News

Sub-Inspector Detained Over Links with Padme

A Sub-Inspector has been taken into custody on allegations of maintaining close ties with organized crime members, including Kehelbaddara Padma, the Police Media Spokesperson and Assistant Inspector General of Police, F. U. Wootler, stated.

The suspect is attached to the Gampaha Division’s Criminal Investigation Department, the spokesperson added.

Following the recent transfer of five members of the organized crime network, including Kehelbaddara Padme, from Indonesia to Sri Lanka, the Criminal Investigation Department has been conducting interrogations.

It is reported that information obtained during these interrogations led to the arrest of the Sub-Inspector in question.

Conservative activist Charlie Kirk assassinated at Utah university

OREM, Utah (AP) — Charlie Kirk, a conservative activist and close ally of President Donald Trump who played an influential role in rallying young Republican voters, was shot and killed Wednesday at a Utah college event in what the governor called a political assassination carried out from a rooftop.

“This is a dark day for our state. It’s a tragic day for our nation,” said Utah Gov. Spencer Cox. “I want to be very clear this is a political assassination.”

No suspect was in custody late Wednesday, though authorities were searching for a new person of interest, according to a law enforcement official familiar with the matter who was not authorized to discuss the situation by name and spoke on condition of anonymity. Two people were detained earlier in the day but neither was determined to have had any connection to the shooting and both have been released, Utah public safety officials said.

Authorities did not immediately identify a motive but the circumstances of the shooting drew renewed attention to an escalating threat of political violence in the United States that in the last several years has cut across the ideological spectrum. The assassination drew bipartisan condemnation, but a national reckoning over ways to prevent political grievances from manifesting as deadly violence seemed elusive.

Videos posted to social media from Utah Valley University show Kirk speaking into a handheld microphone while sitting under a white tent emblazoned with the slogans “The American Comeback” and “Prove Me Wrong.” A single shot rings out and Kirk can be seen reaching up with his right hand as a large volume of blood gushes from the left side of his neck. Stunned spectators are heard gasping and screaming before people start to run away. The Associated Press was able to confirm the videos were taken at Sorensen Center courtyard on the Utah Valley University campus.

Kirk was speaking at a debate hosted by his nonprofit political organization. Immediately before the shooting, Kirk was taking questions from an audience member about mass shootings and gun violence.

“Do you know how many transgender Americans have been mass shooters over the last 10 years?” the person asked. Kirk responded, “Too many.”

The questioner followed up: “Do you know how many mass shooters there have been in America over the last 10 years?”

“Counting or not counting gang violence?” Kirk asked.

Then a single shot rang out. The shooter, who Cox pledged would be held accountable in a state with the death penalty, wore dark clothing and fired from a building roof some distance away to the courtyard where the event took place.

Some 3,000 people were in attendance, according to a statement from the Utah Department of Public Safety, which also said the university police department had six officers working the event along with Kirk’s own security detail.

The death was announced on social media by Trump, who praised the 31-year-old Kirk, the co-founder and CEO of the youth organization Turning Point USA, as “Great, and even Legendary.” Later Wednesday, he released a recorded video from the White House in which he called Kirk a “martyr for truth and freedom” and blamed the rhetoric of the “radical left” for the killing.

Utah Valley University said the campus was immediately evacuated and remained closed. Classes were canceled until further notice. Those still on campus were asked to stay in place until police officers could safely escort them off campus. Armed officers walked around the neighborhood bordering the campus, knocking on doors and asking for information on the shooter.

Officers were seen looking at a photo on their phones and showing it to people to see if they recognized a person of interest.

The event, billed as the first stop on Kirk’s “The American Comeback Tour,” had generated a polarizing campus reaction. An online petition calling for university administrators to bar Kirk from appearing received nearly 1,000 signatures. The university issued a statement last week citing First Amendment rights and affirming its “commitment to free speech, intellectual inquiry, and constructive dialogue.”

Last week, Kirk posted on X images of news clips showing his visit was sparking controversy. He wrote, “What’s going on in Utah?”

The shooting drew swift condemnation across the political aisle as Democratic officials joined Trump, who ordered flags lowered to half-staff and issued a presidential proclamation, and Republican allies of Kirk in decrying the violence.

“The attack on Charlie Kirk is disgusting, vile, and reprehensible,” Democratic California Gov. Gavin Newsom, who last March hosted Kirk on his podcast, posted on X.

“The murder of Charlie Kirk breaks my heart. My deepest sympathies are with his wife, two young children, and friends,” said Gabrielle Giffords, the former Democratic congresswoman who was wounded in a 2011 shooting in her Arizona district.

The shooting appeared poised to become part of a spike of political violence that has touched a range of ideologies and representatives of both major parties. The attacks include the assassination of a Minnesota state lawmaker and her husband at their house in June, the firebombing of a Colorado parade to demand Hamas release hostages, and a fire set at the house of Pennsylvania’s governor, who is Jewish, in April. The most notorious of these events is the shooting of Trump during a campaign rally last year.

Former Utah congressman Jason Chaffetz, a Republican who was at Wednesday’s event, said in an interview on Fox News Channel that he heard one shot and saw Kirk go back.

“It seemed like it was a close shot,” Chaffetz said, who seemed shaken as he spoke.

He said there was a light police presence at the event and Kirk had some security but not enough.

“Utah is one of the safest places on the planet,” he said. “And so we just don’t have these types of things.”

Turning Point was founded in suburban Chicago in 2012 by Kirk, then 18, and William Montgomery, a tea party activist, to proselytize on college campuses for low taxes and limited government. It was not an immediate success.

But Kirk’s zeal for confronting liberals in academia eventually won over an influential set of conservative financiers.

Despite early misgivings, Turning Point enthusiastically backed Trump after he clinched the GOP nomination in 2016. Kirk served as a personal aide to Donald Trump Jr., the president’s eldest son, during the general election campaign.

Soon, Kirk was a regular presence on cable TV, where he leaned into the culture wars and heaped praise on the then-president. Trump and his son were equally effusive and often spoke at Turning Point conferences.

AP News

Train Services Disrupted on Upcountry Line Following ‘Podi Manike’ Derailment

Train services along the Upcountry Railway Line have been disrupted due to the derailment of the ‘Podi Manike’ train (1006), which was en route from Badulla Railway Station to Kandy and Colombo Fort at approximately 8:50 a.m. today.

According to the Department of Railways, the derailment occurred between Badulla and Haliela railway stations at around 9:10 a.m.

The Department has advised that trains operating along the Upcountry Railway Line are likely to experience delays until the situation is resolved.

Prime Minister assures fair solutions for students of Gampaha Wickramarachchi University

Prime Minister and Minister of Education Dr. Harini Amarasuriya yesterday (09) assured Parliament that no student of the Gampaha Wickramarachchi University of Indigenous Medicine will face injustice as the government moves to resolve ongoing issues at the institution.

Responding to a question from MP Ramanathan Archchuna, the Prime Minister confirmed that a committee appointed to investigate the matter has submitted two key recommendations - either to affiliate existing courses with other universities or to continue operating the university independently with enhanced resources.

“Discussions are ongoing to select the most appropriate path forward. Whatever the decision, it will be implemented in a way that protects every student’s right to complete their education without disruption,” Dr. Amarasuriya told Parliament.

She emphasized that existing course specializations would not be changed, and where programs are unique to the university, further consultations will be held to ensure academic and professional viability.

The government is also addressing broader challenges. Consultations have been held to revise curricula for programs under the Faculty of Indigenous Health Sciences & Technology, particularly in Indigenous Medicinal Resources and Indigenous Pharmaceutical Technology. Similar reviews are planned for other faculties.

Efforts are underway to link degree programs with employment opportunities, including curriculum changes for programs lacking clear job pathways.

Infrastructure upgrades are also planned, including relocating the Nugegoda-based faculty to a more suitable facility in Gampaha.

New admissions to three faculties — Indigenous Health Sciences & Technology, Indigenous Social Sciences & Management, and Graduate Studies — have been temporarily suspended, following instructions from the University Grants Commission.

The Prime Minister also added that investigations into alleged irregularities in academic staff recruitment are ongoing and that legal action will be pursued where appropriate.

(lankaleader.lk)

Flights to Kathmandu Resume

Flights between Sri Lanka and Nepal have resumed following the reopening of Kathmandu’s Tribhuvan International Airport by the Civil Aviation Authority of Nepal, after its temporary closure.

Accordingly, SriLankan Airlines flight UL-181 departed from Katunayake Bandaranaike International Airport at 8:15 a.m. today (11) bound for Kathmandu, Nepal. The flight is scheduled to land at Tribhuvan International Airport in Kathmandu at 11:41 a.m. and is expected to return with passengers from Nepal, arriving back at Katunayake at 4:40 p.m. today.

At present, SriLankan Airlines is the only carrier operating direct flights to Tribhuvan International Airport in Kathmandu. These services are conducted four days a week — on Sundays, Mondays, Wednesdays, and Thursdays.

SriLankan Airlines had suspended flights between Sri Lanka and Nepal yesterday (10) following the closure of Nepal’s international airport due to unrest in the country.

As a result, 35 passengers who had arrived at Katunayake Airport yesterday morning to travel to Kathmandu were provided with accommodation and hotel facilities by SriLankan Airlines.

Supreme Court launches digital payment system for case fees

Sri Lanka’s judiciary took a step toward digitalisation on Tuesday as the Supreme Court launched a facility to accept case-related payments via debit and credit cards.

The system was inaugurated under the patronage of Chief Justice Preethi Padman Surasena at the Supreme Court premises in Colombo.

It enables lawyers and the public to settle payments such as fines, case fees, stamp duties, and charges for certified copies through both card transactions and online platforms.

Officials said the move marks the initial phase of automating payments in the court system, with plans to extend the facility from magistrates’ courts to the Supreme Court.

The launch was attended by members of the Judicial Service Commission, Bar Association of Sri Lanka President Rajiv Amarasuriya, and court registrars.

Meanwhile, the Justice Ministry announced that a fast-track programme for digitising court services will formally commence on September 12, under the guidance of Chief Justice Surasena and with the participation of Justice Minister Harshana Nanayakkara at the Judicial Training Institute in Hulftsdorp.

Sun, Rain, or Storm? Today’s Weather

The Department of Meteorology has announced that showers may occur in the Western, Sabaragamuwa, and North Western Provinces, as well as in the districts of Galle, Matara, Kandy, and Nuwara Eliya. In addition, showers or thundershowers are likely to develop in the Northern, Eastern, and Uva Provinces after around 1.00 p.m.

The Department further advises the public to take necessary precautions to minimize the risks posed by temporary strong winds and lightning that may accompany thundershowers.

Bill to Abolish Presidential Privileges Passed with Majority Vote

The second reading of the Bill to Abolish Presidential Privileges was debated in Parliament today (10).

At the conclusion of the vote, the Bill secured 151 votes in favor, while only 01 vote was cast against.

Speaker Dr. Jagath Wickramaratne informed Parliament that the Bill to Abolish Presidential Privileges was passed with a majority of 150 votes.

Final Warning Issued to Former Minister Tiran

It has been reported that former Minister of Public Security Tiran Alles has been receiving continuous death threats from leaders of organized criminal gangs who have fled the country and are now operating overseas. The Police have already commenced investigations in this regard.

According to reports, the first anonymous letter, dated May 4, was sent from an Arab kingdom to Mr. Alles, stating that the “Yukthiya Operation” had forced their members to flee the country, causing the collapse of their businesses and the disintegration of their families. The letter further declared that they would inevitably take revenge and that Mr. Alles should be prepared to pay with his life.

This letter was received at the former Minister’s office on July 9, following which it was immediately forwarded to the Acting Inspector General of Police. Subsequently, a statement was obtained from Mr. Alles, and a special investigation was launched.

Meanwhile, on August 28, another letter described as a “final warning” was received at the office of the former Minister, this time sent from Dubai. According to the postal stamp, it had been mailed on July 16.

The contents of the letter threatened that, regardless of the level of security provided to him, he would be assassinated before long.

It is further reported that the former Minister has also forwarded this letter to the Inspector General of Police for further investigation.

Former Moratuwa Mayor Saman Lal Fernando arrested

Former Mayor of the Moratuwa Municipal Council Saman Lal Fernando has been arrested.

He has been arrested by officers attached to the Commission to Investigate Allegations of Bribery or Corruption (CIABOC) at around 12:50 p.m. today (10).

The Bribery Commission stated the former Mayor has been arrested in connection with an allegation of causing losses to the government by awarding road development projects of the Moratuwa Municipal Council to his associates.

He has reportedly granted 112 contracts using his own discretion and issued payments in violation of accepted procedures.

Former Mayor of the Moratuwa Municipal Council Saman Lal Fernando is scheduled to be produced before the Colombo Chief Magistrate today, the Bribery Commission stated.

(adaderana.lk)

Importing rice from abroad is a great national tragedy – Sajith Premadasa

Opposition Leader Sajith Premadasa stated that despite Sri Lanka producing 2.8 million metric tons of rice annually while the country’s requirement amounts to only 2.4 million metric tons, rice continues to be imported — a matter he described as a national tragedy. He expressed these views during the parliamentary debate on agriculture, with a particular focus on paddy cultivation.

Ensuring financial strength is a duty of the government

“The so-called National Agricultural Policy being formulated by the present government should not remain confined to paper; it must be realized in practice. Until such time, the Samagi Jana Balawegaya will stand firmly for the rights of the farming community. We must reflect on the factors that have contributed to the decline in productivity of paddy cultivation. During a period when Sri Lanka’s agricultural sector was performing at a high level, the ban on chemical fertilizer was introduced. As a result, paddy production dropped by 34%. Even today, fertilizer usage remains 35% lower than the recommended level. Therefore, it is the duty of the government to provide the necessary financial strength to encourage farmers to apply fertilizer at the recommended levels in upcoming seasons, and such support must be extended through extension services.”

The issue of guaranteed prices

“There continues to be a problem with the guaranteed price. Although it is claimed that farmers are offered Rs. 120 per kilogram, this is not a true guaranteed price but rather a controlled price mechanism. No government has ever purchased the entire harvest; what is bought is a limited quantity, also under price control. Even ministers of the government themselves have acknowledged that this stable price should be between Rs. 140 and Rs. 150.

Rising costs of paddy cultivation

“Although there has been talk of enacting a guaranteed price law through parliamentary regulations, this has not materialized. Meanwhile, the farmer continues to suffer due to high costs ranging from seed, fuel, fertilizer, and equipment to other necessary activities. Hence, there must be a program to dismantle monopolies and empower small- and medium-scale mill owners. The government should take the lead in strengthening them, both through clear programs and financial support. In addition, key actors within the value chain must be properly managed.

“There is also a shortage of certified seed paddy. While only 16% of the requirement is currently met, this must be increased to 25%, and better varieties should be developed.”

The need for modern technology

“Modern technology must be utilized to secure high-quality harvests similar to those achieved in the Netherlands. To this end, fertilizer subsidies must be provided adequately and on time. The reality is that the financial allocation for fertilizer subsidies at present is insufficient. Although the country has storage capacity for 350,000 metric tons, the facilities within the state sector too must be expanded.”

Addressing the human–elephant conflict

“Moreover, effective solutions must be found to the human–elephant conflict, in order to minimize crop damage, loss of life, and property destruction. A comprehensive program addressing these concerns should be implemented.

“In the broader cycle of agriculture, from production through to marketing, the government must establish a well-coordinated and structured approach. A National Crop Plan and a National Agricultural Plan are essential to ensure long-term stability and productivity within the sector.”

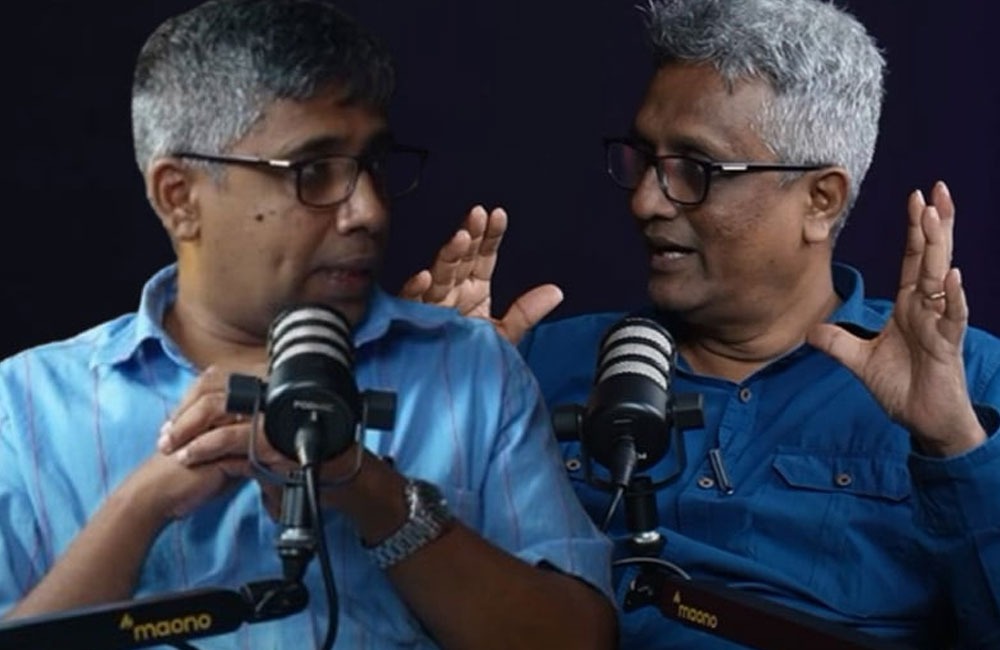

Is commercialisation of criminals acceptable? — (Ideas Front video)

Leader of the Samabima Party, Deepthi Kumara Gunarathne, has raised serious concerns over the growing trend of crime becoming commercialised, with potentially devastating consequences for the society.

During a discussion on the Ideas Front Youtube channel, he noted that society is approaching a dangerous point where criminals are being humanised to the extent that their wrongful actions risk being normalised.

Gunarathne criticised what he described as a “new narrative” portraying criminals as ordinary people with families and aspirations, calling it a “mistaken and harmful” approach.

Meanwhile, political analyst Vipula Karunathilaka, who also participated in the discussion, highlighted troubling practices within the police force, particularly self-promotion and internal promotions without proper institutional checks.

He warned that such actions pose significant risks to law enforcement integrity and noted that no effective institution globally permits such unchecked behaviour.

The discussion was moderated by journalist Narada Bakmeewewa.

(lankaleader.lk)

Page 92 of 656