The Committee on Public Enterprises (COPE) has launched a deep probe into LTL Holdings Ltd., a once state-dominated power sector giant, over governance lapses, conflict of interest, and opacity in ownership exposing troubling overlaps between public and private energy interests in Sri Lanka.

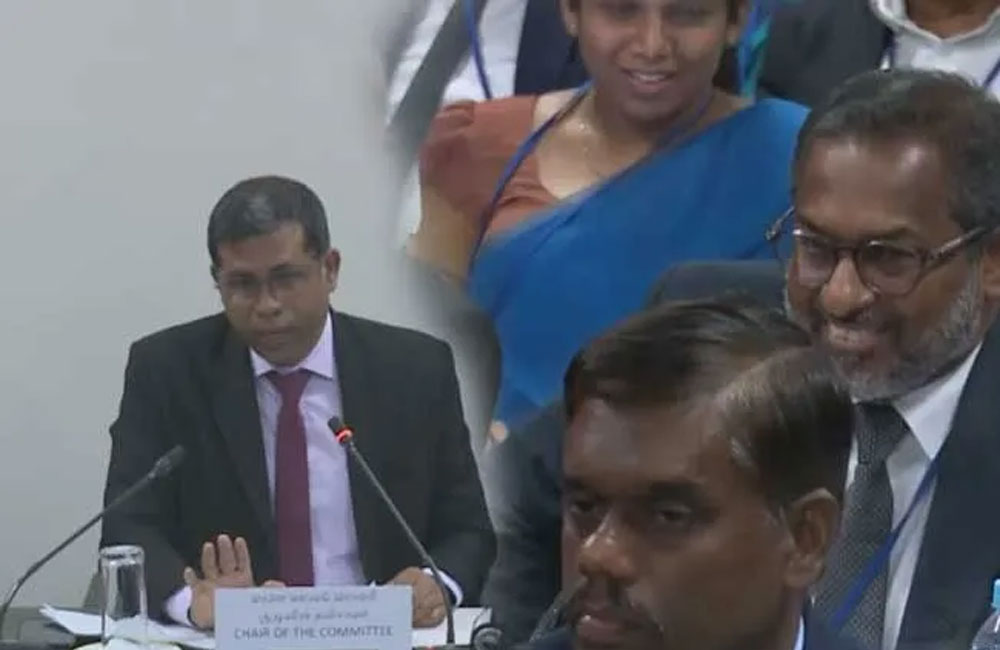

Chaired by MP Dr. Nishantha Samaraweera, the October 24 COPE session delved into LTL’s transformation from a Ceylon Electricity Board (CEB) subsidiary into a sprawling conglomerate with diminishing state control. Originally founded in 1980 as Lanka Transformers Ltd., LTL began with a 70% CEB shareholding and 30% foreign ownership. Decades later, following a web of transactions and ownership reshuffles, CEB’s stake has fallen to just 35%.

COPE’s attention centred on the absence of a government audit of LTL since 2015 and potential conflicts arising from the movement of key executives between CEB and LTL. Both the founding chairman and current CEO once CEB engineers could not confirm the exact dates of their transition, raising doubts about whether regulatory and corporate interests were improperly intertwined.

A major ownership shift occurred after LTL’s Norwegian partner divested in 2005. Instead of CEB reclaiming those shares, they were purchased by a private entity, LTL ESOT (later renamed Peradiv Ltd.), through loan financing. The 10% employee trust set up in 2001 also evolved into Tepro Investments Ltd. in 2017. These transactions collectively diluted CEB’s ownership and opened the door to private control without clear accountability.

The probe also highlighted a controversial 2006 transaction involving West Coast Power Ltd., an LTL subsidiary operating the Yugadanavi power plant. To offset Rs. 26 billion owed by CEB to West Coast for electricity purchases, 28% of LTL’s shares were transferred from CEB to West Coast with Cabinet approval. This move, described by COPE members as a “complex and opaque process,” effectively cut CEB’s shareholding from 70% to 35%.

LTL’s current ownership is divided among CEB (35%), West Coast Power (28%), Peradiv Ltd. (27%), and Tepro Investments (10%). Despite being formed with public funds and overseeing vital national infrastructure, LTL has repeatedly denied the Auditor General’s Department access to its accounts. COPE has now instructed the Power Ministry and Auditor General to enforce a mandatory audit immediately.

Financially, LTL remains a powerhouse, reporting Rs. 59.8 billion in revenue and Rs. 5.8 billion in post-tax profits for the year ending March 2024, with assets of Rs. 133.6 billion and equity of Rs. 74.4 billion. Around 70% of its income is foreign currency-linked, and projections for FY2025 estimate revenue nearing Rs. 91 billion. However, COPE members warn that such profitability may obscure systemic governance risks.

The ongoing inquiry raises pressing questions: Who authorised the share transfers that eroded state ownership? Were procurement deals between CEB and LTL conducted transparently? And why have audits been obstructed for nearly a decade?

As Sri Lanka’s power sector struggles with pricing pressures, capacity shortages, and mounting debt, COPE’s findings could mark a watershed moment testing how far transparency and accountability will extend into the upper echelons of state-linked enterprises.

Leave your comments

Login to post a comment

Post comment as a guest