AMG Critical Materials N.V. (AMG) has announced the sale of its subsidiary, Graphit Kropfmühl GmbH (GK), to Asbury Carbons Inc., a portfolio company of Mill Rock Capital, marking AMG’s complete exit from the natural graphite business. The deal, valued at $65 million, positions Asbury Carbons to expand its global graphite operations, including in Sri Lanka.

GK’s Global Operations and Sri Lankan Link

GK operates a graphite mine in Kropfmühl, Germany, and holds a majority stake in Bogala Graphite Lanka PLC, which manages one of Sri Lanka’s oldest graphite mines. The acquisition includes all GK operations and approximately 350 employees worldwide. For the 12 months ending August 2025, GK recorded $65 million in revenue, reflecting stable performance despite challenges in the natural graphite market.

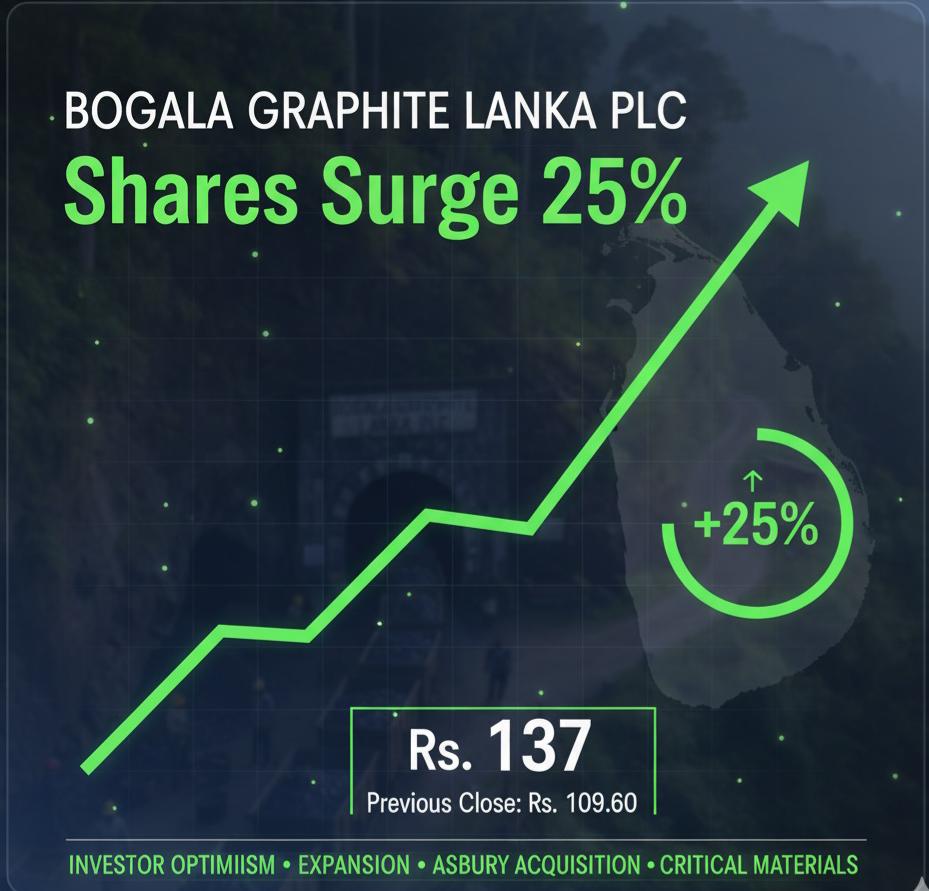

Following the announcement, Bogala Graphite Lanka PLC shares surged 25%, closing at Rs. 137, driven by investor optimism about Asbury’s potential to boost Sri Lanka’s graphite production and market reach.

Commenting on the divestment, AMG CEO and Management Board Chairman Dr. Heinz Schimmelbusch said the sale underlines AMG’s focus on strategic portfolio management. “While natural graphite remains an attractive industry, GK did not achieve the scale required to compete as a major supplier to the battery anode market. Under Asbury Carbons, GK will have better prospects for growth,” he stated.

Schimmelbusch added that the proceeds would be used to strengthen AMG’s balance sheet and invest in its core growth areas, particularly critical materials essential for clean energy technologies.

Full Ownership Before Sale

This sale follows AMG’s March 2025 repurchase of the remaining 40% of GK shares from Alterna Capital Partners, finalizing full ownership before the divestment. Under the agreement, AMG can settle the purchase in cash within three years or opt for AMG shares at its discretion.

Asbury’s Expansion Strategy

Asbury Carbons, headquartered in Asbury, New Jersey, is a global leader in carbon-based materials with over 300 employees across 10 facilities in North America and Europe. The company supplies graphite and carbon solutions to industrial clients in steel, automotive, energy, and technology sectors.

Gregg Jones, CEO and Chairman of Asbury Carbons, described the acquisition as a strategic milestone: “Bringing together Asbury and GK combines over 250 years of collective expertise. This move enhances our global supply chain resilience and allows us to deliver advanced carbon technologies to our clients.”

The transaction, pending customary regulatory approvals, is expected to close by the end of 2025. Analysts note that the sale underscores shifting dynamics in the graphite industry, as demand for battery-grade materials intensifies amid global energy transitions.With Asbury’s entry into the Sri Lankan graphite sector through GK’s majority stake in Bogala Graphite, industry observers anticipate renewed foreign investment interest and potential expansion in Sri Lanka’s high-purity graphite exports a critical component in electric vehicle and battery manufacturing.