Business

Alibaba’s Daraz and Dialog Axiata sign a strategic partnership to grow digital commerce in SL

Dialog Axiata Group and Daraz Sri Lanka have entered into a strategic partnership to collaborate on digital commerce.

As the first step in this partnership, Daraz Sri Lanka is to integrate the management and business operations of wOw.lk, the online retail platform owned by Dialog Axiata Group. The integration will help Daraz to further expand and improve its e-commerce presence in Sri Lanka. Effective December 1st, visitors to wOw.lk will be re-directed to Daraz.lk enabling greater access to products and services through the fast-growing online retail platform, Daraz.lk. That said, existing wOw.lk customers who had purchased products from its platform will continue to enjoy the warranty structure offered to them during their point of purchase.

Over the past 7 years wOw.lk has been instrumental in establishing Sri Lanka’s e-commerce presence and with this new partnership in the making, Dialog customers will benefit from Daraz as an exclusive online shopping destination.

“The integration of Dialog’s e-commerce operation gives Daraz a strong position in the market and allows us to drive growth more aggressively while giving our customers nothing but the best in online shopping. wOw.lk is one of the pioneers of e-commerce in Sri Lanka, and we plan to build on that legacy through Daraz.lk” said Rakhil Fernando, Managing Director of Daraz.

The marketplace model adopted by Daraz has proven to be successful for both shoppers and seller partners, providing greater visibility for brands and a wider range of products to shop from. Daraz’s affiliation with the global e-commerce success, Alibaba, has ensured that timely and proven technology is passed down to an online market as young as Sri Lanka. Over the 3 years of operations in the island, Daraz.lk has created a leveling ground for international brands as well as SME’s to be part of their journey in extending the online retail market. The latest development will result in an amalgamation of more brands, thus adding to the present 800,000 plus product assortment available on Daraz.

Commenting on the partnership Dr Nushad Perera, Chief Digital Services Officer of Dialog Axiata PLC stated, “Both our organizations are strongly committed to building our country’s digital infrastructure and this partnership will further enhance access to affordable digital commerce for every Sri Lankan”.

Central Bank issues license cancellation notice to The Finance Company

The Finance Company PLC (TFC), a Finance Company licensed under the Finance Business Act No. 42 of 2011 (FBA) was severely impacted by the failure ofa number of financial institutions within the Ceylinco Group in 2008.

Since then, the financial status of the company deteriorated gradually, leading to a severe liquidity crisis. Although, several efforts were made to identify prospective investors and to restructure the company, such efforts have not materialized to a satisfactory level yet.

The Monetary Board of the Central Bank of Sri Lanka (CBSL) having considered the weak financial performances of TFC,tooka number of regulatory actions under the provisions of FBA, with effect from 15th February 2019, with a view to safeguard the interests of the depositors and other stakeholders of the company. The regulatory measures included suspension of accepting new deposits, withdrawal of deposits and disbursement of loans and advances to facilitate the restructuring process of TFC.The primary objective of the regulatory actions was to identify a potential investor for TFC within a reasonable time period. However, TFC has not been able to find an acceptable investor to date to revive the company.

It is important to understand that the revival of TFC entirely depends on the availability of an acceptable investor who is willing to invest in the equity capital of the company. Accordingly,the Monetary Board instructed TFC to call Expressions of Interest (EOIs) from potential investors and to request such investors to submit their Business Restructuring Proposals to revive TFC.

However, TFC was not able to receive an acceptable EOI from any credible investor along with evidence for the availability of funds. It is also noteworthy to mention that the company is incurring a monthly loss of around Rs 200mn. Hence, it is obvious that operation of the company in this manner will be further detrimental to the interest of the depositors and other stakeholders.

Accordingly, the Monetary Board in terms of the powers vested under the FBA, decided to issue a Notice of Cancellation of the License issued to TFC, with effect from 23rd October 2019 to safeguard the interests of the depositors and other creditors. Any credible investor can still submit an acceptable EOI along with proof of funds for capital infusion and a Business Restructuring Plan for the consideration of TFC and CBSL.

Interest due for deposits will be paid continuously to the depositors as per the CBSL directions. At the same time, all borrowers of the company are strictly advised to pay their dues. Such borrowers are encouraged to pay their dues via bank accounts designated by TFC or to the nearest TFC branch. They should also ensure to obtain receipts for the repayments they make.

Attention is also drawn to the fact that the deposit insurance and liquidity support scheme will also safeguard the interest of all depositors to a maximum of Rs.600,000/- per depositor, which will cover 94 percent of the TFC depositors in full. Therefore, the depositors are kindly requested to cooperate with the CBSL.

The depositors may contact the Department of Supervision on Non-Bank Financial Institutions of the Central Bank of Sri Lanka through 0112 477 573, 0112 477 229, 0112 398646, 0112 398733 or 0112 477 504 and This email address is being protected from spambots. You need JavaScript enabled to view it. for further clarifications.

New Hyundai motor vehicle agency creates a stir

Confusion has taken center stage in the local vehicle market over reports that Hyundai Motors Company Korea is appointing a new agent for the Sri Lanka market.

The issue has come to public attention when the popular brand’s models have started to appear in shopping malls with so-called exciting prices.

Unknown to the wider Hyundai vehicle owners, Hyundai Motors regional office based in Malaysia, had reportedly forged links with a local conglomerate and had appointed them as an agent.

Accordingly, Abans Automotive have written to the Registrar of Motor Vehicles (RMV) informing of their new status as agent of Hyundai Motors. This was during the currency of the agent of nearly 20 years, Hyundai Motors Lanka Limited.

The RMV has also been in receipt of yet another letter in which it is purported to be from Hyundai Motors stating that Hyundai Motors Lanka was not the agent and therefore should not be permitted to directly register vehicles, which is a system available to registered agents.

Hyundai Lanka who has enjoyed their agency status in the country for nearly 20 years had immediately contacted the RMV as they believed that the two letters to the RMV even though it was purported to be from the same person had allegedly carried two distinctly different signatures.

The RMV have since then written to Hyundai Motors seeking clarification and were sent by email the body of the letter this time without a verifiable signature.

These events on its own have suggested a sense of unfair and perhaps sharp business practices deepening the unhappiness of an agent who has served the Hyundai customers in Sri Lanka rather well for almost 20 years.

The current agent in Sri Lanka has represented the brand for approximately 20 years and has dedicated showrooms, but importantly, Hyundai Lanka have dedicated and experienced workshop staff trained to be familiar with the full range of Hyundai vehicles. This has become especially more important as vehicles in this day and age are heavily dependent on electrical work including the Hybrid versions.

However, the latest developments have created a sense of uncertainty, especially when it comes to warranty issues and as to who would honour the manufacturer’s warranties.

In comparative terms Hyundai is a cheaper vehicle than any other premium brand - meaning that a typical user of Hyundai vehicles will have just the one vehicle rather than the typical owner of a premium brand vehicle who is likely to have more than one vehicle at their disposal. The reasoning being that with a lower end of the spectrum vehicles like the Hyundai, the owner is likely to have just the one car and therefore dependent on timely service and repairs.

It is now being stated that the authorities need to look at setting up a Monopolies Commissioner in Sri Lanka due to the rationale that the Monopolies Commission would be able to rule that agents of specialist items like vehicles for example must be forced to ensure that certified workshops are in place staffed with knowledgeable staff in order that consumers do not get caught out when commercial disagreements occur between principles.

Abans has meanwhile denied that the letters were questionable and has suggested that the issue was more about bruised egos than any other.

However, as of 7th November it has been revealed that the Korean named in the letters has made a personal visit to the RMV (Registrar of Motor Vehicles) and signed letters in front of the Registrar.

Nevertheless, the real question in the whole drama is on the existing warranty honouring, service issues etc that appear to have been left in abeyance.

French financial institution steps into assist Sri Lanka's SMEs

A French financial institution has stepped into financing Sri Lanka's small and medium-scale enterprises via the commercial Bank of Ceylon.

Proparco, a subsidiary of Agence Française de Développement (AFD) Group dedicated to private sector financing, signed an agreement with the Commercial Bank of Ceylon for the funding arrangement recently.

Through this agreement, Proparco will be supporting a major player in financing Sri Lankan small and medium-sized enterprises through a USD 25m loan allocated to Commercial Bank of Ceylon (CBC),AFD official said.

By allocating a USD 25m loan to CBC, Proparco is reasserting its support to SMEs in the country after many other credit lines targeted towards this key segment of the economy.

This new long-term financing is expected to create or support over 5,000 jobs in Sri Lanka.

This operation is in line with Proparco’s commitment to support access to finance for SMEs in developing countries and emerging economies.

Over the last ten years, Proparco’s parent company, the French Development Agency, has committed 600 million EUR to sustainable projects in Sri Lanka in key development sectorsincluding water and sanitation, urban development, energy, and irrigation.

With this project, the AFD Group's investments in the country will cross 850 million euro.

Small and medium-sized enterprises (SMEs) are the backbone of Sri Lanka’s economy.

They make up about 75% of the total number of companies in the country and account for almost half of employment and GDP in the country.

Despite the key role they play in the national economy, Sri Lankan SMEs experience major difficulties in obtaining credit, which has a significant impact on their capacity to invest, recruit and grow.

Daraz brings online sale for local shoppers

Daraz platform, a subsidiary of Ali Baba will be launching its biggest sales pitch in Sri Lanka on 11th November providing an opportunity for online shoppers to participate in the world's largest online sale for the second time, Managing Director of Daraz, Rakhil Fernando said at a media conference in Colombo.

Alibaba which acquired Daraz in 2018 has recorded US$ 30 billion at its last sale in Alibaba group of which Sri Lanka's contribution was around LKR 400 million.

Daraz Sri Lanka has over 700 employees where they process over 15,000 packages every single day.

There are over seven hundred thousand (700,000) different items stockpiled for the Daraz launch on November 11 with discounted prices up to 80-85 percent on certain items to bank credit card holders, he disclosed.

2018 saw Daraz.lk introduce the largest online sale in the world to Sri Lanka, and they are ready to host it again this year. 11.11 campaign, one of the most anticipated online sales in the world will take place on the 11th of November, as the name suggests, on the Daraz platform.

Over the course of its three years in Sri Lanka, Daraz has grown its network of sellers resulting in one of the biggest assortments available online.

Compared to last year, the seller community has grown from 8,000 to almost 26,000 and with around a thousand joining every month.

This community is capable of providing 1 million products live on Daraz today, promising one of the largest 11.11. campaign experiences for online shoppers in Sri Lanka this year, he added.

Business registration from home

He was moving regulations in parliament under the Public Contract Act and accordingly, fees payable (VAT excluded) on four types of contracts have been amended.

In that, the new fee of Rs 2000 is applicable for application for registration as an agent, sub-agent, representative or nominee for or on behalf of a tenderer, the new fee of Rs 10,000 for application for registration of a public contract, the new fee of Rs 2000 for application for renewal of a registration and the new fee of Rs 10,000 for application for re-registration of a public contract.

The Department of Registrar of Companies earned a revenue of about Rs 600 million and Rs. 664 million in 2017 and 2018 respectively.

The “Starting a Business Indicator” of Ease of Doing Business rankings for Sri Lanka (at 87.87 out of 100) showed the country ranked at second in South Asia just after Maldives (at 89.17).

The South Asian regional average for Starting a Business Indicator is 85.44.

Turkey- Sri Lanka trade continue to surge

Further strengthening the longstanding relations between Sri Lanka and Turkey, bilateral trade between both countries continues to grow.

“Both countries have regularised its dialogue and cooperation through the Turkey-Sri Lanka Joint Economic Commission.

This provides a structured platform to develop and further advance the bilateral economic and technical partnership.

Diversifying and broadening our economic agenda is a priority for both Governments. Turkey is becoming one of Sri Lanka’s important trading partners,” Minister of Industry and Commerce Rishad Bathiudeen said.

Addressing the ‘96th Anniversary of the Proclamation of the Republic of Turkey’ celebrations held in Colombo, Minister Bathiudeen hinted that Turkey is no more a small trade partner of Sri Lanka.

”Turkey is becoming one of Sri Lanka’s important trading partners. The total bilateral trade turnover in 2018 was US$ 351.18 Million,” he added.

According to Sri Lanka Department of Commerce, total bilateral trade in 2017 was US $ 318 Mn, which means total trade between both countries has grown in 2018 (YoY) by 10.4% and in comparison to 2016, the 2018 trade has surged by a huge 57% (from US $ 224 Mn).

“Both countries are also formalising the legal framework for cooperation in sports, education, agriculture, SME development, customs and defence. We have also recognized the need to diversify our basket of exports to Turkey,” Bathiudeen noted.

In 2018, Sri Lanka’s exports to Turkey was at US $ 218.4 Mn. 75% of exports to Turkey in 2018 were Ceylon Tea (at US $ 163 Mn), followed by yarn (8%), apparel (3.5%), and rubber tyres (2%).

Sinhaputhra Finance gets chance to raise capital

This action was taken further to the regulatory actions taken against the Company, the Monetary Board of the Central Bank.

In view of the proposed capital augmentation plan submitted by the Sinhaputhra Finance PLC and in the interest of depositors, the Monetary Board decided to provide it with an opportunity to implement the proposed capital augmentation plan within the time frame stipulated.

Beleaguered finance company, Sinhaputhra Finance PLC’s licence was given notice of cancellation by the industry regulator, the Central Bank with the company objecting to the move.

In an announcement to the Colombo Stock Exchange (CSE)last month the CB said that owing to the critical financial condition, and due to non compliance to the Finance Business Act directions issued by CB, this decision was taken. Sinhaputra has the right to object within 30 days, it said.

The company announced to the CSE that the company has submitted an objection and that a comprehensive capital plan backed by an investor who has demonstrated financial credibility of meeting the regulatory capital requirement was submitted to the Monetary Board of the CB and the company's awaiting their response.

Last year the company said that it was talking to prospective investors to infuse much-needed capital.

The company in a stock market filing last November said that the Board of Directors was negotiating with a few potential investors through a professional investment bank.

Currently, the company’s focus is to find an investor who can actually move beyond the Rs. 2.5 billion capital requirement based on the deadline given,” it said, adding that it will be able to resolve this matter before January 31, 2019.

The CSE put the company on a 'Watch List' due to an emphasis of matter on going concern in the audit report for the year ended March 31, 2018.

DLB 'Kotipathi Kapruka'; Lucky winner bags biggest jackpot in Sri Lanka's history

The Development Lotteries Board (DLB) announced today that its 'Kotipathi Kapruka' lottery has been able to award the biggest jackpot in Sri Lanka . A lucky winner from Ratnapura has won the final jackpot of LKR 145,029,213.00 in the 513th draw of of the lottery on October 27.

This winning lottery ticket has been sold by DLB agent, Ms. R. Priyanthi of Godakawela.

Although the Kotipathi Kapruka Lottery was initially introduced to the market in 2016, it was relaunched last August with an attractive look and DLB is proud to announce that within a short period of 3 years, a lucky person has been able to win the largest jackpot awarded in Sri Lanka's history, a statement from the DLB said.

Kotipathi Kapruka which was initially named as Kotipathi Shanida has been able to produce 08 jackpot winners to date and has disbursed a sum of LKR 751 million as prize money.

"While wishing all our customers the best of luck in their future purchases of DLB lotteries, we hope that they too will win the jackpot and the DLB expects to offer better and innovative lotteries in the future too", the statement said.

Indian industrialists vie multi million projects in SL

This was conveyed when Director Praful Kumar along with his delegation met with the Minister of Industry and Commerce, Rishad Bathiudeen in Colombo.

The Industry-led and industry-managed CII is India's second largest industry chamber with more than 9100 direct and over 300000 indirect membership of firms from 291 various national and regional bodies (private and public sectors, SMEs to multi nationals). CII is no stranger to Sri Lanka and its previous teams visiting Colombo met Minister Rishad Bathiudeen on several occasions.

"We are interested in securing large scale projects in Sri Lanka such as refineries, IT parks, desalinisation plants, pharmaceutical zones, container terminals and vocational training facilities. Many mechanisms are available in India for funding of such large projects overseas. We at CII can be a facilitator for such project funding in Sri Lanka as well. We can move in with funding from Indian Exim Bank. The Buyers’ Credit (BC) project funding mechanism of Indian Exim Bank is one such way,” Director Praful Kumar said.

In Buyers’ Credit, project execution is done by an Indian firm called the project exporter. Even though the fund recipient is an Indian company, the firms in the target country too benefit immensely. 75% of the material for the project needs to come from the Indian firm, but Sri Lankan contractors can supply the labour -and also the 25% materials in the BC project.

The benefit of this is that there is no limit for the dollar value of the project-it could be a low US $ one million or high US $ 500 million-or much more. The US $398 Mn project commenced in Ghana recently under BC by the Indian Exim bank and the project on a new road in Maldives at US $20 Mn are examples. Average project length is three years and it takes about three to six months for initial background work. High-value projects such as ports, bridges, highways, and IT parks are a good match for BC projects.

"Even though revenue generating projects are preferred for most BC projects, even social non-profit projects without revenues, too are possible. We can facilitate top Indian multinationals such as Reliance, Wipro, Tata, Aditya Birla etc to Sri Lanka in this if the projects are large scale," he said.

Meanwhile, since March 2018, Sri Lanka has been placed in the Positive List of Countries for Buyer’s Credit under India’s National Export Insurance Account (NEIA) by India’s Export Credit Guarantee Corporation (ECGC).

The main investment sectors that Indian FDIs in are tourism & hotels, petroleum-retail, manufacturing, real estate, telecommunication, banking and financial services. Among investments by Sri Lankan companies in India are apparel (Brandix, MAS holdings), furniture (Damro), energy (LTL Holdings), and in freight servicing and logistics (DRH Logistics and Freight Links International).

Seven medical camp of DLB sathkara at Hambantota

Another phase of the series of medical camps hold by DLB under the theme 'DLB sathkara' for the benefit of its Sales Agents and Sales Assistants, has been successfully came to the end in Hambantota recently.

This has been held for the benefit of the Sales Agents and Sales Assistants of Hambantota district and it marked the seventh event of the series. This camp was held on 13th October and nearly 300 came to get the service of the camp. The camp conducted medical tests and further offered spectacles to needy people along with other medicine.

In the meantime tricycles were also awarded to three differently able sales assistants and further garden umbrellas were provided to sales assistants whilst the sales agents were provided with bicycles.

Mr. Sena Suriyapperuma, Chairman of DLB , Mr. Chanaka Dodangoda, Deputy General Manager, Mr. Sunil Jayarathna, Assistant General Manager (Sales) , Mr. Mahinda Dissanayaka, District, Zonal Manager of Hambantota and other guests have participated in the event.

https://english.newstube.lk/business?start=156#sigProId1412511787

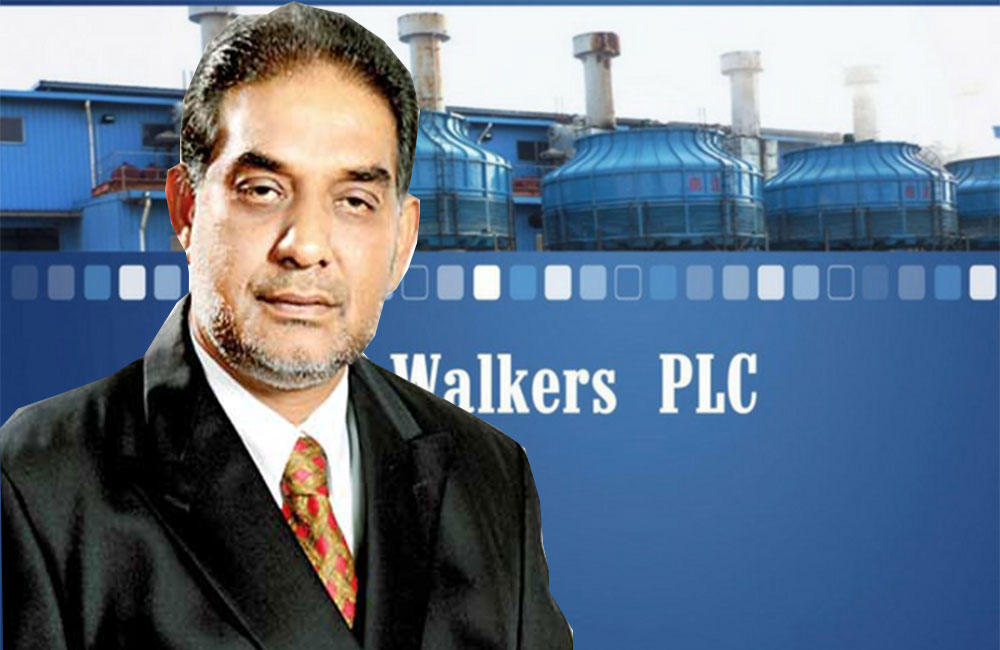

Casino mogul Ravi Wijeratne takes over MTD Walkers PLC

Accordingly, in a filing to the CSE released today, MTD Walkers PLC said that they received a letter dated 6th September 2019 on Monday (9th September) from Ravindranath Wijeratne which stated that he had agreed with MTD Capital Bhd to purchase a majority stake amounting to 152,183,583 ordinary voting shares of the company constituting 90.78% through a voluntary offer to be made to all the shareholders of the company, in terms of the Takeovers and Mergers Code of 1995 as amended.

In March 2018, Anunine Holdings, led by Deshamanya Anurath Abeyratne and his family, has bought the entirety of its 91% controlling stake in MTD Walkers PLC for an amount between US$ 8-10 million.

Several local banks sought injunctions against MTD Walkers PLC on February 6th, 2019 over the recovery of loans.

Published accounts reveal liabilities in the region of Rs.18 billion clearly stating that the sale price of US$ 8 million is inadequate to settle all liabilities.

A renowned Indian and Japanese investor consortium has taken over the ownership of MTD Walkers from Malaysia’s MTD Capital Bhd shortly in a transparent share transaction in the CSE dispelling unwarranted rumors spread by interested parties, company sources said.

The deal was sealed following the infusion of US$ 25 million by the new investors, stock analysts said.

The Colombo Stock Exchange halted trading of MTD Walkers’ shares in January this year after calling for clarification—albeit belatedly—about recent events at the troubled conglomerate.

Separately, the Commercial High Court issued enjoining orders in favour of eight banks, restraining MTD Walkers PLC from transferring any of its shares in any of its subsidiaries to its Malaysian parent company until it settles billions of rupees in debt to the lenders.

Page 14 of 29