industry while minimizing potential negative environmental and social impacts, IFC noted in its statement.

“Investments in tourism lead to job creation, generation of revenues and foreign exchange and strengthens local suppliers,” said Amena Arif, IFC Country Manager for Sri Lanka and Maldives. “IFC will also provide advice to Melwa Hotels on how to manage environmental and biodiversity matters to minimize their environmental footprint.”

Sri Lanka is a priority country for IFC. Its committed portfolio in the country covers projects across a range of sectors, including infrastructure, tourism, renewable energy, finance, and healthcare.

Dialog brings ALTBalaji VOD to Sri Lanka

Dialog Axiata PLC, one of Sri Lanka’s leading connectivity providers, has announced its partnership with ALTBalaji in order to provide Viu app users with original Indian video content for the first time in Sri Lanka at subsidised rates.

Dialog is offering its ViU subscribers a one-month free access to ALTBalaji, with a Rs. 160 monthly charge after the trial period.

Available in 90 countries with a claimed global paid subscriber base of over 2.5 million, ALTBalaji is rapidly growing towards four million subscribers.

With a growing library of original shows and a robust distribution strategy, ALTBalaji aims to reach out to the audience worldwide. This strategic partnership with Dialog through the ViU app will result in the introduction of original Indian content to over a million Sri Lankan users, diversifying its already varied portfolio of offerings

Hutch Lanka to merge with Etisalat

Hong Kong conglomerate CK Hutchison Group has announced plans to merge its Sri Lankan mobile unit Hutch Lanka with UAE-based Etisalat’s mobile business in the nation Etisalat Lanka.

The combined company will be majority owned and controlled by CK Hutchison, the company said in a statement.

The merger is aimed at better positioning the companies to serve their Sri Lankan customers, and is part of Etisalat’s ongoing portfolio optimization strategy.

The deal still requires competition and regulatory approvals in Sri Lanka as well as other closing conditions.

If approved, the merger would reduce the number of mobile operators in Sri Lanka from five to four and put the combined company in a better position to compete with incumbents Dialog Axiata and Mobitel.

According to GSMA Intelligence, Etisalat Lanka has a roughly 13% share of the local market, while Hutch Lanka has around 10%. This compares to 45% for market leader Dialog Aixiata and 24% for Mobitel. The remaining 8% is controlled by Bharti Airtel Lanka.

Mobitel to partner with Sri Lanka Red Cross as communication partner

Sri Lanka mobile operator Mobitel has signed a MoU with the Sri Lanka Red Cross Society (SLRCS).

Under the terms of the deal, Mobitel will serve as communication partner for the SLRCS. Mobitel will provide the SLRCS with a mobile donation platform (subscription based/on demand) and assist SLRCS Disaster Response Teams to serve disaster-affected areas.

It will implement special communication programs and services in SLRCS housing and community building projects and extend latest technology assistance for SLRCS Disaster Management Operation rooms and command centers.

PFC delegation to visit Sri Lanka to promote furniture sector

A high level delegation representing the Pakistan Furniture Council (PFC) will visit Sri Lanka this week to explore new avenues for cooperation in infrastructure development, policy and institution development, superior technological capabilities, modernizing work force in knowledge ,skills and attitudes, and marketing and investment opportunities in the furniture sector, PFC Chief Executive Mian Kashif Ashfaq said.

Kashif said that the furniture trade with Sri Lanka is at its lowest level and there is a dire need to explore furniture markets in this part of the region.

He also said that Sri Lanka can provide huge opportunities to Pakistani exporters to market their products including handmade furniture in European markets in collaboration with Lankan companies.

MasterCard introduces its QR payment service in Sri Lanka

MasterCard has introduced its merchant presented QR payment solution in Sri Lanka to facilitate safe and secure QR-based mobile transactions for its customers.

Using the platform, users can pay for the purchases by scanning the QR code provided by the merchant.

The service is compatible with any mobile application that supports a standardised QR code.The company said that its solution can be integrated into mobile payment solutions by financial service providers and can also be used with its existing cards.

Mastercard country manager for Sri Lanka and Maldives, RB Santosh Kumar said: “Mastercard is excited to bring Mastercard QR to Sri Lanka, one of its key focus markets in South Asia.

“Continuing to support the country’s ongoing efforts to encourage adoption of cashless payments, Mastercard seeks to simplify access to digital payments for businesses and consumers through this fast, secure, convenient and cost-effective solution.”

Kumar went on to note that the company is working with local customers and partners to integrate the solution into their existing systems.

“We look forward to seeing many more merchants and consumers availing the convenience and security of digital payments through solutions such as Mastercard QR”, the country manager added.

SriLankan Airlines records highest ever revenue

SriLankan Airlines has achieved a record un-audited annual passenger revenue of Rs. 126.9 billion (US Dollars 830.7 million) for its recently ended financial year of 2017/18 – the highest ever in the Company’s 38-year history. The revenue comes on the back of the recent expansion of the airline to include services to several new destinations such as Gan Islands, Hyderabad and Melbourne and additional frequencies to popular cities in its network.

The airline’s cargo division recorded a spectacular performance – achieving a revenue of Rs. 14.7 billion on its own. Both passenger and cargo divisions exceeded their annual target, enabling the SriLankan Airlines Group – bolstered by an even stronger performance at its best performing business unit SriLankan Ground Services – to comfortably exceed the overall annual revenue target.

The overall Group turnover exceeded one Billion US Dollars, making SriLankan one of the handful of companies in Sri Lanka to reach this milestone. It also becomes the highest revenue generating company amongst all Sri Lankan businesses which publicly report their financials.

The year has been one of transformation for SriLankan, in which it inducted four brand new fuel efficient narrow-bodied aircraft to the fleet – in the process becoming the first A321neo aircraft operator in Asia. It has also made significant improvements to on-board service, including offering flat-bed Business Class seats on all wide-bodied aircraft and Wi-Fi services on nearly half of its fleet.

The airline is currently at the verge of implementing the second phase of its restructuring plan, which would see the airline become a profitable and self-sufficient entity within a short period. The restructuring initiatives would see the airline further fine tune its route network and implement a range of cost optimisation initiatives. It intends to report its audited financial results for FY2017/18, which are required to undergo the review of Auditor General of Sri Lanka, before the end of September 2018.

Page 24 of 29