News

Scammed in Seconds: Police Warn of a Dangerous Digital Trend

What begins as a simple message often appears harmless - even promising.

“Work from home. Earn in dollars.”

“Guaranteed job in Europe.”

“Fast-track university admission.”

For many Sri Lankans browsing WhatsApp or Telegram late at night, such messages seem like a rare opportunity. However, police warn these offers are frequently the first step in sophisticated financial scams designed to exploit trust and desperation.

Scams Built on Emotional Manipulation

According to the Police Media Division, online financial fraud has surged, driven largely by social media platforms and encrypted messaging services. Unlike traditional cybercrime, these scams rely less on advanced technology and more on psychological tactics.

Scammers often pretend to be recruitment agents, education consultants, or financial facilitators, advertising overseas jobs, online income schemes, or study opportunities — commonly linked to Europe. Victims are gradually persuaded to provide details to “confirm” their identity, “activate” accounts, or pay supposed processing fees.

This is where the fraud escalates.

How Victims Are Exploited

Under deceptive claims, scammers obtain sensitive information, including bank details, login credentials, one-time passwords (OTPs), and QR codes connected to digital wallets. In some cases, victims are convinced to transfer funds through their own bank accounts, unknowingly assisting in money laundering.

By the time victims realise something is wrong, their accounts have been drained, personal data compromised, and all contact with the scammers cut off.

Focus on Northern and Eastern Provinces

Police investigations show a growing number of large-scale scam cases originating in the Northern and Eastern Provinces. Authorities believe this trend is linked to high youth unemployment, strong interest in foreign employment, and widespread smartphone usage combined with limited access to verified migration guidance.

Fraudsters commonly apply pressure by claiming offers are time-limited, presenting forged documents, using fake institutional logos, or impersonating officials — all designed to appear credible and urgent.

The Trap of ‘Easy’ Online Income

Another popular scam involves online earning schemes. Victims are added to messaging groups where participants share screenshots of supposed profits. Small payments may be made initially to gain trust. Soon after, victims are asked to invest more money, scan QR codes, or install apps.

Once this happens, scammers gain control. Malicious apps steal data, QR codes redirect funds, and browser extensions capture passwords, turning a promised side income into continuous financial loss.

Police Advice to the Public

The Police Media Division emphasises that genuine employment and education opportunities do not operate in secrecy or through random messages.

Foreign employment and overseas study should only be pursued via registered and government-approved institutions, including the Sri Lanka Bureau of Foreign Employment (SLBFE) and recognised education authorities.

Police urge the public to follow these key precautions:

-

Avoid income offers from unknown individuals or unverified social media groups.

-

Never scan QR codes or download apps and extensions shared by strangers.

-

Do not transfer money to unfamiliar accounts or allow others to use your bank account.

-

Never share banking details, passwords, or OTPs with anyone.

-

Be cautious when installing mobile apps and granting device permissions without verification.

Awareness as the First Line of Defence

Police stress that modern online scams are organised, adaptable, and often cross-border operations. Their success depends not on hacking systems, but on exploiting human trust.

Authorities say prevention starts with awareness — pausing before clicking, questioning before sharing, and verifying before believing.

In today’s digital environment, caution is not fear; it is protection.

And as police remind the public: if an online offer sounds too quick, too simple, or too good to be true, it almost certainly is.

(Source: lankanews.lk)

Rupee Weakens Further Against US Dollar in Early Week Trading

The Sri Lankan Rupee recorded a further decline against the US Dollar today (January 19), continuing its downward movement from last Friday.

Central Bank data show that the dollar’s buying rate has risen to Rs. 305.95 from Rs. 305.67, while the selling rate increased from Rs. 313.20 to Rs. 313.49. The latest figures reflect a modest but steady depreciation of the local currency.In addition to the US Dollar, the rupee also posted minor fluctuations against several other foreign currencies, including those of Gulf nations.

World leaders show caution on Trump’s broader ‘board of peace’ amid fears for U.N.

Governments reacted cautiously on Sunday to US President Donald Trump’s invitation to join his “Board of Peace” initiative aimed at resolving conflicts globally, a plan that diplomats said could harm the work of the United Nations.

Only Hungary, whose leader is a close Trump ally, gave an unequivocal acceptance in response to the invitations, which have been addressed to some 60 nations and began arriving in European capitals on Saturday, according to diplomats.

Other governments appeared reluctant to make public statements, leaving officials to express concerns anonymously about the impact on the work of the U.N.

The board would be chaired for life by Trump and would start by addressing the Gaza conflict and then be expanded to deal with other conflicts, according to a copy of the letter and draft charter seen by Reuters.

Member states would be limited to three-year terms unless they pay $1 billion each to fund the board’s activities and earn permanent membership, the letter states.

“This simply offers permanent membership to partner countries who demonstrate deep commitment to peace, security, and prosperity,” the White House said in a post on X.

Italian Prime Minister Giorgia Meloni, visiting South Korea, told reporters her country was “ready to do our part”, although it was not clear whether she was specifically referring to Gaza or the broader peace.

Canada’s Prime Minister Mark Carney said on Sunday he had agreed to Trump’s Board of Peace for Gaza in principle although details were still being worked out.

The Board of Peace’s mandate was only authorized by the United Nations Security Council through 2027 and was solely focused on the Gaza conflict.

‘DARK TIMES’

The inclusion of a ‘charter’ in the invitation letter stoked concerns among some European governments that it could undermine the work of the United Nations, which Trump has accused of not supporting his efforts to end conflicts around the world.

“It’s a ‘Trump United Nations’ that ignores the fundamentals of the U.N. charter,” said one diplomat.

Three other Western diplomats said it looked as if it would undermine the United Nations if it went ahead.

A further three diplomats and an Israeli source said that Trump wanted the Board of Peace to eventually have a broader role beyond Gaza that would oversee the other conflicts that Trump has said he has resolved.

The leaders of France, Germany, Italy, Hungary, Australia, Canada, the European Commission and key Middle East powers were among those invited to sit on the Board of Peace, according to officials.

“Declaring that durable peace requires pragmatic judgment, common-sense solutions, and the courage to depart from approaches and institutions that have too often failed,” the document showed.

In what appeared to be directed at the United Nations, the document added that there was a “need for a more nimble and effective international peace-building body”.

Trump, who covets the Nobel Peace Prize, said in the letter that the board would convene in the near future, adding: “This board will be one of a kind, there has never been anything like it!”

In public comments in response to a reporter’s question, a senior U.N. official did not address the plan directly, but said the United Nations was the only institution with the moral and legal ability to bring together every nation, big or small.

“And if we question that … we fall back and very, very, dark, times,” Annalena Baerbock, president of the United Nations General Assembly, told Sky News, adding that it was up to individual states to decide what to do.

The White House on Friday named some individuals who will sit on the board, which would outlive its role supervising the temporary governance of Gaza, under a fragile ceasefire since October.

They included U.S. Secretary of State Marco Rubio, President Donald Trump’s special envoy Steve Witkoff, former British prime minister Tony Blair and Trump’s son-in-law, Jared Kushner.

Israel and the Palestinian militant group Hamas signed off on Trump’s plan, which says a Palestinian technocratic administration will be overseen by an international board, which will supervise Gaza’s governance for a transitional period.

TRUMP GOES FOR GLOBAL PEACE ROLE

“It’s going to, in my opinion, start with Gaza and then do conflicts as they arise,” President Donald Trump told Reuters in an interview earlier this week.

Many rights experts and advocates have said that Trump overseeing a board to supervise a foreign territory’s governance resembles a colonial structure, while Blair’s involvement was criticized last year due to his role in the Iraq war and the history of British imperialism in the Middle East.

The White House did not detail the responsibilities of each member of the board. The names do not include any Palestinians. The White House said more members will be announced over the coming weeks.

It also named a separate, 11-member “Gaza Executive Board” to support the technocratic body.

This would include Turkish Foreign Minister Hakan Fidan, U.N. Middle East peace coordinator Sigrid Kaag, United Arab Emirates International Cooperation Minister Reem Al-Hashimy, Israeli-Cypriot billionaire Yakir Gabay and officials from Qatar and the United Arab Emirates.

Israeli Prime Minister Benjamin Netanyahu’s office said the composition of this board had not been coordinated with Israel and contradicted its policy – possibly a reference to Fidan’s presence, as Israel objects to Turkish involvement. Israel’s government also has a tense relationship with Qatar. An Israeli government spokesperson declined to comment beyond the statement.

(Source:pulseline.lk)

Prime Minister Harini Amarasuriya Leaves for World Economic Forum in Switzerland

Prime Minister Dr. Harini Amarasuriya left Sri Lanka early this morning (19) to attend the 56th Annual Meeting of the World Economic Forum (WEF) in Davos-Klosters, Switzerland, according to the Prime Minister’s Office.

The prestigious global forum is scheduled to take place from today until January 23, 2026. This year’s gathering will be held under the theme “A Spirit of Dialogue” and is expected to attract more than 3,000 participants from around the world.

The event will bring together heads of state and government, senior policymakers, chief executives of major multinational companies, and leading figures in technology and innovation. During her visit, the Prime Minister is also set to engage in a series of high-level bilateral discussions with international leaders and heads of global institutions.

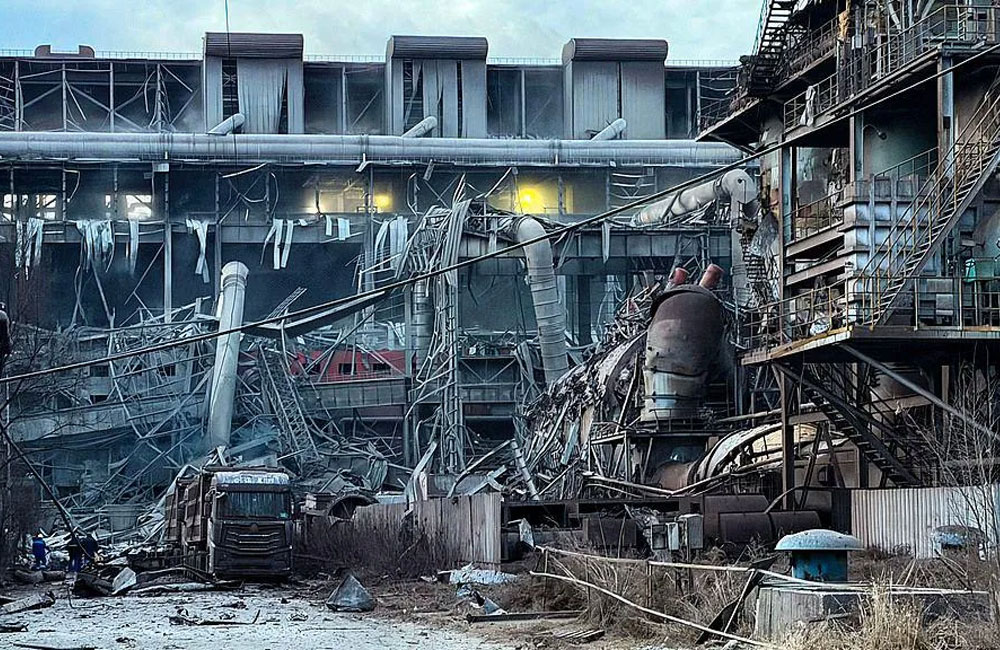

Factory explosion in China kills two, injures 84

A huge explosion at a factory in northern China has killed two people and injured 84 others, with eight people still missing, state media reported.

The blast happened at around 15:00 local time (07:00 GMT) Sunday at Baogang United Steel plant in Inner Mongolia, causing noticeable tremors in the area.

Footage online showed the explosion sending large plumes of smoke into the sky, while the ground was littered with debris, including collapsed ceilings and pipes.

Five among the dozens hospitalised suffered serious injuries, state media reported. Authorities are investigating the cause of the blast.

Baogang United Steel is a major state-owned iron and steel enterprise.

China has a long history of industrial accidents, from factory explosions and mine collapses to mudslides.

In 2015, two massive explosions in the port of Tianjin killed 173 people, leaving hundreds more injured and devastating large areas of the city.

In May last year, an explosion in a chemical plant in the eastern province of Shandong killed five people and injured at least 19. The blast ripped the windows of building nearby from their hinges.

Source: adaderana.lk

Foreign-Made Pistol and Ammunition Found at Keselwatta Apartment Complex

Police have recovered a foreign-manufactured pistol from an unused water tank at an apartment complex in the Keselwatta area, authorities said.

In addition to the firearm, officers seized 29 rounds of ammunition from the same location. The discovery was made during a search of the premises, prompting further police action.

Keselwatte Police have launched an investigation to determine who concealed the weapon and how it came to be placed inside the apartment complex.

Education Ministry Suspends Two Senior Officials Over Grade Six English Module

The Ministry of Education and Higher Education has ordered the suspension of two senior officials linked to the preparation of the disputed Grade Six English learning module, following the completion of an initial inquiry.

The decision, which comes into effect from January 19, is based on the findings of an investigative report submitted by Ranjith Ariyaratne, who was appointed to examine concerns surrounding the module. The report identified procedural shortcomings and lapses in duty by relevant officials as key factors that led to the controversy.

These findings were tabled at a special meeting of the National Education Institute’s board on January 17, where the matter was discussed in detail. Although the board is due to reconvene later this week to further examine specific aspects of the report, the ministry confirmed that the suspensions will be implemented without delay.

In addition, the ministry has initiated a separate investigation into the issue and stated that firm disciplinary measures will be taken against any officials found to be accountable.

CIABOC Questions Parliament on How MPs’ Salaries Are Paid

The Commission to Investigate Allegations of Bribery or Corruption (CIABOC) has requested information from Parliament on the procedure used to disburse salaries to Members of Parliament, seeking to determine whether payments are made through a single account or transferred directly into each MP’s personal bank account.

This move follows a complaint lodged by former MP Udaya Gammanpila, who claimed that public funds issued monthly to members of the National People’s Power were allegedly used for political activities, which he says amounts to corruption.

Gammanpila submitted the complaint on September 21 last year and has since indicated that, in line with existing legal provisions, he plans to seek an update from CIABOC regarding the progress of the investigation.

Over 1,700 Salt Containers Stranded at Colombo Port Amid Regulatory Violations

More than 1,700 containers of imported salt are currently being held at the Port of Colombo after importers failed to comply with government regulations, officials said, worsening congestion at the country’s main port and raising concerns about regulatory enforcement following last year’s salt shortage.

Sri Lanka Customs officials revealed that over 1,000 containers have remained stored at port warehouses for more than six months after the permitted import period expired. In addition, nearly 700 containers are under detention due to quality-related issues and delays in certification by the Sri Lanka Standards Institution (SLSI).

The government had permitted private sector salt imports last year to ease a domestic supply shortfall. However, a gazette notification limited imports to a deadline of June 10, 2025. Despite this, several importers continued to bring in consignments after the approval period had ended, resulting in shipments being left uncleared at port facilities.

Customs Director and Media Spokesman Chandana Punchihewa said authorities are strictly enforcing the gazette and have instructed importers to re-export consignments brought in without authorization. He noted that importers have been informed of the requirement but have yet to take the necessary action.

Officials also confirmed that at least one importing company has filed a court case in connection with the detained shipments.

Meanwhile, Sri Lanka Ports Authority Chairman Sirimevan Ranasinghe said discussions are ongoing to address the issue, as the backlog of containers has significantly contributed to port congestion.

With import, export and re-export volumes continuing to rise, Ports and Civil Aviation Minister Anura Karunathilake has directed officials to implement measures to ease congestion and reduce operational disruptions. As part of these efforts, authorities have decided to speed up clearance by transferring low-risk containers to the Bloemendhal Container Yard, operated by the Sri Lanka Ports Authority, under full supervision of the Customs Department.

Two high-speed trains derail in Spain, police sources say 21 people killed

A high-speed train derailed and smashed into another oncoming train in southern Spain on Sunday, pushing the second train off the tracks and down an embankment in a collision that police sources confirmed to Reuters had killed at least 21 people.

The cause for the crash is not yet known, Spanish Transport Minister Oscar Puente told reporters at a press conference at Atocha station in Madrid, adding it was “really strange” that a derailment should have happened on a straight stretch of track. This section of track was renewed in May, he added.

The accident happened near Adamuz, in Cordoba province, about 360km (223 miles) south of the capital Madrid. A regional health chief said 18 injured people had already been transferred to hospital, some with life-threatening wounds.

State broadcaster Television Espanola reported that the driver of one of the trains, which was travelling from Madrid to Huelva, was among those who died, and that a total of 100 people had been injured, 25 seriously.

“The Iryo 6189 Malaga - (to Madrid) train has derailed from the track at Adamuz, crashing onto the adjacent track. The (Madrid) to Huelva train which was travelling on the adjacent track has also derailed,” Adif, which runs the rail network, said in a social media post.

Adif said the accident happened at 6:40 p.m. (1740 GMT), about 10 minutes after the Iryo train left Cordoba heading towards Madrid.

Iryo is a private rail operator, majority-owned by Italian state-controlled railway group Ferrovie dello Stato. The train involved was a Freccia 1000 train which was travelling between Malaga and Madrid, a spokesperson for Ferrovie dello Stato said.

The company said in a statement that it deeply regretted what had happened and had activated all emergency protocols to work closely with the relevant authorities.

The second train, an Alvia, was operated by Renfe, which El Pais reported was travelling at around 200 km (124 miles) per hour at the moment of impact.

Renfe said the derailment of its train had been caused by the Iryo train derailing into its path, adding that emergency services were still recovering passengers.

Renfe said its president was travelling to the crash site and that it was working to support passengers and their families.

Adif has suspended all rail services between Madrid and Andalusia.

HORRIFIC SCENE

Spanish Prime Minister Pedro Sanchez cleared his diary for Monday to address the tragedy, while the Spanish King and Queen were following events with concern, a spokesperson said. Foreign embassies sent text messages to staff asking them to confirm they were safe.

Troops have also been deployed from a military base near the crash site to support rescue and recovery efforts, the Military Emergency Service confirmed.

The Iryo train had more than 300 passengers on board, while the Renfe train had around 100.

Antonio Sanz, Andalusia regional government health chief, said six people who were very seriously injured, five seriously injured and seven with other injuries were being cared for in different hospitals around the region.

He said access to the crash site was difficult, and that one train had fallen down a four-metre embankment to the side of the tracks.

“We expected a very complicated night. The number of dead could rise,” he told reporters in Cordoba.

He declined to answer questions about the possible cause of the crash, saying it was the responsibility of Adif to investigate.

Paco Carmona, Cordoba fire chief, told TVE that while the Iryo had been evacuated within hours of the accident, the Renfe train’s carriages were badly damaged, with twisted metal and seats.

“There are still people trapped. The operation is concentrating on getting people out of areas which are very narrow,” he said. “We have to remove the bodies to reach anyone who is still alive. It is proving to be a complicated task.”

Transport Minister Puente said he was following events from rail operator Adif’s headquarters in Madrid.

“The latest information is very serious,” he posted on X. “The impact was terrible, causing the first two carriages of the Renfe train to be thrown off the track. The number of victims cannot be confirmed at this time. The most important thing now is to help the victims.”

The mayor of Adamuz, Rafael Moreno, told El Pais newspaper that he had been among the first to arrive at the scene of the accident alongside the local police and saw what he believed to be a badly lacerated body several metres from the accident site.

“The scene is horrific,” he said. “I don’t think they were on the same track, but it’s not clear. Now the mayors and residents of the area are focused on helping the passengers.”

TEARFUL PASSENGERS

Images on local television showed a reception centre set up for passengers in the town of Adamuz, population 5,000, with locals coming and going with food and blankets amid nighttime temperatures of around 42 degrees Fahrenheit (6 degrees Celsius).

Tearful passengers disembarking from the bus spoke briefly to local press before being shepherded inside.

“There are many injured. I am still trembling,” Maria San José, 33, a passenger in coach 6 on the train travelling from Malaga to Madrid, told El Pais newspaper.

A passenger from the Alvia train, who was not named, told TVE: “There were people screaming, their bags fell from the shelves. I was travelling to Huelva in the fourth carriage, the last, luckily.”

Salvador Jimenez, a journalist for RTVE who was on board the Iryo train, shared images showing the nose of that train’s rear carriage of the train lying on its side, with evacuated passengers sitting on its upturned side.

Jimenez told TVE by phone from beside the stricken trains that passengers had used emergency hammers to smash the windows and climb out, and they had seen two people taken out of the overturned carriages on stretchers.

Source: adaderana.lk

National Audit Office crippled by leadership vacancy

The prolonged delay in appointing a permanent Auditor General has disrupted the issuance of audit reports and inquiries, raising concerns over transparency, oversight, and the management of public and foreign-funded projects..

The post has been unfilled for nearly ten months, marking the first extended vacancy in the country’s history.

The absence of a permanent Auditor-General has stalled many core functions of the National Audit Office, including audits of government programs and externally funded initiatives.

Auditor-General W.P.C. Wickramaratne retired on April 8 last year.

Senior Deputy Auditor-General Dharmapala Gammanpila was appointed acting Auditor-General on April 9, but his tenure ended on December 6, leaving the office without permanent leadership.

Gammanpila, a career auditor with more than three decades of experience, had been recommended for confirmation by the Constitutional Council during his acting term, but the appointment was never finalised.

Since then, representatives from audit and public service associations have petitioned president Anura Kumara Dissanayake to confirm Gammanpila.

During this period, the president submitted four alternative candidates, all of whom were rejected by the Constitutional Council.

Traditionally, the senior-most official in the National Audit Office is confirmed as Auditor-General.

( Source: lankaleader.lk)

Iranian President warns that attacks on Khamenei mean “all-out war”

Iranian President Masoud Pezeshkian warned on Sunday that any attack on Supreme Leader Ali Khamenei would be considered a declaration of “all-out war” against the Iranian nation, following a sharp exchange of rhetoric with U.S. President Donald Trump.

Pezeshkian’s comments, posted on social media platform X, come amid heightened tensions after Trump told Politico on Saturday that it was “time to look for new leadership in Iran.”

“Any attack on our great leader will be tantamount to an all-out war against the Iranian nation,” Pezeshkian wrote.

The Iranian president also blamed Washington for the country’s economic struggles, citing “longstanding hostility” and “inhumane sanctions” imposed by the United States and its allies as the primary drivers of hardship for the Iranian people.

The diplomatic spat intensified earlier on Saturday when Khamenei labeled Trump a “criminal,” holding him responsible for casualties and damages sustained during recent periods of domestic unrest in Iran.

Relations between Tehran and Washington have remained fraught since Trump’s return to the White House, characterized by a continuation of the “maximum pressure” policy and frequent verbal confrontations between the two leaderships.

(Source : adaderana.lk)

Page 37 of 686